Deadline Approaches for SEC’s Spot Ethereum Decision

This article was originally published on ETFTrends.com.

By May 23 — exactly a week from now — the SEC will need to reach a decision on VanEck’s spot ethereum application.

VanEck isn’t the only one aiming to get approval. The deadline for ARK Investment Management’s filing with 21Shares is May 24, just a single day after VanEck's. Recently, ARK and 21Shares updated their application to remove a staking clause.

Minimal Hope

As for what to expect from the SEC, analysts aren’t exactly enthusiastic. Ric Edelman, head of the Digital Asset Council of Financial Professionals, recently told CNBC he “would be astonished if the SEC said yes at this point,” citing the lack of correspondence between the SEC and VanEck.

VanEck CEO Jan van Eck is not optimistic that the SEC will approve the firm’s ethereum ETF application just yet. In April, van Eck told CNBC he expected his firm’s ethereum filing to “probably be rejected.”

“The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the bitcoin ETFs — and right now, pins are dropping as far as ethereum is concerned,” the VanEck CEO added.

A March filing regarding BlackRock’s petitioned spot ether ETF indicated the SEC may be considering labeling ethereum as a security, not a commodity. The filing delayed BlackRock’s decision until June and asked for public comment on whether ETH is a security or a commodity.

Meanwhile, Grayscale Investments has withdrawn its filing for an ethereum futures ETF. This comes while Grayscale awaits approval on its proposal to convert the Grayscale Ethereum Trust into a spot ether ETF.

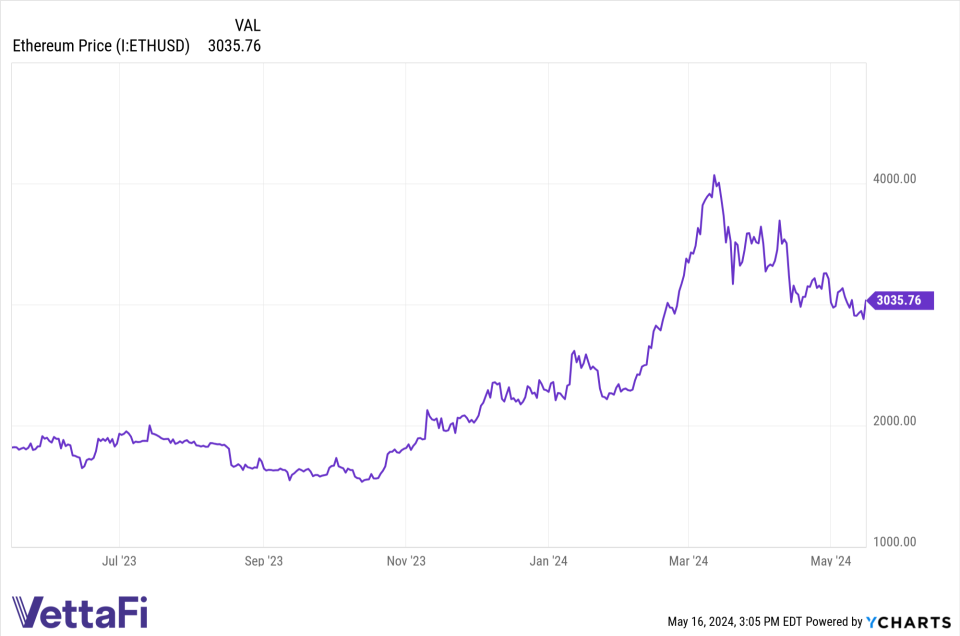

Despite the pessimism over the SEC’s next moves, the price of ethereum is doing quite well. The cryptocurrency is currently hovering around the $3,000 range. This marks a stark gain in more than a year: Ethereum sat closer to $1,800 in May 2023.

Looking ahead, the SEC’s debate over whether ethereum is a commodity or a security could keep spot ethereum ETFs off the market for now. Ether’s regulatory status will ultimately determine whether or not spot ether is here to stay.

For more news, information, and strategy, visit the Crypto Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM

Yahoo Finance

Yahoo Finance