Choosing Beyond Siltronic For One Superior Dividend Stock

In the German equity market, where dividends have seen an average growth of 6.4% over the past year, investors are often drawn to stocks offering attractive payouts. However, it's crucial to examine not just the size of the dividend but its growth trajectory as well. Companies with declining dividends, such as Siltronic, may pose risks for those relying on dividend income for long-term financial stability.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.67% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.41% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.79% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.67% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.14% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.98% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.24% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.12% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

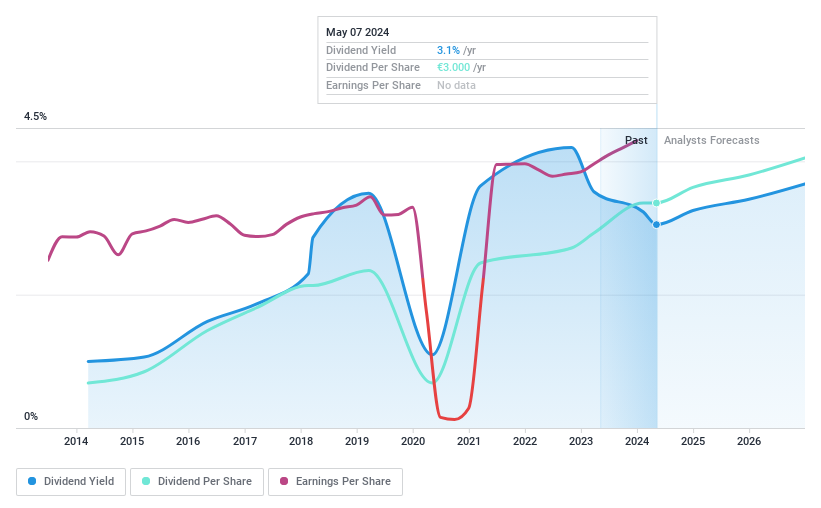

Heidelberg Materials

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Heidelberg Materials AG operates globally, producing and distributing cement, aggregates, ready-mixed concrete, and asphalt, with a market capitalization of approximately €17.59 billion.

Operations: The company generates revenue through several key segments: €11.21 billion from cement, €4.88 billion from aggregates, and €5.90 billion from ready-mixed concrete and asphalt.

Dividend Yield: 3.1%

Heidelberg Materials AG, despite a volatile dividend history over the past decade, has demonstrated resilience with a recent 15% increase in its annual dividend payout to €3 per share. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 27.3% and 29%, respectively. This coverage is complemented by consistent earnings growth, including a notable 26.6% rise last year and an expected annual growth rate of 4.28%. However, its current yield of 3.16% remains below the German market's top quartile average of 4.66%. Recent strategic moves include significant fixed-income green bond offerings totaling €685 million and an aggressive share buyback program signaling strong financial confidence moving forward.

One To Reconsider

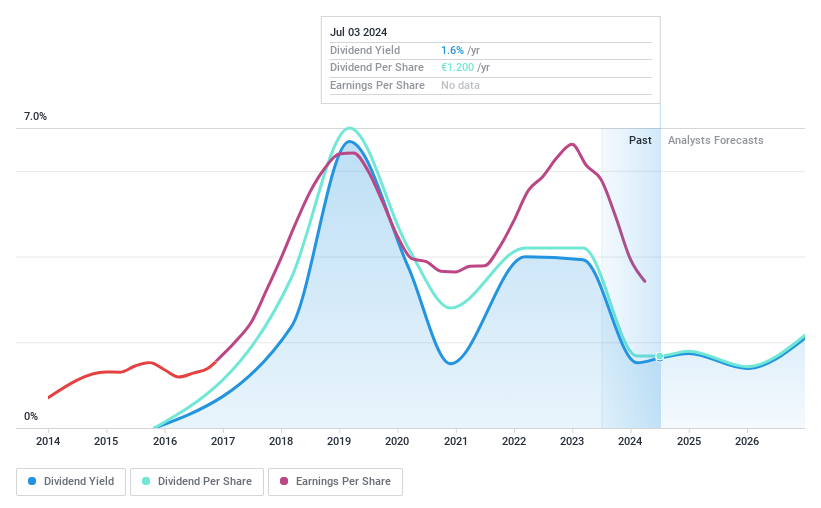

Siltronic

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Siltronic AG operates globally, supplying hyperpure semiconductor silicon wafers, with a market capitalization of approximately €2.21 billion.

Operations: The company generates €1.45 billion primarily from the development, production, and sale of semiconductor silicon wafers.

Dividend Yield: 1.6%

Siltronic AG's dividend profile is less appealing due to its unstable and declining payouts, with a recent annual drop exceeding 20%. Despite a low payout ratio of 25%, indicating earnings coverage, the dividends are not supported by free cash flows. Additionally, the company's profit margins have decreased from 19.7% to 9.9% over the past year, and earnings are projected to shrink annually by 1.5% for the next three years. This financial backdrop suggests caution for dividend-focused investors considering Siltronic AG.

Click here and access our complete dividend analysis report to understand the dynamics of Siltronic.

Summing It All Up

Unlock our comprehensive list of 31 Top Dividend Stocks by clicking here.

Are you invested in any of these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:HEI and XTRA:WAF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance