Euronext Paris Growth Companies With Insider Ownership Up To 19%

As French markets navigate through political uncertainties with upcoming elections and varying economic indicators, investors remain keenly observant of potential shifts in market dynamics. In such a climate, growth companies with substantial insider ownership can be particularly compelling as they often suggest a strong alignment between management's interests and those of shareholders.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

Adocia (ENXTPA:ADOC) | 12.1% | 59.8% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 42.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

Claranova (ENXTPA:CLA) | 13.4% | 90.6% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

Munic (ENXTPA:ALMUN) | 29.4% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 70.6% |

We're going to check out a few of the best picks from our screener tool.

Lectra

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions across the fashion, automotive, and furniture sectors in various global regions including Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.12 billion.

Operations: The company generates revenue from its operations in the Americas and Asia-Pacific, with amounts totaling €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Lectra, a French growth company with high insider ownership, is currently trading at 36% below its estimated fair value. Analysts anticipate a 25.9% increase in stock price and significant earnings growth of 28.6% annually over the next three years, outpacing the French market's expected 10.9%. However, its forecasted Return on Equity of 13.3% remains low compared to benchmarks. Recent financials show a slight dip in net income despite an increase in sales for Q1 2024.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

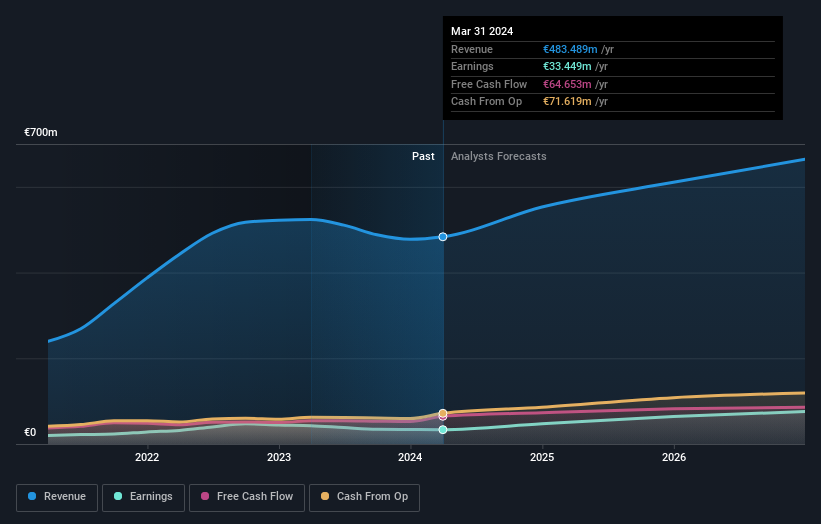

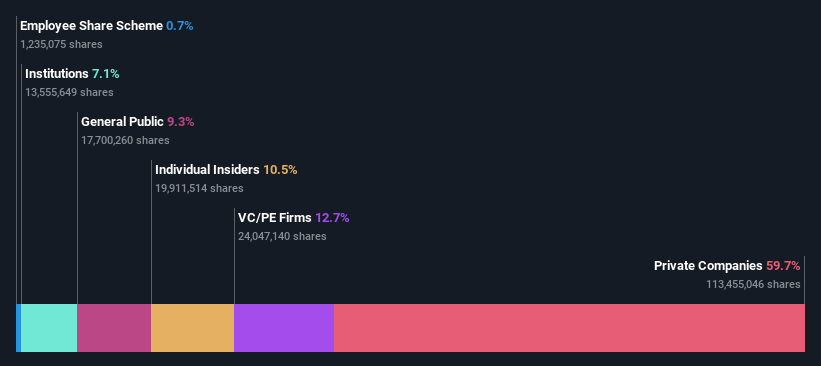

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.11 billion.

Operations: The company generates revenue from three main segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud (€185.43 million).

Insider Ownership: 10.5%

OVH Groupe, a French growth company with significant insider ownership, is set to become profitable within three years, outperforming average market growth expectations. Despite a low forecasted Return on Equity of 1.7% in three years and a highly volatile share price recently, revenue growth projections are robust at 10.9% annually, surpassing the French market's 5.7%. Recent advancements include the launch of ADV-Gen3 Bare Metal servers featuring AMD EPYC 4004 Series processors, enhancing performance and network capabilities significantly.

Click here and access our complete growth analysis report to understand the dynamics of OVH Groupe.

Our valuation report here indicates OVH Groupe may be overvalued.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

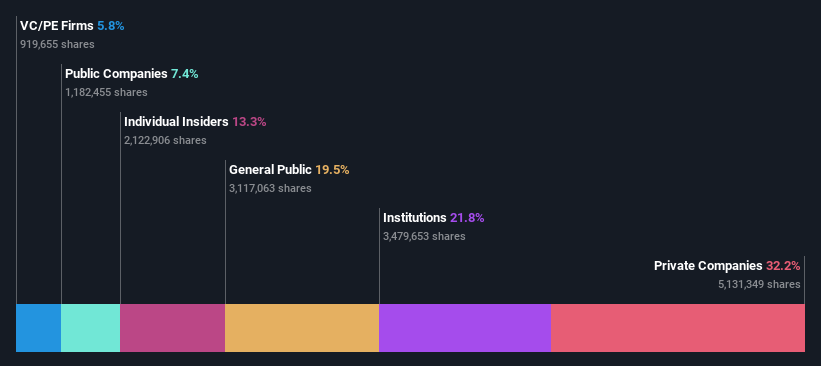

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.21 billion.

Operations: The company generates revenue primarily through installing and maintaining electronic shelf labels, contributing €801.96 million.

Insider Ownership: 13.5%

VusionGroup S.A. is experiencing robust growth with revenue and earnings forecasted to expand at 21.9% and 25.2% per year respectively, outpacing the French market significantly. Despite a highly volatile share price in recent months, the company's Return on Equity is expected to be strong at 29.3% in three years. Recent financials show a substantial increase, with sales rising to €801.96 million and net income reaching €79.77 million last year, reflecting effective operational execution and market positioning.

Turning Ideas Into Actions

Unlock more gems! Our Fast Growing Euronext Paris Companies With High Insider Ownership screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Fast Growing Euronext Paris Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:LSS ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance