Britain ‘at risk’ of private healthcare tax raid under Labour

Labour could tax private healthcare as well as education to raise millions for the NHS, it has been warned.

Health experts have raised fears that Labour could revive Jeremy Corbyn’s 2017 pledge to increase a levy known as insurance premium tax (IPT) if the party wins the general election.

In a surprise appearance on Tuesday, former prime minister Boris Johnson said that attacking private healthcare will be on Labour’s “agenda” under Keir’s Starmer’s government.

“Labour are so cocky that they’re barely concealing their agenda anymore,” he said at a rally in central London.

“And we can see what it is: racking up taxes on pensions, on property, persecuting private enterprise, attacking private education and private healthcare, with all the pointless extra burden that will place on the taxpayer.”

Shadow health secretary, Wes Streeting, has previously said the Labour party has “no plans” to introduce VAT on private healthcare.

But experts said tax rises for people choosing to go private were “perfectly possible” under a Labour government and that the move could raise £550m a year for the crisis-stricken NHS.

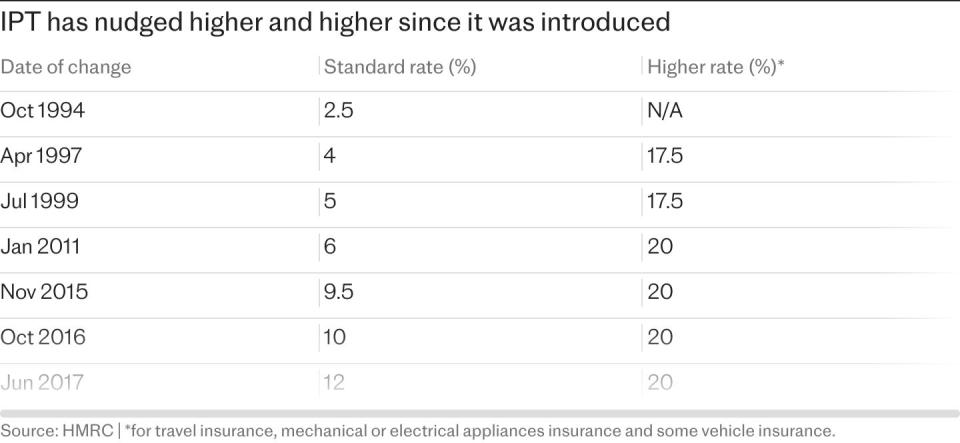

Under Jeremy’s Corbyn, the party had previously pledged to raise insurance premium tax, which is paid on most insurance policies, from 12pc to 20pc. Around 20pc of the British population currently use some form of private healthcare.

Brian Walters, of insurance broker Regency Health, said: “Jeremy Corbyn proposed to increase this tax from 12pc to 20pc in the run up to the 2017 general election and, although this hasn’t been reprised by Keir Starmer, there is a worrying parallel with Labour’s private-school policy.”

Tackling NHS delays could reduce the vast numbers of patients going private but this is likely to require a huge cash injection from the incoming government, he said.

Scott Harwood, of accountancy firm RSM, added: “Given the similarity in demographics, the Labour Party might look at private healthcare in the same way they view private schools. If they decide to tax both, it could increase government revenue.”

IPT, introduced in 1994, has been described as Britain’s “hidden-in-plain-sight” tax because many people do not realise they pay it. It is charged at 12pc on insurance premiums, with a higher 20pc rate for certain types of insurance not including healthcare.

In 2023-24, Britain paid £8.15bn in IPT, up 11.4pc year-on-year as insurance premiums and demand for private healthcare surged due to NHS backlogs.

Approximately £825m of this is paid by millions of adults with health insurance each year, according to analysis by accountancy firm RSM, who estimate that increasing the rate from 12pc to 20pc would raise £550m.

£1.5bn VAT raid

Britain’s private health market is worth around £10bn and while IPT applies, it is not currently subject to VAT.

The Health Foundation, a think tank, said recently that both Labour and the Conservatives’ funding promises “fall well short” of the NHS’ requirements, calculating that a further £38bn a year will be needed by the end of the next Parliament

While raising IPT would raise £550m a year, introducing VAT could raise approximately £1.5bn for the Treasury – the same as Labour expects to make from its raid on private schools.

Mr Streeting has previously said that the new government would use the private sector to clear the NHS backlog.

However, Sir Keir appeared to show disdain for the private healthcare system when he insisted during an interview he would not go private even if his loved one in need of treatment was stuck on an NHS waiting list.

Mike Warburton, former tax director at Grant Thorntons, said VAT on private healthcare or a rise in IPT were both “entirely possible” provided Labour did not run into legal trouble over the plans.

Top lawyers warned this week that Labour’s private school plans risked falling foul of European Court of Human Rights (ECHR) law.

But others said a VAT raid would be too politically risky for Labour.

William Laing, of healthcare data provider LaingBuisson, said a VAT raid under Labour was unlikely because it would impact a much larger proportion of the population than the party’s tax raid on private schools.

“Only 7pc of people are privately educated. But for private healthcare, it’s around 20pc. So they would alienate a lot of people if they did.”

However he said a rise in IPT was “perfectly possible” and could lead to more people dropping out of the private healthcare system.

Mr Harwood said: “As private medical insurance is subject to IPT, it is already taxed. The Labour Party will no doubt wait to see how taxing private schools goes before deciding on healthcare.”

Swathes of people are going private for the first time due to NHS delays.

Dale Cooper, of insurance company Howden, said enquiries for health insurance had jumped sixfold compared to pre-pandemic years.

“The demographic is also significantly younger than it used to be,” he said. “Now people are overwhelmingly in their 40s with children. Previously, young people taking out cover was almost unheard of.”

Most people who use private healthcare have insurance. According to data from the Private Healthcare Information Network, there were a record 898,000 admissions to private hospitals in 2023 as the public health service crumbled. Of these, 69pc were paid for with insurance.

Kristian Niemietz, of the Institute of Economic Affairs, a think tank, said: “People who use private healthcare make less demands on the NHS, thus taking pressure off it, and saving taxpayer money. Instead of penalising those people through the tax system, the government should, on the contrary, tax them more lightly, to recognise those savings. This does not have to be done through the VAT system, but it should be done somewhere – and preferably to a greater extent than now.”

Mr Walters of Regency Health said a tax raid on healthcare could risk an exodus from the private sector – putting more pressure on the struggling NHS.

He said: “If this were to happen, the health insurance subscriber base would undoubtedly recede, with rampant premium inflation already stretching consumers.

“Disincentivising consumers and employees to take out or maintain private medical insurance would obviously increase the burden on the NHS but the concern remains that, on the Labour front bench, ideology trumps economics.”

IPT is charged on premiums, and usually the insurer will pass on the cost to the policyholder. For those with company insurance, this is the employer.

However, private medical insurance to employees is a “benefit-in-kind” so employees pay an income tax charge based on the value of the benefit, which would typically reflect the total cost of the insurance including IPT.

The ABI has urged the government to reduce IPT, saying it could “help reduce barriers to the uptake of health insurance by employers and employees and ease the pressure on the NHS”.

A Conservative Party spokesman said: “Nothing is safe from Labour’s tax raid. You name it, Labour will tax it.

“Just 130,000 votes in 48 hours’ time will be enough to stop Starmer’s Supermajority and protect your hard-earned money – vote Conservative on 4 July.”

Labour was contacted for comment.

Yahoo Finance

Yahoo Finance