Comet Holding Leads Trio Of Value Stocks On SIX Swiss Exchange

Swiss stocks experienced a downturn on Tuesday, shadowed by broader European market trends and concerns over potential interest rate changes from the Federal Reserve and European Central Bank. Amidst this cautious market environment, identifying undervalued stocks such as Comet Holding can offer investors potential opportunities for value.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF46.50 | CHF76.58 | 39.3% |

Burckhardt Compression Holding (SWX:BCHN) | CHF599.00 | CHF849.08 | 29.5% |

Julius Bär Gruppe (SWX:BAER) | CHF51.18 | CHF96.31 | 46.9% |

Sonova Holding (SWX:SOON) | CHF279.20 | CHF463.92 | 39.8% |

Temenos (SWX:TEMN) | CHF62.65 | CHF85.86 | 27% |

Comet Holding (SWX:COTN) | CHF357.00 | CHF581.31 | 38.6% |

SGS (SWX:SGSN) | CHF79.60 | CHF125.39 | 36.5% |

Medartis Holding (SWX:MED) | CHF69.00 | CHF129.75 | 46.8% |

Kudelski (SWX:KUD) | CHF1.40 | CHF1.88 | 25.5% |

Sika (SWX:SIKA) | CHF255.30 | CHF329.12 | 22.4% |

Let's explore several standout options from the results in the screener

Comet Holding

Overview: Comet Holding AG operates globally, offering X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other regions with a market capitalization of CHF 2.79 billion.

Operations: Comet Holding's revenue is generated through three primary segments: X-Ray Systems (IXS) which brought in CHF 116.96 million, Industrial X-Ray Modules (IXM) at CHF 100.26 million, and Plasma Control Technologies (PCT), contributing CHF 193.16 million.

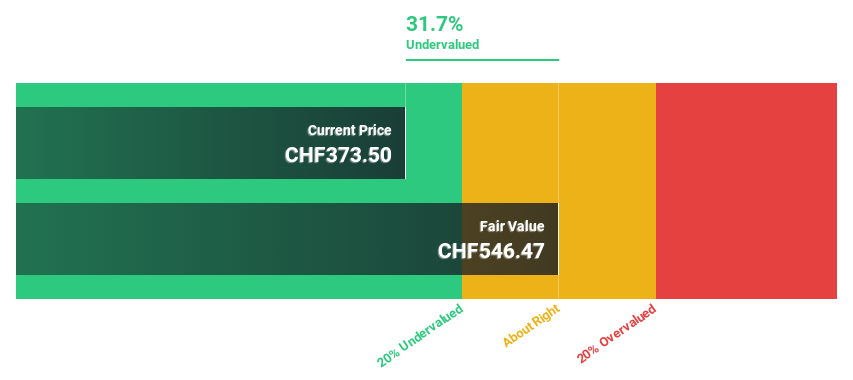

Estimated Discount To Fair Value: 38.6%

Comet Holding, priced at CHF357, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of CHF581.31. Despite a profit margin drop to 3.9% from last year's 13.3%, Comet's earnings are expected to surge by 43.14% annually over the next three years, outpacing the Swiss market growth rate substantially. The stock remains highly volatile, reflecting its current trading status at 38.6% below fair value and potential for substantial appreciation.

Sonova Holding

Overview: Sonova Holding AG is a company that specializes in producing and distributing hearing care solutions for both adults and children across regions including the United States, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of CHF 16.71 billion.

Operations: Sonova generates revenue primarily through its Hearing Instruments segment, which brought in CHF 3.36 billion, and its Cochlear Implants segment with revenues of CHF 282.40 million.

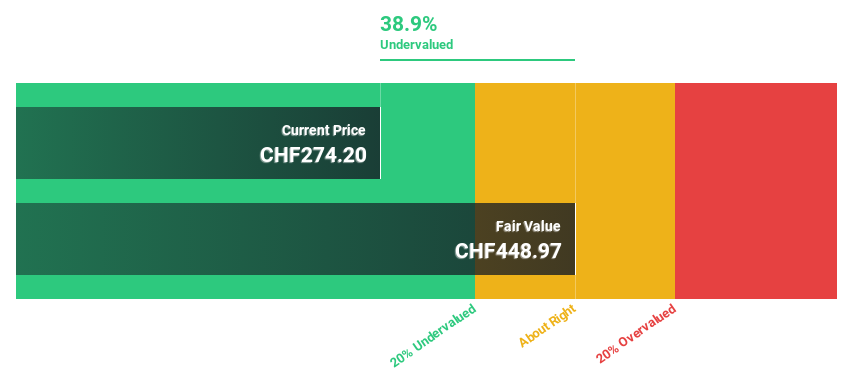

Estimated Discount To Fair Value: 39.8%

Sonova Holding, with a current price of CHF279.2, appears undervalued by DCF standards, suggesting a fair value of CHF463.92. Despite high debt levels, Sonova's robust forecasted revenue growth at 7.1% annually surpasses the Swiss market's 4.4%, coupled with an earnings growth projection of 9.9% per year—higher than the market average of 8.4%. Additionally, its return on equity is expected to be strong at 26.2% in three years, indicating potential for increased financial performance despite not reaching very high growth rates.

Swissquote Group Holding

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and professional institutional clients with a market capitalization of CHF 4.24 billion.

Operations: The company generates its revenue primarily from two segments: Leveraged Forex, which brought in CHF 101.09 million, and Securities Trading, contributing CHF 429.78 million.

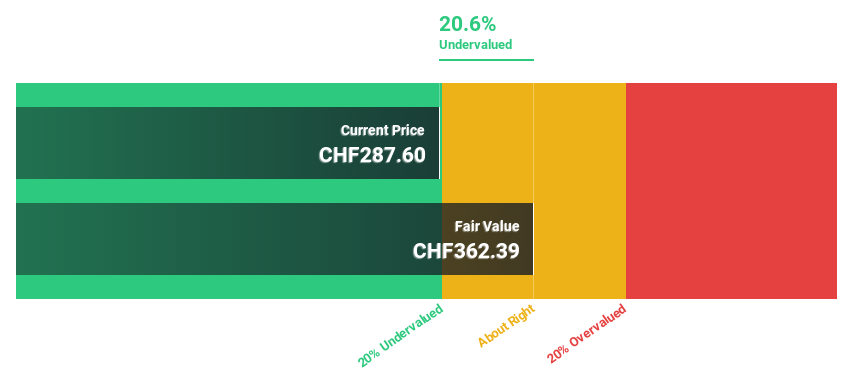

Estimated Discount To Fair Value: 20.6%

Swissquote Group Holding, priced at CHF288.2, is trading below its estimated fair value of CHF363.11, reflecting a potential undervaluation based on DCF analysis. While its earnings growth is not exceptional, it's set to outpace the Swiss market with a forecasted annual increase of 14%. Additionally, the company’s revenue growth projection of 10.3% annually also exceeds the market expectation of 4.4%. Moreover, Swissquote's return on equity is anticipated to be robust at 23.1% in three years.

Turning Ideas Into Actions

Embark on your investment journey to our 13 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows selection here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:COTN SWX:SQN and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance