Copa Holdings (CPA) Q3 Earnings Beat Estimates, Rise Y/Y

Copa Holdings, S.A. CPA reported mixed third-quarter 2022 results wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same.

Quarterly earnings of $2.91 per share surpassed the Zacks Consensus Estimate of $2.63 and rose significantly year over year. Revenues of $809.4 million missed the Zacks Consensus Estimate of $816.2 million but improved year over year on the back of passenger revenues.

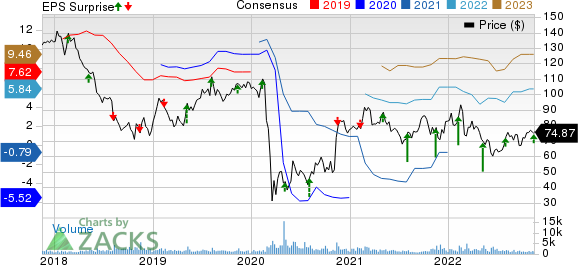

Copa Holdings, S.A. Price, Consensus and EPS Surprise

Copa Holdings, S.A. price-consensus-eps-surprise-chart | Copa Holdings, S.A. Quote

Below, we present all comparisons (in % terms) with third-quarter 2019 levels (pre-coronavirus).

Passenger revenues (contributed 95.6% to the top line) increased 13% owing to higher yields (up 12.1%). Cargo and mail revenues jumped 80.2% to $26.4 million, owing to higher cargo volumes and yields. Other operating revenues improved 7.2% to $8.82 million, owing to revenues from non-air ConnectMiles partners.

On a consolidated basis, traffic (measured in revenue passenger miles) grew 0.8%, while (measured in available seat miles or ASMs) decreased 0.6%. As a result, the load factor increased 1.2 percentage points to 86.8% in the reported quarter. Passenger revenue per available seat miles increased 13.7% to 12.2 cents. Additionally, revenue per available seat mile increased 15% to 12.8 cents. Cost per available seat mile increased 16.4%. Excluding fuel, the metric dipped 5.3%. The average fuel price per liter soared 76.6% to $3.81.

Total operating expenses increased 15.7% to $665.75 million due to the 64.1% increase in fuel costs. Expenses on wages, salaries and other employee benefits fell 14.8% on reduced headcount. Sales and distribution costs increased 14.6% due to higher sales. Passenger servicing costs dropped 27.9%. Flight operation costs decreased 4.1%.

Copa Holdings exited the third quarter with cash and cash equivalents of $198.74 million compared with $134.13 million at the end of June 2022. Total debt, including lease liabilities, was $1.7 billion compared with $1.6 billion at the end of the second quarter.

CPA exited the third quarter with a consolidated fleet of 95 aircraft, which comprises 67 Boeing 737-800s, 18 Boeing 737 MAX 9s, 9 Boeing 737-700s, and 1 Boeing 737-800 freighter. During the reported quarter, the carrier took delivery of one Boeing 737 MAX 9 aircraft.

In October, CPA further took delivery of one Boeing 737 MAX 9 and anticipated receiving one additional aircraft in November. This shall end CPA’s 2022 with a total fleet of 97 aircraft.

Copa Holdings anticipates an operating margin of almost 22% for fourth-quarter 2022. CPA expects capacity to be 6.5 billion ASMs, up 6% from fourth-quarter 2019 capacity. The load factor is estimated to be around 88% in the December quarter. The fuel price is estimated to be $3.75 per gallon.

For 2023, CPA anticipates increasing its capacity by nearly 15% from 2022.

Currently, Copa Holdings carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Transportation Companies

Delta AirLines’ DAL third-quarter 2022 earnings (excluding 42 cents from non-recurring items) of $1.51 per share fell short of the Zacks Consensus Estimate of $1.56. Escalated operating expenses induced the earnings miss. Multiple flight cancelations and booking weaknesses due to Hurricane Ian also hurt results. DAL reported earnings of 30 cents per share a year ago, dull in comparison to the current scenario, as air-travel demand was not so buoyant then.

DAL reported revenues of $13,975 million, which lagged the Zacks Consensus Estimate of $14,157.2 million. Driven by the high air-travel demand, total revenues increased more than 52% on a year-over-year basis.

United Airlines’ UAL third-quarter 2022 earnings (excluding 5 cents from non-recurring items) of $2.81 per share beat the Zacks Consensus Estimate of $2.21 and our estimate of $2.17. An upbeat in air-travel demand aided results. In the year-ago quarter, UAL incurred a loss of $1.02 per share when air-travel demand was not as buoyant as in the current scenario. The third quarter of 2022 was the second consecutive profitable quarter at UAL since the onset of the pandemic.

Operating revenues of $12,877 million beat the Zacks Consensus Estimate of $12,709.5 million and our estimate of $12, 631.6 million. UAL’s revenues increased more than 66% year over year owing to an upbeat in air-travel demand. The optimistic air-travel demand scenario is also evident from the fact that total operating revenues increased 13.2% from third-quarter 2019 (pre-coronavirus) levels.

J.B. Hunt Transport Services, Inc. JBHT reported better-than-expected third-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.JBHT’squarterly earnings of $2.57 per share surpassed the Zacks Consensus Estimate of $2.45 and improved 36.7% year over year.

Total operating revenues of $3,838.3 million also outperformed the Zacks Consensus Estimate of $3803.4 million. The top line jumped 22.1% year over year on the back of strength across — Dedicated Contract Services, Intermodal, Truckload and Final Mile Services segments. Total operating revenues, excluding fuel surcharges, rose 12.4% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance