Empire Company Limited (TSE:EMP.A) Passed Our Checks, And It's About To Pay A CA$0.18 Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Empire Company Limited (TSE:EMP.A) is about to go ex-dividend in just 4 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Empire's shares before the 12th of October in order to be eligible for the dividend, which will be paid on the 31st of October.

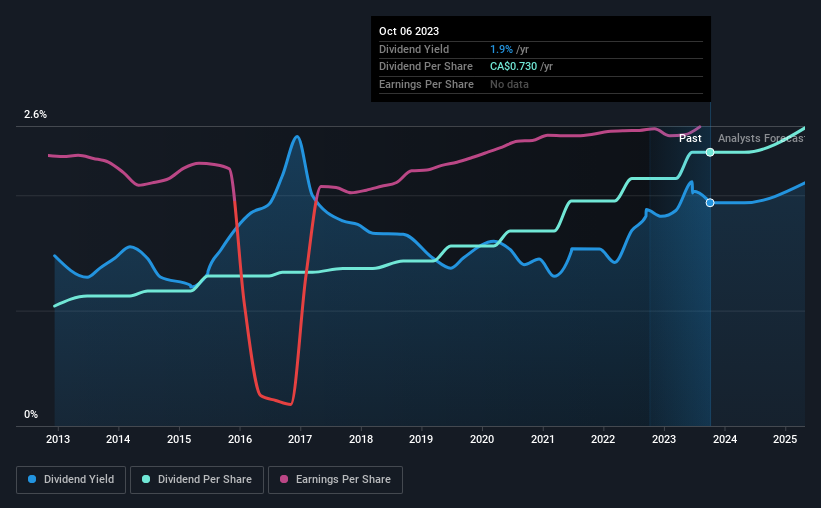

The company's next dividend payment will be CA$0.18 per share, on the back of last year when the company paid a total of CA$0.73 to shareholders. Last year's total dividend payments show that Empire has a trailing yield of 1.9% on the current share price of CA$37.73. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Empire has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Empire

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Empire has a low and conservative payout ratio of just 23% of its income after tax. A useful secondary check can be to evaluate whether Empire generated enough free cash flow to afford its dividend. It paid out 17% of its free cash flow as dividends last year, which is conservatively low.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's encouraging to see Empire has grown its earnings rapidly, up 39% a year for the past five years. Empire earnings per share have been sprinting ahead like the Road Runner at a track and field day; scarcely stopping even for a cheeky "beep-beep". We also like that it is reinvesting most of its profits in its business.'

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Empire has lifted its dividend by approximately 8.6% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

Final Takeaway

Has Empire got what it takes to maintain its dividend payments? Empire has been growing earnings at a rapid rate, and has a conservatively low payout ratio, implying that it is reinvesting heavily in its business; a sterling combination. Overall we think this is an attractive combination and worthy of further research.

In light of that, while Empire has an appealing dividend, it's worth knowing the risks involved with this stock. To help with this, we've discovered 1 warning sign for Empire that you should be aware of before investing in their shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance