The single biggest issue driving the UK property market 'is not Brexit'

House prices have barely changed in the past six months in the UK, new figures on the sluggish state of the UK property market reveal.

Russell Galley, managing director at Halifax, which compiled the figures, said the “dearth of available properties to meet demand” was the single biggest issue holding back prices and activity most.

The average property sold for £233,541 in August as prices continued to edge up in July, with a 0.3% rise in the latest house price index by Halifax and IHS Markit.

But the gains only took the average price paid for a UK home marginally above the figures for March, when it stood at £233,458.

Halifax’s latest report also highlights a steep decline in property sales year-on-year. Its analysis of HMRC data shows the number of transactions in July – 86,630 sales – was 12.4% lower than a year earlier.

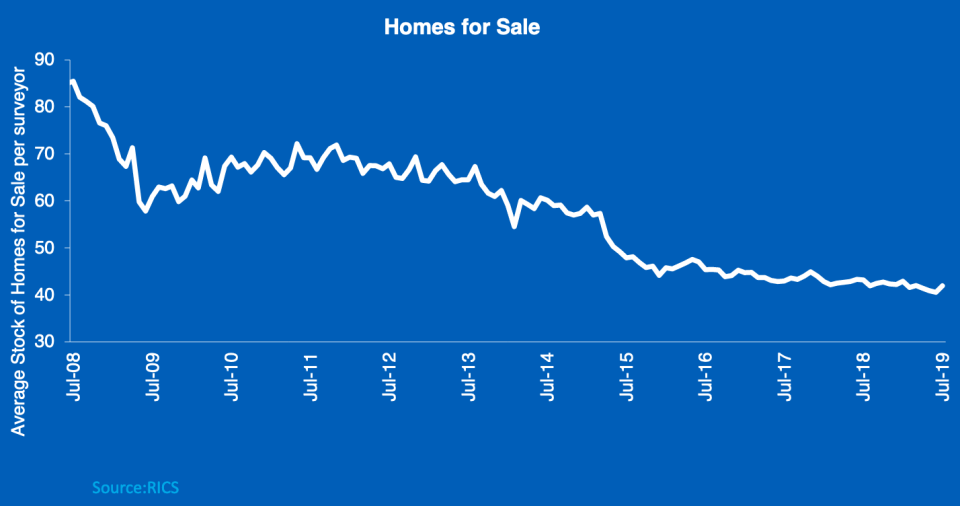

The average number of homes for sale per surveyor saw a slight monthly uptick, but remains down on a decade ago.

Galley said “ongoing economic uncertainty” continued to weigh on consumer sentiment, suggesting the Brexit crisis is also a significant factor limiting activity.

READ MORE: Why a no-deal Brexit could send London’s luxury property market soaring

“There was no real shift in house prices in August as the average property value grew by just 0.3% month on month. This further extends the predominantly flat trend we’ve seen over the last six months, with the average house price having barely changed since March.

Halifax figures showed prices edged up 0.1% in the quarter, and were up 1.8% on August 2018.

Galley said “important underlying factors” like affordability and employment remained strong, meaning the housing market was still showing “a degree of resilience for the time being.”

But he said the market would “undoubtedly” be influenced by events in the wider economy, amid warnings by experts that the housing market could slump if Britain crashes out of the EU without a deal.

READ MORE: Fears for UK economy as construction suffers sharpest slide in a decade

Yahoo Finance

Yahoo Finance