Charles River's (CRL) RMS Growth Aids Amid FX Headwind

Charles River Laboratories’ CRL Research Models and Services (RMS) business continues to benefit from the Charles River Accelerator and Development Labs (CRADL) initiative. Yet, the global business environment remains challenging, denting the company’s growth. The stock carries a Zacks Rank #3 (Hold).

RMS business services are in high demand among the company’s clients in the field of basic research and screening of non-clinical drug candidates. These service offerings provide greater flexibility for clients’ research and also support increased scientific complexity. The RMS segment continues to benefit from higher NHP (nonhuman primate) revenues as well as broad-based growth in all geographic regions for small research models.

Over the past several quarters, the company has been witnessing strong growth within the insourcing solutions (IS) business led by the CRADL initiative. These days, clients are increasingly adopting CRADL’s flexible model to access laboratory space without having to invest in internal infrastructure. To support client demand, Charles River is consistently expanding CRADL’s footprint both organically and through the acquisition of Explora BioLabs (done in 2022), a provider of contract vivarium research services. During the first quarter of 2024, the company signed new contracts for its legacy IS Vivarium management solutions and noted that the CRADL growth rate is expected to accelerate during 2024.

Meanwhile, Charles River has been broadening the scope of its products and services across the drug discovery and early-stage development continuum through focused acquisitions. Within Discovery and Safety Assessment (DSA), the 2021 acquisitions of Retrogenix (an early-stage contract research organization) and Vigene Biosciences (a premier gene therapy contract development and manufacturing organization or CDMO) are currently contributing strongly to the company’s top line.

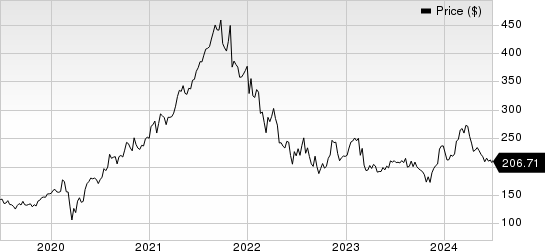

Charles River Laboratories International, Inc. Price

Charles River Laboratories International, Inc. price | Charles River Laboratories International, Inc. Quote

Within RMS, the company, in November 2023, acquired a 41% additional stake in Noveprim, a NHP provider of Mauritius. This acquisition led to a 90% controlling interest in Noveprim, firmly supporting Charles River’s NHP supply strategy. The company also acquired Explora Biolabs in April 2022. San Diego-based Explora complements the company’s existing Insourcing Solutions business, specifically its CRADL footprint and offers incremental opportunities to partner with an emerging client base.

On the flip side, a significant chunk of Charles River’s RMS and DSA revenues is generated in China. Any trade policy related conflict between the United States and China might hamper the company’s business developments in this region. Further, the Manufacturing Solutions segment is experiencing softness across the broader end markets, which, according to the company, is due to a post-COVID slowdown from biopharma manufacturers, CDMOs and their suppliers. Clients, particularly CDMOs, are cutting costs as part of their COVID-19 destocking efforts and reducing testing volumes.

According to Charles River, in Microbial Solutions, the global biopharma demand environment is affecting the Endosafe endotoxin testing product line as clients are reducing both testing volumes and investments in new instruments. These market conditions more noticeably impacted the Microbial Solutions business in the quarters of 2023. At the end of the first quarter of 2024 too, the company recognized similar destocking activities. However, Charles River assumes that the winding down of the destocking activities is now largely complete.

Further, foreign exchange is a major headwind for Charles River as a considerable percentage of its revenues comes from outside the United States. The strengthening of the euro and some other developed market currencies has been constantly hampering the company’s performance in the international markets.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, ResMed RMD and Medpace MEDP. While Hims & Hers Health sports a Zacks Rank #1 (Strong Buy), ResMed and Medpace carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath shares have surged 154.5% in the past year. Estimates for the company’s earnings have increased from 18 cents to 19 cents for 2024 and from 33 cents to 35 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for ResMed’s fiscal 2024 earnings per share have remained constant at $7.70 in the past 30 days. Shares of the company have plunged 13.1% in the past year compared with the industry’s decline of 1.8%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Estimates for Medpace’s 2024 earnings per share have remained constant at $11.29 in the past 30 days. Shares of the company have surged 76.9% in the past year compared with the industry’s 4.9% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance