Coronavirus: Average UK wages are falling for the first time since 2014

Average wages for UK employees have fallen year-on-year for the first time since 2014 as the coronavirus crisis has squeezed incomes, official figures suggest.

Total pay for workers in staff jobs, which includes both wages and bonuses, was 0.3% lower between March and May than a year earlier, the first annual decline since mid-2014.

Regular pay, excluding bonuses, remained positive but saw growth slow to 0.7% year-on-year, according to Office for National Statistics (ONS) data published on Thursday.

But pay has taken a steeper drop in real terms, which take inflation into account. Regular pay slid 0.2% and pay and bonuses combined dropped 1.3% as bonuses took the sharpest cuts between March and May compared to a year earlier.

READ MORE: UK employers have shed almost 650,000 jobs since March

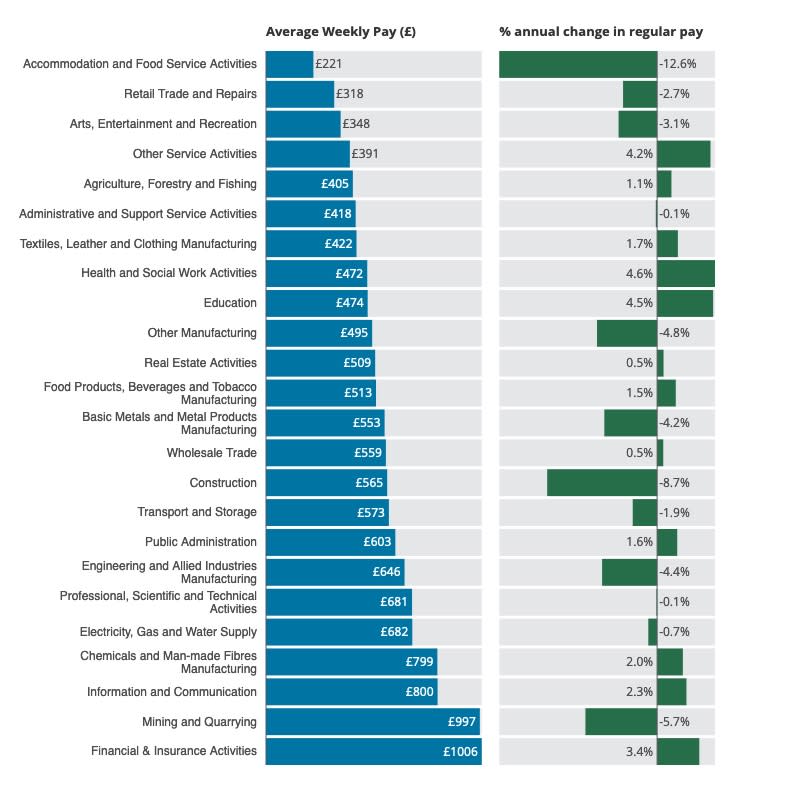

The ONS said pay declined most in industries where furloughing has been most common, reflecting sectors hit hardest by lockdown. It noted these are sectors where pay is already low, including accommodation and food services.

Separate analysis by the Treasury shows a 12% or £102 a week decline in working households’ earnings from work between February and May. Incomes are down by 7.9% or £67 a week when the government’s furlough and self-employed support schemes, welfare benefits and lower tax bills are taken into account.

Britain had already seen a significant squeeze on real incomes since the global financial crisis, only beginning to recover in recent years and only surpassing 2008 levels earlier this year. It is now again below its pre-crisis level in 2008.

A tight labour market with record official employment rates had been pushing pay higher in recent years, as employers had to compete for staff and workers’ confidence increased.

But the pace of wage growth had already begun to cool last year, and the pandemic’s arrival has thrown the jobs market into turmoil. Higher unemployment may hold down pay levels for some time to come.

The latest ONS data showed UK employers have shed almost 650,000 jobs since March. Analysts said the government’s furlough scheme had staved off a much steeper rise in these official figures in the early stages of the pandemic, however.

More than 9.4 million workers have been placed on government-subsidised furlough leave since lockdown, and 2.7 million self-employed workers have received grants. The majority affected have seen their incomes decline, as the schemes only cover 80% of their average recent incomes and most employers have not topped this up.

READ MORE: Recruitment giant Hays has shed over 1,000 jobs as hiring dries up

“Without further government action, the risk is the cuts to jobs and wages so far will just be the tip of an iceberg that crushes livelihoods and crashes our economy,” said John Phillips, acting general secretary of the GMB union.

Concerns have grown in recent months that a fresh jobs crisis is looming, with economic recovery seen as too weak to sustain employment levels and the government winding down furlough support.

Almost a third of UK firms are planning to slash jobs in the next three months, according to a separate survey published on Thursday by the British Chambers of Commerce (BCC).

Yahoo Finance

Yahoo Finance