'Dramatic collapse' of cash in UK could exclude millions of elderly, poor and rural people

Up to eight million people risk being shut out of the economy as Britain “sleepwalks” into a cashless society, according to a new report calling for radical action from the government to address the issue.

The ‘Access to Cash’ report published on Wednesday warned of the risk of a “dramatic collapse” in the UK’s cash system as digital payments rapidly overtake coins and notes.

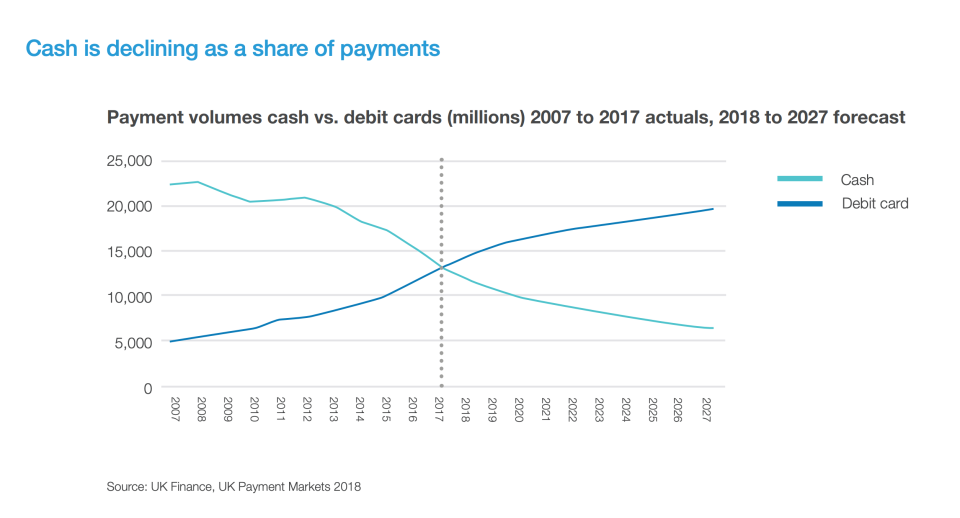

Just 30% of UK transactions are currently with cash and at the current rate of decline, cash would disappear by 2026. The report’s authors believe it will still be around by then but think cash will represent just one in 10 payments.

The shift to a cashless society means elderly people, the poor, and rural communities are at risk of being “left behind” as the UK becomes increasingly cashless.

“17% of the UK population – over eight million adults – would struggle to cope in a cashless society,” the report said.

READ MORE: The UK generated £191trn in cashless payments last year

Natalie Ceeney CBE, who chaired the inquiry, wrote in the report: “Sweden, the most cashless society in the world, outlines the dangers of sleepwalking into a cashless society: millions of people could potentially be left out of the economy, and face increased risks of isolation, exploitation, debt and rising costs.”

The 130-page report took evidence from 120 organisation and interest groups, spanning consumer groups, regulators, and commercial operators. It also commissioned an online survey of 2,000 UK consumers.

The report said that the decline in ATMs is “just the tip of the iceberg” when it comes to the impact of a cashless society.

“Small business associations are concerned about the growing challenges of handling cash: closing bank branches and rising charges make it more expensive and riskier to handle cash,” Ceeney wrote.

“Rural communities see an increasingly digital world that only works for those with broadband and mobile connectivity. And the commercial players supporting the cash infrastructure are questioning how a model built for a high-cash economy can be economically viable when most payments are made digitally.”

READ MORE: The UK has ‘no plans’ for what happens when it goes cashless

While the report’s authors are not against an entirely digital payment system in the UK, they call for radical action now to tackle the looming problems that going cashless poses.

“In Sweden, we were repeatedly advised by central bankers, consumer groups and the cross-party commission exploring cash to plan now – because once their infrastructure had gone, putting it back was close to impossible,” the report said.

“The Swedish government has recently agreed to ‘put the brakes on’ their shift to cashlessness because they are leaving people behind and need time to plan how to include everyone.”

The report makes five recommendations to tackle the problem of people being left behind:

The government guarantees that people can continue to have access to cash;

To mandate that cash must be accepted in shops;

To overhaul the wholesale cash infrastructure so it is more like a utility rather than a private sector operation;

Make digital inclusion a priority, so that the more vulnerable in society are not left behind by advances in payment technology;

For the government to adopt and develop a plan for cash.

The Bank of England signalled its support for the report’s third recommendation, announcing on Wednesday that it will “develop a new system for wholesale cash distribution that will support the UK in an environment of declining cash volumes.”

“We are committed to cash,” Sarah John, the Bank of England’s chief cashier, said in a statement. “Although its use is declining, many people, including vulnerable groups, still prefer to use cash. It is important that everybody has a choice about how they make payments.

“The action we are announcing today will help to support cash as a viable means of payment for those who want to use it.”

The “Access to Cash” review was started in July 2018. It was funded by Link but written independently of the ATM operating company .

READ MORE: The millions of Brits who will suffer from a cashless society

Yahoo Finance

Yahoo Finance