Exploring Alternatives To Frasers Property With One Superior SGX Dividend Stock

In the quest for reliable dividend stocks, understanding the trajectory of a company's dividend payouts is essential. In Singapore, where dividends on average increased by 3.7% last year, it's important to identify stocks that consistently maintain or increase their dividends. However, companies like Frasers Property present a cautionary tale with their declining dividend trends, signaling potential risks for income-focused investors.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.24% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.53% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.34% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.83% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.56% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.62% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.95% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Underneath we present one of the stocks filtered out by our screen and one to consider sidestepping.

Top Pick

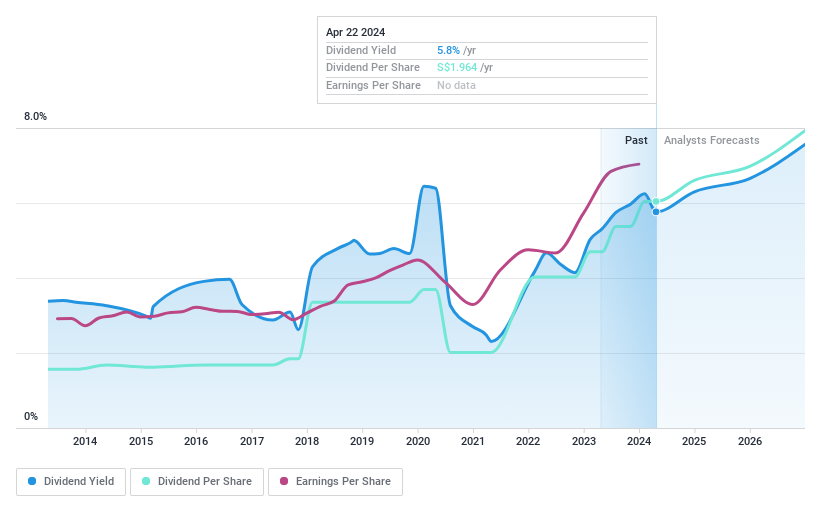

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and globally, with a market capitalization of approximately SGD 107.96 billion.

Operations: The company generates its revenue primarily from commercial banking and financial services across various regions including Singapore, Hong Kong, the rest of Greater China, South and Southeast Asia, and internationally.

Dividend Yield: 5.2%

DBS Group Holdings has demonstrated a commitment to maintaining its dividend payments, with recent increases announced in 2024. The first quarter interim dividend and the final dividend for 2023 were both set at SGD 0.54 per share. Despite some operational challenges, including technology outages and executive changes, DBS reported a significant increase in net income to SGD 2.96 billion for Q1 2024 from SGD 2.57 billion the previous year. However, it's important to note that DBS's dividends have shown volatility over the past decade and its current yield of 5.17% is below the top quartile of Singapore market payers at 6.29%.

One To Reconsider

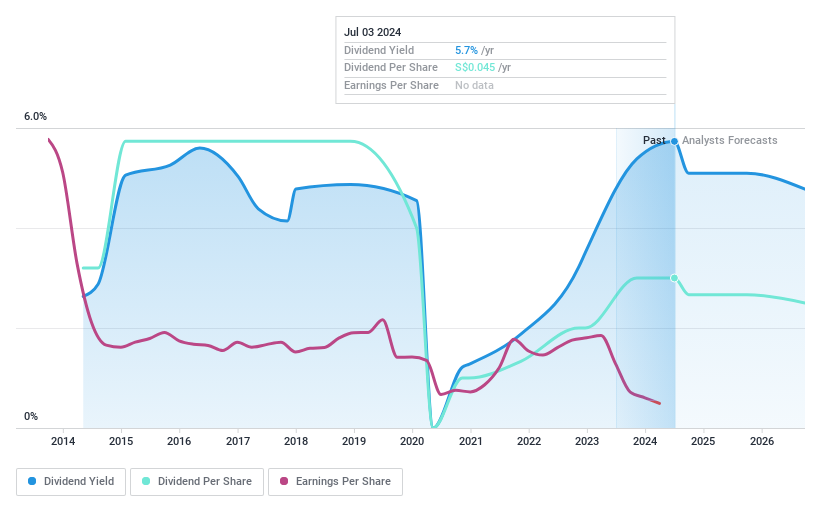

Frasers Property

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Frasers Property Limited is an investment holding company that develops, invests in, and manages a diverse portfolio of real estate properties, with a market capitalization of approximately SGD 3.08 billion.

Operations: The company's revenue is generated from various geographical and operational segments, including Australia (SGD 775.32 million), Singapore (SGD 587.84 million), Industrial properties (SGD 636.43 million), Hospitality (SGD 776.70 million), and Thailand & Vietnam (SGD 565.03 million).

Dividend Yield: 5.7%

Frasers Property has experienced a decline in its dividend reliability, with payments showing inconsistency and a downward trend over the past decade. The company's recent financial performance underscores concerns, as it reported significantly lower net income of SGD 57.42 million for the first half of 2024, down from SGD 225.77 million in the previous year. Additionally, its dividend yield of 5.73% falls below the top quartile benchmark of 6.29% in Singapore's market, further challenging its attractiveness to dividend-focused investors.

Where To Now?

Discover the full array of 20 Top SGX Dividend Stocks right here.

Got skin in the game with some of these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05SGX:TQ5.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance