Examining 3 SGX Dividend Stocks With Yields Up To 9.6%

As the global finance industry stands on the brink of transformation with AI technologies poised to redefine operational landscapes and profitability, the Singapore market continues its steady performance amidst these technological shifts. In this environment, understanding which stocks consistently offer dividends becomes crucial for investors looking to maintain stable returns in a rapidly evolving sector.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.55% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.09% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.59% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.64% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.25% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.91% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.60% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

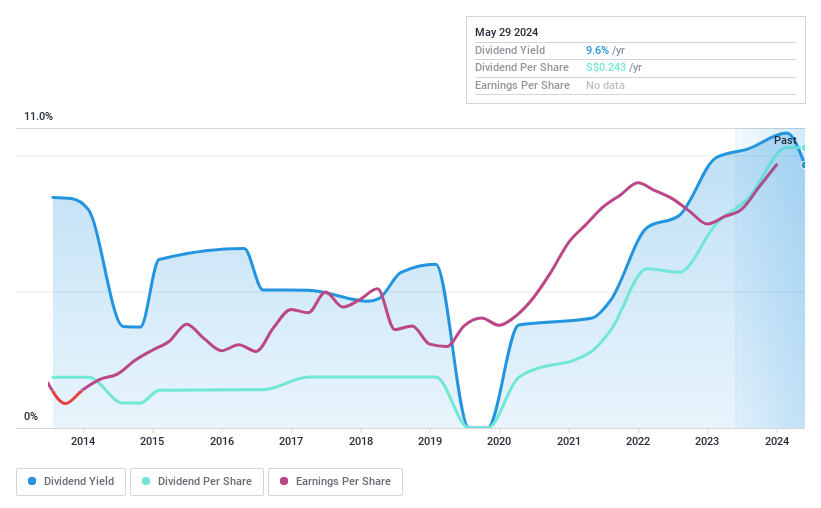

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 227.04 million.

Operations: Multi-Chem Limited generates its revenue from distributing information technology products, with significant contributions from Singapore (SGD 372.78 million), Others (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million).

Dividend Yield: 9.6%

Multi-Chem Limited, a participant in Singapore's dividend stock arena, offers a dividend yield that places it within the top 25% of local payers. However, its dividend history shows volatility with significant annual drops over the past decade. Despite this instability, both earnings and cash flows currently support its dividends, with payout ratios of 80.7% and 88.1%, respectively. Recent board enhancements could influence future governance and stability as experienced directors like Chong Teck Sin join leadership roles effective from April 2024.

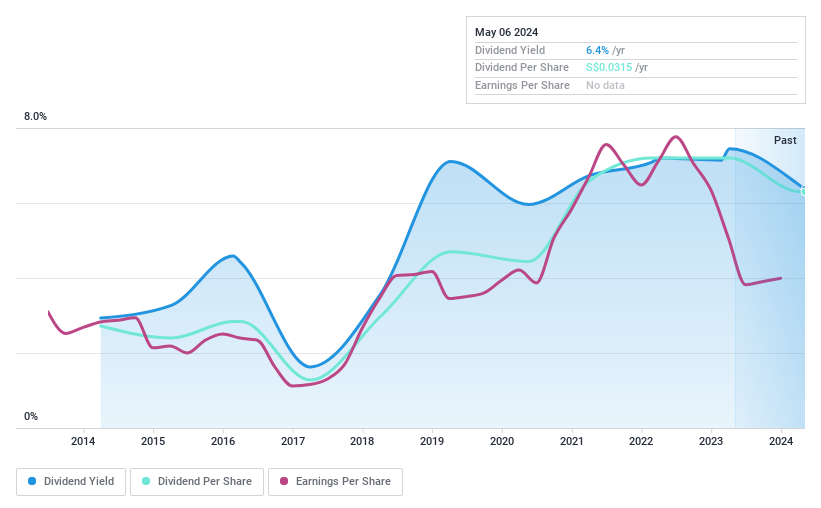

YHI International

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited operates as an investment holding company, distributing automotive and industrial products across regions including Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, and New Zealand with a market capitalization of SGD 138.56 million.

Operations: YHI International Limited generates revenue through various segments, including Distribution in ASEAN with SGD 120.10 million, Oceania with SGD 136.97 million, and other regions totaling SGD 22.37 million, as well as Manufacturing in ASEAN and North East Asia (excluding rental) contributing SGD 47.72 million and SGD 57.87 million respectively.

Dividend Yield: 6.6%

YHI International Limited's recent dividend declaration of S$0.0315 per share reflects a cautious approach amid its inconsistent dividend history. Despite trading below fair value by 27.7%, the company's dividends are supported by a low cash payout ratio of 26.6% and an earnings payout ratio of 70.1%. However, its dividend payments have demonstrated volatility over the past decade, which might concern investors looking for stable returns.

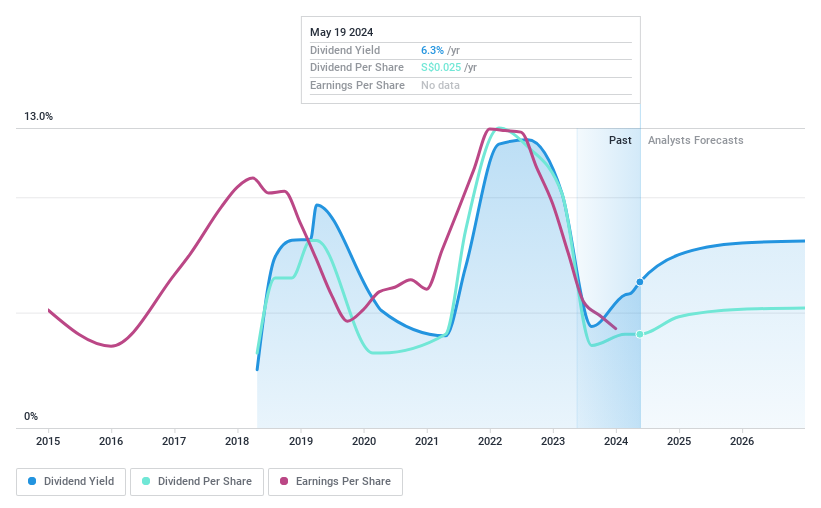

APAC Realty

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: APAC Realty Limited, an investment holding company, operates in real estate services across Singapore, Indonesia, Vietnam, and other international markets with a market capitalization of SGD 142.08 million.

Operations: APAC Realty Limited generates revenue primarily through real estate brokerage, contributing SGD 548.88 million, and a smaller portion from rental income at SGD 2.15 million.

Dividend Yield: 6.2%

APAC Realty's recent dividend of S$0.014 per share, approved on 22 April 2024, underscores a cautious stance given its volatile dividend history over the past six years. Although it trades at half its estimated fair value and has a competitive yield among top Singapore dividend payers, its dividends are only moderately covered by earnings and cash flows with payout ratios of 75.4% and 55.6% respectively. The firm's profit margins have dipped to 2.1%, down from last year’s 3.8%.

Next Steps

Discover the full array of 21 Top SGX Dividend Stocks right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:BPF and SGX:CLN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance