Constellation (CEG) Rises 76.9% YTD: Time to Buy the Stock?

Shares of Constellation Energy Corporation CEG have rallied 76.9% year to date compared to its industry’s growth of 27%. The company continues to add more clean energy to the grid by acquiring new nuclear plants and extending the lives of existing plants through new licenses.

The company recently released its 2024 Sustainability report, which details its progress on clean energy transition, having produced 178 terawatt hours of clean, carbon-free electricity or nearly 10% of the country’s clean energy in 2023. Constellation Energy is maintaining a high nuclear fleet capacity factor and achieved 94.4% last year. Its fleet capacity factor was an impressive 93.3% in first-quarter 2024, which indicates continued strong production in the current year.

Courtesy of strong commercial performance through portfolio optimization and customer margins, Constellation Energy has outperformed its sector and the S&P 500 in the year-to-date period.

Price Performance (YTD)

Image Source: Zacks Investment Research

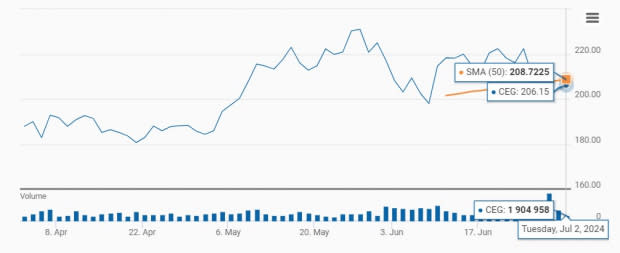

Constellation Energy is currently trading just below the 50-day moving average, indicating the right opportunity now to accumulate the stock.

Constellation Stock Trades Just Below 50-Day Average

Image Source: Zacks Investment Research

Factors Acting in Favor of Constellation

The demand for clean electricity is rising and Constellation Energy’s ability to produce high volume of emission-free electricity from its nuclear plants is the primary contributor to its performance. Fleetwide capacity factor has remained more than 94% over the past decade, or about 4% higher than the industry average. Demand for clean electricity produced by Constellation Energy is on the rise as it continued to support the system amid low production from renewable projects even when demand was high.

Constellation Energy’s primary power production comes from its nuclear fleet and it is well-positioned on nuclear fuel. The company has created a diverse and resilient portfolio that can withstand a Russian supply disruption and has engaged in multiple long-term uranium supply contracts running well into the 2030s. These steps will ensure continued production from its nuclear fleet. Nuclear plant production makes Constellation Energy one of the largest producers of carbon-free electricity. Another utility, NextEra Energy NEE, also produces a large volume of clean electricity from its renewable projects and other clean sources.

An increase in artificial intelligence (AI) usage in the future should spur demand for clean electricity. Data centers operate 24X7, 365 days a year, and electricity demand from these centers is destined to increase, as AI-based queries need substantially higher power than traditional Internet usage. The big tech operators will need reliable, clean power to operate data centers. Per management, some big tech companies are in discussion to shift their AI centers next to Constellation's nuclear plants for uninterrupted clean power supply.

The company plans to invest $800 million in new equipment to increase the output of the Braidwood and Byron clean energy centers in Illinois, increasing the existing capacity by 158 MW. Improvement in capacity at other nuclear plants could add up to one gigawatt of new clean energy capacity over the next decade and assist the company in meeting the greater need for clean energy demand.

Constellation Energy expects to generate an additional $875 million net income in 2024-2025 through organic means like wind repowering, nuclear uprates, nuclear license renewals and clean hydrogen production. The acquisition of a partial ownership stake in South Texas Electric Generating Station, a 2,645-MW dual-unit nuclear plant located in Bay City, TX, will further boost its clean power generation capacity and profits.

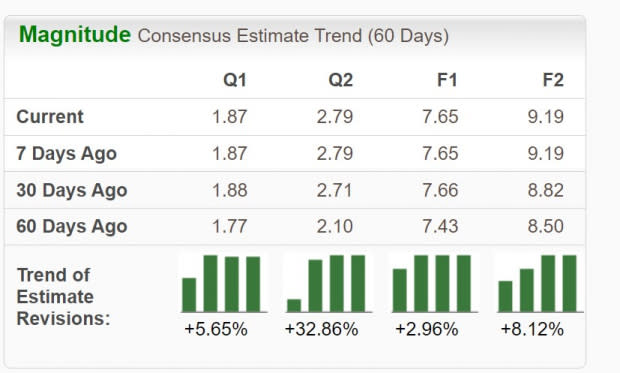

Estimates Moving Up

Constellation Energy now expects its 2024 earnings per share in the range of $7.23-$8.03 compared with $5.01 a year-ago. The Zacks Consensus Estimate for CEG’s 2024 and 2025 earnings per share has moved up 2.9% and 8.1%, respectively, in the last 60 days. The upward revision in earnings estimates indicates analysts’ increasing confidence in the stock.

The Zacks Consensus Estimate for 2024 and 2025 earnings per share of its peer NRG Energy NRG has gone down by 16.4% and 15.4%, respectively, in the last 60 days.

Image Source: Zacks Investment Research

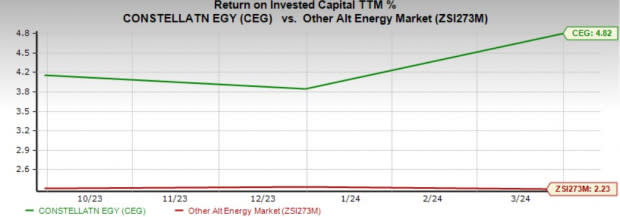

Returns Higher Than the Industry

Return on invested capital (ROIC) has outperformed the industry average in the trailing 12 months. ROIC of CEG was 4.32% compared with the industry average of 2.33%. The company has been investing effectively in profitable projects, which is evident from its ROIC.

Image Source: Zacks Investment Research

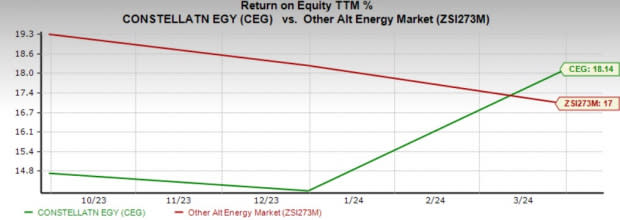

CEG’s trailing 12-month return on equity is 18.1%, ahead of the industry average of 17%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders’ funds in its operations to generate income.

Image Source: Zacks Investment Research

Delivering Value to Shareholders

Constellation Energy continues to return value to its shareholders through its share repurchase program and dividend payments.

On Apr 30, 2024, CEG’s board of directors approved a $1 billion increase to the $2-billion stock repurchase program authorized last year. The company has already repurchased shares worth $1.5 billion from the repurchase coffer. Constellation Energy’s current shares outstanding at the end of the first quarter was 318 million. It assumes shares outstanding at the end of 2024 to be nearly 316 million, indicating further buyback this year.

The board has also approved a quarterly dividend of 35.25 cents in the first quarter of 2024, reflecting an increase of 25% from the previous quarter. The company aims to increase its dividend by 10% annually subject to board approval. Check CEG’s dividend history here.

Valuation

The company is currently trading at a premium compared to its industry on forward 12-months P/E basis, which is justified given its premier position in the competitive C&I market and investment-grade balance sheet.

Image Source: Zacks Investment Research

Time to Stock Up

Constellation Energy's investment in increasing clean energy production volumes, expansion of operations through organic and inorganic initiatives and rising demand from its customers place it well for further growth from the current levels.

Given the positive movement in earnings estimates and strong return on capital, the Zacks Rank #1 (Strong Buy) Constellation is currently an ideal candidate to add to your portfolio.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance