Brazil Industrial Output Falls for Second Straight Month

(Bloomberg) -- Brazil’s industrial output fell in May for a second straight month as central bankers signal they are in no rush to resume rate cuts, and tight credit conditions are likely to persist.

Most Read from Bloomberg

Biden Struggles to Contain Mounting Pressure to Drop Out of Race

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

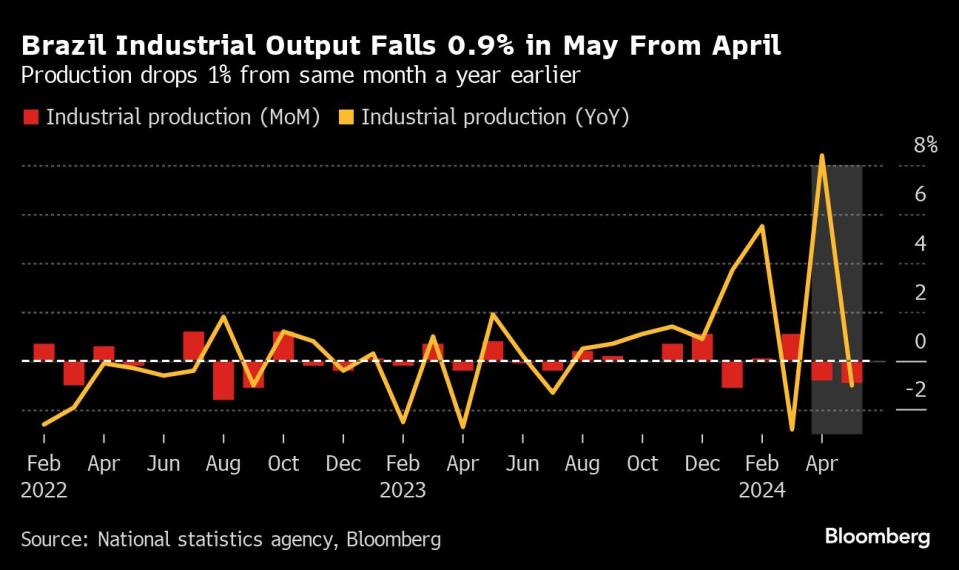

Production fell 0.9% from the month prior, less than the median forecast for a decline of 1.4% in a Bloomberg survey of analysts. The monthly contraction recorded in April was revised to -0.8%. From a year earlier, industry fell 1%, the national statistics agency reported on Wednesday.

Policymakers led by Roberto Campos Neto halted their monetary easing campaign last month, leaving the benchmark rate at 10.5%. Fiscal woes and rising inflation expectations have led economists to forecast borrowing costs will remain steady for some time, cutting short hopes of looser credit conditions among manufacturers and credit-driven industries.

May’s data could begin to reflect the impact of heavy rains that left large parts of Brazil’s southern cities underwater. More than 94% of all economic activity in the region was affected by the floods, impacting as much as 8% of the country’s formal jobs, according to central bank’s studies.

(Updates to add chart after second paragraph)

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance