Double-Digit Rates to Bite Brazil Companies as Easing Stalls

(Bloomberg) -- Brazilian companies that loaded up on cheap debt are bracing for a new reality: double-digit interest rates for longer than anyone expected.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

Hedge Fund Talent Schools Are Looking for the Perfect Trader

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

The Central Bank of Brazil’s easing cycle appears headed for a premature end, with traders expecting it to hold the policy rate at 10.5% when it meets later Wednesday. Borrowing costs will remain above 10% for the foreseeable future, according to pricing in Brazil’s swap curve.

That poses a fresh challenge to companies carrying floating-rate debt they took on when rates were around historic lows of 2% during the pandemic. Executives planned for rates to come down allowing them to refinance those loans.

Across the globe, consumers, chief financial officers, and government finance ministers are being forced to adjust to a world in which rates stay higher-for-longer. The situation in Brazil stands out as policymakers in Latin America’s largest economy were among the first to raise rates and to start cutting.

That campaign has been derailed by questions over sticky inflation and the country’s ability to control its fiscal deficit.

“There is a general discomfort in relation to Brazil’s fiscal situation,” said Ricardo Carvalho, head of Brazilian corporates at Fitch Ratings, adding that the offshore bond market is largely off limits to all but the largest, highest-rated companies.

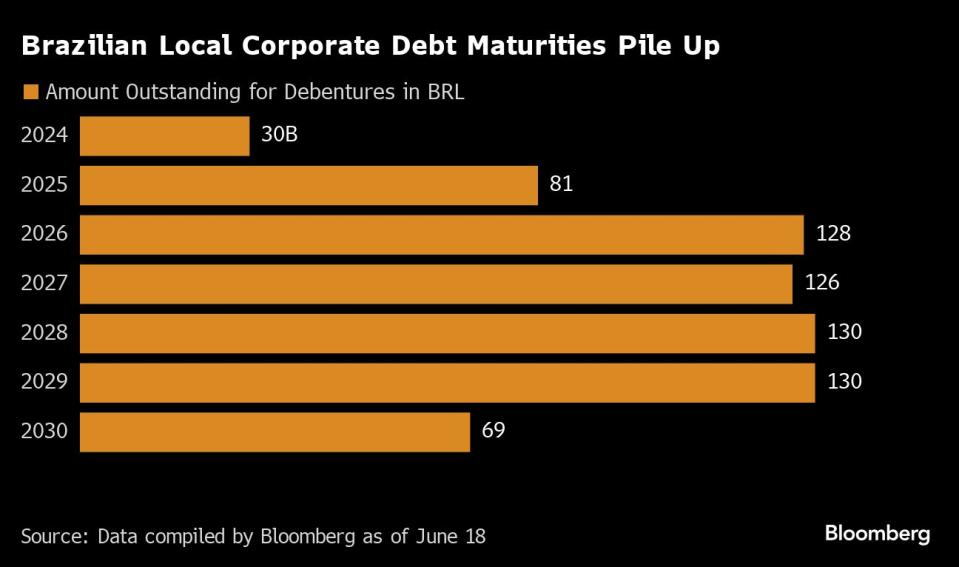

Corporate borrowers in the country face 81 billion reais ($14.9 billion) in maturities in local bonds, known as debentures, in 2025 and 128 billion reais in 2026, according to data compiled by Bloomberg. Another $18 billion is coming due by the end of 2026 on notes sold in overseas markets.

Sales of dollar bonds by Brazilian companies have dipped by more than half over the past three months compared to the start of the year, after Federal Reserve officials repeatedly said that interest rates should remain higher for longer in the US. Most recently, officials penciled in just one rate-cut this year, disappointing traders who expected more easing sooner.

In the local market, liquidity is ample, even if borrowing remains expensive. Issuance of debentures soared 204% compared with the same period last year, according to data from Anbima — Brazil’s capital markets association.

“Companies will continue to use the local market, but the difference is that you will have a higher cost of capital,” Carvalho said. “But that’s better than not having someone willing to give you credit at all.”

Credit conditions have eased as borrowing costs in Brazil fell, marking a recovery since a liquidity crisis in early 2023. But the benchmark Selic rate — which stands at 10.5% after being cut from a high of 13.75% — isn’t low enough to give companies a breather, said Rodrigo Gallegos, a partner at RGF & Associados.

There are already signs some are cracking. In the first quarter, 4,203 companies filed for judicial recovery — a process similar to Chapter 11 reorganization in the US. That’s up nearly 4% from the previous quarter, according to data from RGF, a Sao Paulo-based consultancy that specializes in restructuring.

“Very high rates have a direct impact on judicial recoveries,” Gallegos said.

Corporate Stress

The agriculture sector, a powerhouse in Brazil, has already seen a wave of filings for bankruptcy protection. Meanwhile, Brazilian health-care companies, such as Diagnosticos da America SA and Oncoclinicas do Brasil Servicos Medicos SA, have taken steps to lower their debt burdens after embarking on an acquisition spree when rates were low.

Retailers have also buckled, with credit remaining tight since the downfall of Americanas SA in an accounting scandal that put the entire sector under the microscope. Airlines have also struggled with heavy debt, high fuel costs, and shortages of aircraft.

It all sets the stage for more restructurings, said Giuliano Colombo, a lawyer at Pinheiro Neto Advogados.

“There is no way companies can be healthy paying double-digit interest rates,” he said. “That’s tough to pay, especially if you have high debt levels.”

It’s also likely that more companies will pursue so-called liability management exercises, in which they raise capital to refinance debt to avoid expensive legal proceedings.

“The mood is of melancholy and frustration,” Colombo said.

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance