Is Your Emergency Fund Ahead Of The Curve? The Savings Needed To Be In The Top 5% For Your Age Group

Personal finance gurus and successful investors may all have their own opinions on how to save money for retirement successfully, but one thing is clear: you need to have an emergency fund. A new guide from CNBC Select has revealed how much you need to save for retirement and an emergency fund according to your age group.

Don't Miss:

Are you rich? Here’s what Americans think you need to be considered wealthy.

Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

Planning your retirement is on the minds of many adults in the USA, and with rising costs of living and high inflation, this has never been a more stressful time to plan for your retirement. Luckily, the financial experts at CNBC Select have compiled a helpful guide on some age-based saving milestones. According to data provided by retirement plan provider Fidelity Investments, you must save 10 times your income to retire at 67 years old comfortably. The earlier you want to retire, the more money you'll have to save.

According to Fidelity, you need to have saved the equivalent of your annual salary by the age of 30. By 40, this figure jumps to three times your income; by the time you reach 60, you should have saved at least eight times your income. These savings include earnings from your 401(k) and any investments.

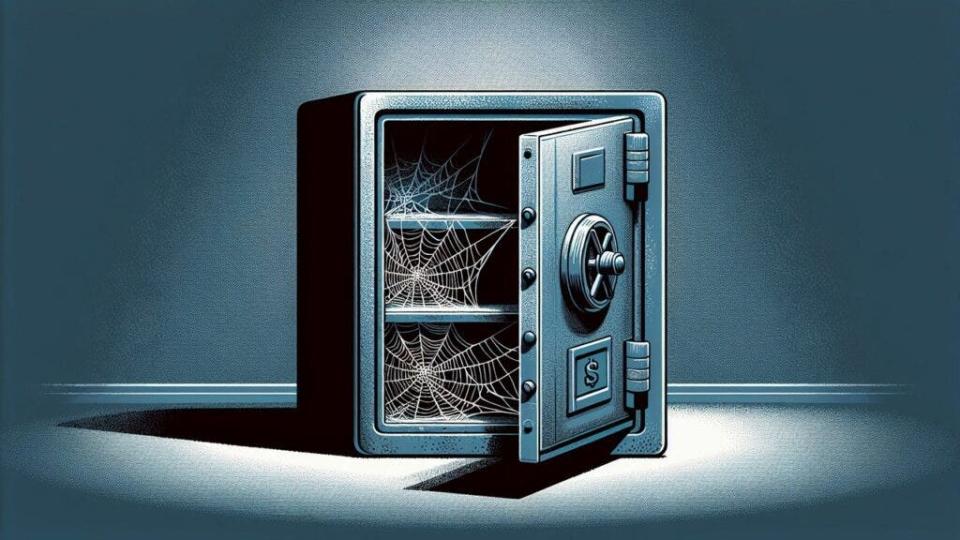

But that's the hard part, isn't it: saving for retirement.

The Schroders 2024 U.S. Retirement Survey found that almost 50% of Generation X have not done any planning for retirement, including saving. The survey also found that 46% of participants expect to have less than $500,000 in savings by the time they retire and that most participants believe they will need at least $1.2 million saved to retire comfortably. This suggests a looming retirement savings crisis, partly because pension plans are becoming extinct. For example, CNN Business reported that in 2022, only 15% of the private sector workers had a pension plan. The media outlet also shared that only 44% of American adults could afford to set aside $1,000 per month for an emergency fund, and others are dipping into their retirement funds early.

Trending: Gen Z and Millennial millionaires couldn't care less for stocks and bonds — Here's what they're buying instead.

With such dire stats, how do you even begin saving money for your retirement, let alone an emergency fund? Even small monthly contributions can grow significantly if you start early enough. For example, CNBC Select found that putting $20 a week into a high-yield savings account saves at least $1,000 per year. This means making simple lifestyle changes like eating at home, making lunches, or limiting how much coffee you buy each week. Taking advantage of compound interest is one of the best ways to build wealth. Former Wall Street titan Sallie Krawcheck advises people to automate their savings and use high-yield accounts with no monthly fees and deposit or balance requirements. CNBC Select recommends using a LendingClub High-Yield Savings account that offers 4.50% APY.

Don’t forget about short-term savings goals like an emergency fund. Personal finance guru Dave Ramsey advises that the first step in growing an emergency fund is saving at least $1,000. Ramsey admits that this is not enough but should instead be used to cover small expenses and that an emergency fund should save between three and six months’ worth of expenses. This number will vary depending on what type of job you have. Like freelancers, people with less stable work should ideally have at least one year's worth of expenses saved.

Read Next:

How to turn a $100,000 investment into $1 Million — and retire a millionaire.

Will the surge continue or decline on real estate prices? People are finding out about risk-free real estate investing with just $10

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Is Your Emergency Fund Ahead Of The Curve? The Savings Needed To Be In The Top 5% For Your Age Group originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance