Constellation Brands (NYSE:STZ) Reports Q2 In Line With Expectations

Beer, wine, and spirits company Constellation Brands (NYSE:STZ) reported results in line with analysts' expectations in Q2 CY2024, with revenue up 5.8% year on year to $2.66 billion. It made a non-GAAP profit of $3.57 per share, improving from its profit of $2.91 per share in the same quarter last year.

Is now the time to buy Constellation Brands? Find out in our full research report.

Constellation Brands (STZ) Q2 CY2024 Highlights:

Revenue: $2.66 billion vs analyst estimates of $2.67 billion (small miss)

EPS (non-GAAP): $3.57 vs analyst estimates of $3.45 (3.4% beat)

Gross Margin (GAAP): 52.7%, up from 50% in the same quarter last year

Free Cash Flow of $315.2 million, up from $76 million in the previous quarter

Organic Revenue rose 6% year on year (7% in the same quarter last year)

Market Capitalization: $47.22 billion

With a presence in more than 100 countries, Constellation Brands (NYSE:STZ) is a globally renowned producer and marketer of beer, wine, and spirits.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Constellation Brands is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

As you can see below, the company's annualized revenue growth rate of 5.2% over the last three years was sluggish for a consumer staples business.

This quarter, Constellation Brands's revenue grew 5.8% year on year to $2.66 billion, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 6.6% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

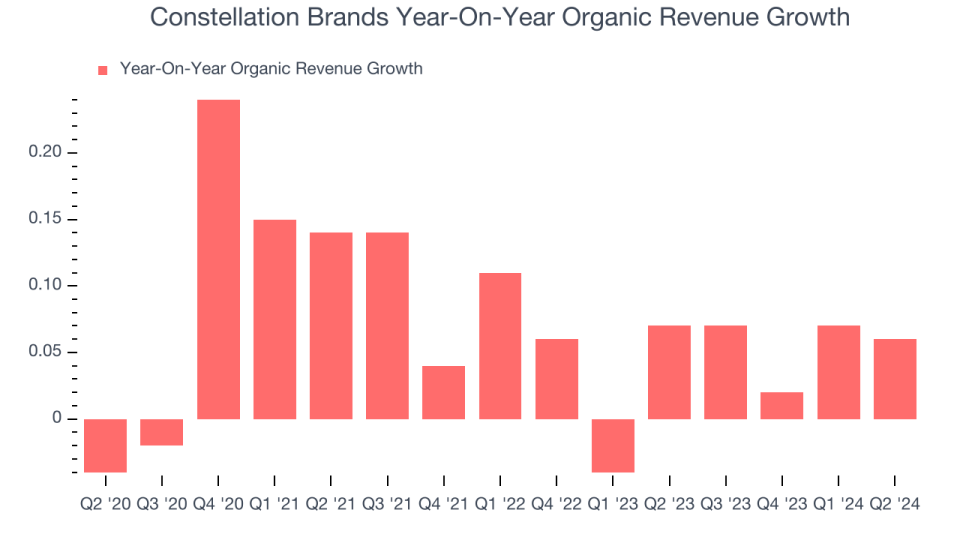

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

The demand for Constellation Brands's products has generally risen over the last two years but lagged behind the broader sector. On average, the company's organic sales have grown by 4.4% year on year.

In the latest quarter, Constellation Brands's organic sales rose 6% year on year. This growth was a deceleration from the 7% year-on-year increase it posted 12 months ago, showing the business is still performing well but lost a bit of steam.

Key Takeaways from Constellation Brands's Q2 Results

We were impressed by Constellation Brands's optimistic full-year earnings forecast, which blew past analysts' expectations. We were also glad its gross margin outperformed Wall Street's estimates. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock remained flat at $261.25 immediately after reporting.

Constellation Brands may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance