Dividend Decisions: Avoiding Mativ Holdings For A Better Alternative

Dividend-paying stocks are often sought after for their potential to provide investors with a steady stream of income. However, the allure of these dividends can be misleading if the payments are not consistent. Companies like Mativ Holdings, which have experienced significant dividend cuts, highlight the importance of examining dividend stability before investing. Such inconsistencies can indicate deeper financial issues that might not make them ideal for those seeking reliable dividend investments.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.26% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.37% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.08% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.02% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.93% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.78% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.14% | ★★★★★★ |

Financial Institutions (NasdaqGS:FISI) | 6.21% | ★★★★★☆ |

Helmerich & Payne (NYSE:HP) | 4.89% | ★★★★★☆ |

First Bancorp (NasdaqGS:FNLC) | 5.58% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top Dividend Stocks screener.

We're going to check out one of the best picks from our screener tool and one that could be a dividend trap.

Top Pick

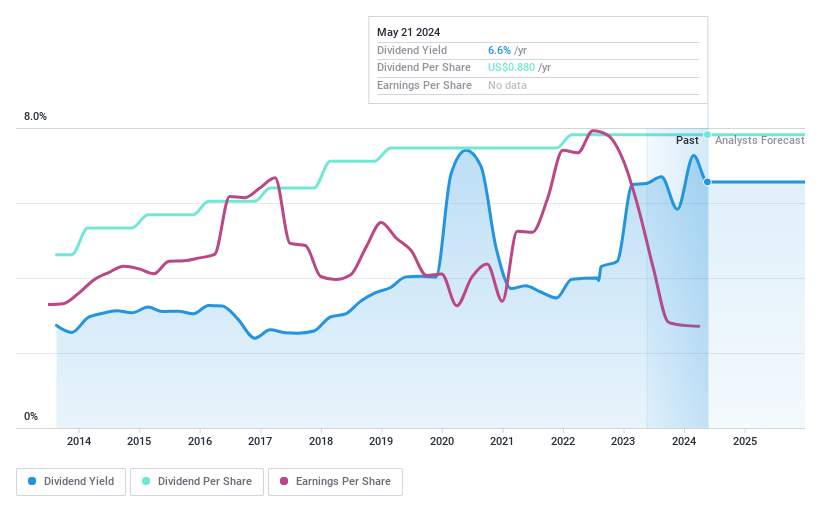

Flushing Financial

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flushing Financial Corporation, serving as the bank holding company for Flushing Bank, offers banking products and services to consumers, businesses, and governmental units with a market capitalization of approximately $379.35 million.

Operations: The primary revenue segment for the bank is its Community Bank division, which generated $191.50 million.

Dividend Yield: 6.7%

Flushing Financial maintains a strong dividend yield at 6.67%, positioning it in the top 25% of US dividend payers, demonstrating attractiveness to those seeking steady income streams. Despite a high payout ratio of 92.6%, which suggests dividends are not well covered by earnings, its track record of stable and reliable dividends over the past decade adds a layer of security. Recent affirmations include maintaining its quarterly dividend, underscoring commitment amidst modest earnings declines and an active share buyback program, reinforcing shareholder value through direct capital returns.

Unlock comprehensive insights into our analysis of Flushing Financial stock in this dividend report.

One To Reconsider

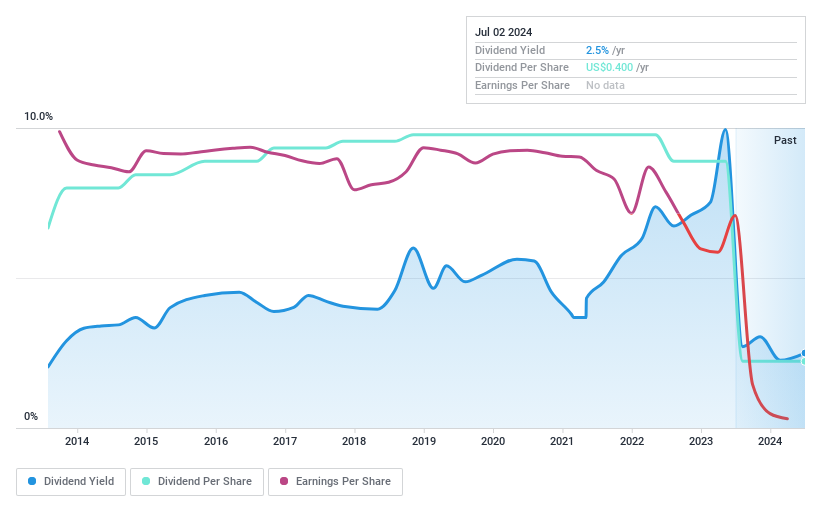

Mativ Holdings

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Mativ Holdings, Inc. operates globally, manufacturing and selling specialty materials across the United States, Europe, Asia Pacific, and the Americas with a market capitalization of approximately $868.62 million.

Operations: The company's revenue segments total approximately $1.98 billion, spanning across various global regions including the United States, Europe, Asia Pacific, and the Americas.

Dividend Yield: 2.5%

Mativ Holdings, Inc. presents a cautionary case for dividend investors due to its unstable and unreliable dividend history, with significant reductions over the past decade. Despite a low cash payout ratio of 43.4%, dividends are not adequately covered by earnings, reflecting deeper financial challenges as evidenced by recent quarterly losses widening to US$28 million from US$7.7 million year-over-year. Additionally, its current yield of 2.5% falls below the top quartile of US dividend payers at 4.71%.

Seize The Opportunity

Discover the full array of 202 Top Dividend Stocks right here.

Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:FFIC and NYSE:MATV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance