Eversource (ES) Rides on Renewable Focus, Strategic Investments

Eversource Energy’s ES long-term capital investment plans to further enhance its infrastructure and expansion of renewable operations should drive its overall performance. The company has plans to expand its water business through acquisitions.

However, this Zacks Rank #3 (Hold) company is exposed to stringent regulations and substandard performance from third parties that act as headwinds.

Tailwinds

Eversource’s capital investments serve as a proxy for future organic growth. It is currently focused on upgrading its electric distribution and transmission infrastructure. The company expects capital investment of $23.1 billion during 2024-2028, out of which it plans to invest nearly $16.1 billion in electric and natural gas distribution networks, and $7.2 billion in the electric transmission segment.

ES has finalized definitive documents regarding its previously announced agreement to sell its 50% ownership stake in the 924-megawatt (MW) Sunrise Wind project to Ørsted. Despite the company’s exit from the unregulated wind business, it is fully committed to the region’s clean energy transition, with its regulated companies building many of the facilities that would enable more than 9,000 MW of offshore wind generation to reach the homes and businesses of Southern New England.

During the 2024-2028 period, the company has plans to invest $1.1 billion in the water distribution business to further strengthen its water operations and serve the expanding customer base.

Headwinds

The company’s operations are subject to federal, state and local legislative requirements, as well as extensive environmental regulations. The introduction of new mandates might impact its financial performance.

Eversource outsources certain business functions to third-party suppliers and service providers. Substandard performance by these third parties could harm its financial condition, reputation and results of operations.

Price Performance

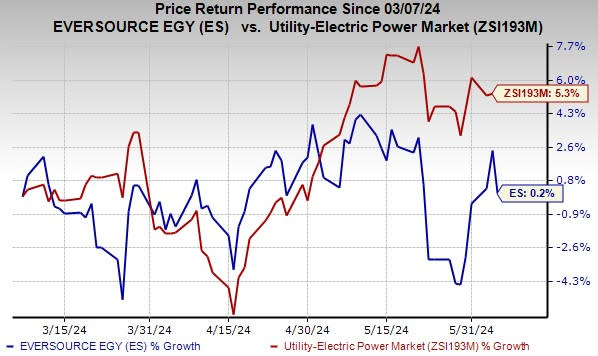

In the past three months, shares of the company have risen 0.2% compared with the industry’s 5.3% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are PPL Corporation PPL, IDACORP IDA and DTE Energy DTE, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PPL’s long-term (three to five years) earnings growth rate is 6.82%. The Zacks Consensus Estimate for 2024 earnings per share (EPS) indicates a year-over-year increase of 6.9%.

The Zacks Consensus Estimate for IDA’S 2024 EPS indicates a year-over-year improvement of 4.1%. It delivered an average earnings surprise of 6.8% in the last four quarters.

DTE’s long-term earnings growth rate is 8.2%. The Zacks Consensus Estimate for 2024 EPS indicates year-over-year growth of 16.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPL Corporation (PPL) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance