Coronavirus: Brent hits 18-year low as crude oil price turns negative

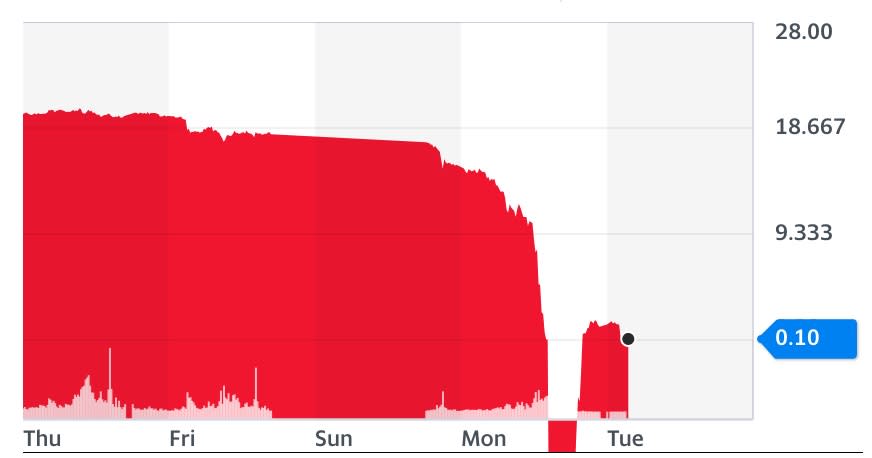

US crude oil prices (CL=F) were trading at historic lows below $0 a barrel on Tuesday after turning negative for the first time in history.

A second day of declines sent a ripple of alarm through stock markets, with benchmark brent prices also hitting an 18-year low as global recession fears mount. Investors raced to sell oil as coronavirus has hammered global demand and overwhelmed storage facilities.

The unprecedented sell-off on Monday saw crude prices sink to as low as minus $40 a barrel, with prices also turning negative on Tuesday morning in London. Crude was trading at minus $6.30 a barrel shortly before midday in London on Tuesday.

The price of brent (BZ=F) fell by almost a quarter to below the $20 mark and its lowest level since 2002 in morning trading, before recovering slightly. Brent was trading a $21.11 at around 11.40am in London, down 16.7%.

Oil storage has become scarce as demand has plummeted, leaving many traders with unwanted May crude futures contracts on the brink of expiring. Investors unable to sell risk deliveries of barrels of oil with nowhere to store them.

READ MORE: Stocks slide as oil prices collapse and Trump vows to curb immigration

With industry on lockdown and global car, air and other travel heavily restricted, demand for fuel has tumbled by 30%, according to Reuters. Stephen Innes, chief market strategist at AxiCorp, called it a “meltdown” in the market.

"Today it's pretty clear that a major issue in the market is a glut in the United States and lack of storage capacity," Michael McCarthy, chief market strategist at CMC Markets in Sydney, told Reuters.

“No one wants oil now,” wrote Neil Wilson, chief market analyst at Markets.com, on Monday night. “Demand has collapsed in the short term but output cuts by OPEC are yet to take effect so the world is awash with crude with nowhere to put it.”

Howie Lee, an economist at OCBC, said he would not bet against negative prices happening again, with some analysts suggesting weak demand and storage problems could trigger a similar rout on June contracts next month.

The historic drop into negative prices unnerved investors worldwide, with Asian markets closing lower overnight and most major European indices in the red on Tuesday morning in London. One emerging market index hit its lowest level in three weeks.

READ MORE: Why low and negative oil prices are unlikely to mean free petrol

Emma Wall, head of investment analysis at Hargreaves Lansdown, said the scale of oil traders’ fears about future demand were what had trickled over into wider alarm on the markets. “It’s the message it sends - the idea that there will be so little demand for oil next month that the oil producers were willing to pay you to take the black stuff off their hands.”

Some analysts said a sustained sharp drop in oil prices could spark a slowdown in global inflation, and even trigger deflation in some economies.

Yahoo Finance

Yahoo Finance