Coronavirus: Why negative or super low crude oil prices won't mean free or 1p petrol

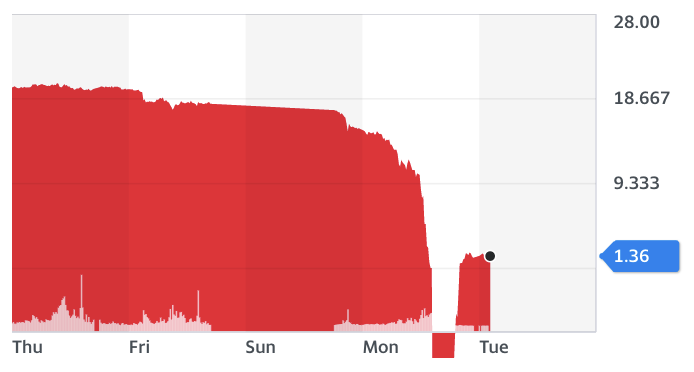

Crude oil prices have had wild swings over the last day — crashing into negative territory for the first time in history — meaning prices, at one point, were -$13.75 per barrel.

But while prices have somewhat rebounded into positive territory — $1.36 per barrel for US West Texas Intermediate crude futures (CL=F), the international benchmark Brent oil futures (BZ=F) hit $25.22 per barrel as of 7.30am UK time. People have questioned what this will mean for prices at the petrol pump.

First and foremost, remember, prices at the pump are not a perfect reflection of the oil markets.

When crude oil first started to crater over a month ago, due to fears of a supply glut and demand destruction from the coronavirus pandemic, supermarkets such as Morrisons (MRW.L) and Walmart’s (WMT) Asda repeatedly reduced their fuel prices, even in cuts of 12p per litre for petrol and 8p per litre for diesel.

But even though crude oil prices hover around the $1 per barrel mark, it absolutely does not mean that prices at the pump will crash to the likes of 1p per litre.

Futures contracts are traded on an exchange and are financial contracts between two parties to buy and sell an asset at a later date for a certain price. The issue is that oil is a physical commodity — it’s tangible, it needs to be stored and that comes at a cost.

What this means is that, let’s say, you agreed in a futures contract to buy 10 barrels of oil on 1 June for $50 each. However, if you want to keep those 10 barrels of oil that you bought for $50 per barrel, you will need to store it somewhere.

READ MORE: Coronavirus: US oil prices rebound after turning negative for the first time in history

The issue is that the market is oversupplied and demand has cratered because production, travel, and a number of industries are frozen due to the coronavirus pandemic. Lockdowns have wiped out around a third of global oil demand.

Storing, of course, comes at a cost. At the moment, storage facilities are filled up and there are about 160 million barrels of oil sitting on tankers waiting for buyers.

So those who can store it are unlikely to buy it from you and if you want to get rid of it, you’ll have to pay someone. But they will still have to store it if it can’t be used.

Delivery and importing/exporting comes at a cost too as well as cost of overheads for running a gas station. Petrol and diesel prices include government taxes and a profit margin for the seller.

The physical asset value isn’t the direct translation to what we see at the pumps and in a major downturn, companies will be looking to recoup losses. Even though prices may decline sharply over the year, it does not mean it’ll come for “free.”

Yahoo Finance

Yahoo Finance