Exploring Three German Exchange Stocks With Estimated Intrinsic Discounts Ranging From 34.2% To 44.5%

Amid a landscape of mixed performances across major European indices, Germany's DAX index has shown resilience with a modest rise of 0.40% despite broader regional uncertainties. This context sets the stage for investors to consider the potential value in German stocks that may currently be trading below their intrinsic worth. In such an environment, identifying stocks that are undervalued—those whose market prices are less than their estimated true value—can be particularly compelling. This approach aligns with cautious investment strategies suitable for navigating through periods of economic and political flux.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kontron (XTRA:SANT) | €19.87 | €33.03 | 39.8% |

Novem Group (XTRA:NVM) | €5.44 | €10.14 | 46.3% |

Stabilus (XTRA:STM) | €43.90 | €79.09 | 44.5% |

PSI Software (XTRA:PSAN) | €22.60 | €43.72 | 48.3% |

Stratec (XTRA:SBS) | €46.35 | €81.46 | 43.1% |

MTU Aero Engines (XTRA:MTX) | €251.00 | €415.13 | 39.5% |

CHAPTERS Group (XTRA:CHG) | €23.60 | €46.75 | 49.5% |

SBF (DB:CY1K) | €3.42 | €5.76 | 40.6% |

Your Family Entertainment (DB:RTV) | €2.46 | €4.52 | 45.6% |

Redcare Pharmacy (XTRA:RDC) | €114.80 | €208.66 | 45% |

Let's dive into some prime choices out of from the screener

MTU Aero Engines

Overview: MTU Aero Engines AG operates in the design, production, marketing, and maintenance of commercial and military aircraft engines and industrial gas turbines globally, with a market capitalization of approximately €13.51 billion.

Operations: MTU Aero Engines generates revenue primarily through its Commercial Maintenance Business (MRO) and Commercial and Military Engine Business (OEM), with revenues of €4.35 billion and €1.27 billion respectively.

Estimated Discount To Fair Value: 39.5%

MTU Aero Engines, trading at €244.6, is valued below its fair value estimate of €415.76, indicating significant undervaluation based on discounted cash flows. The company’s earnings are expected to grow by 35.5% annually, with revenue growth projected at 12.2% per year—faster than the German market average of 5.2%. Despite a recent dip in net income from €134 million to €126 million in Q1 2024, MTU's return on equity is anticipated to reach a robust 20.3% in three years.

SAP

Overview: SAP SE operates globally, offering a wide range of applications, technology, and services, with a market capitalization of approximately €217.47 billion.

Operations: SAP's primary revenue of €31.81 billion is generated from its Applications, Technology & Services segment.

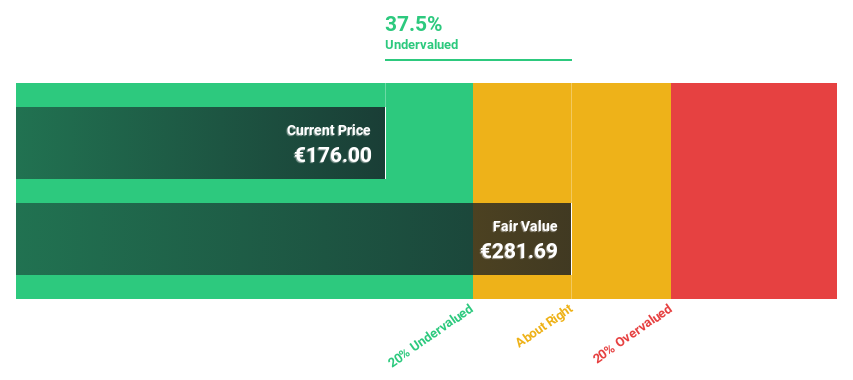

Estimated Discount To Fair Value: 34.2%

SAP, priced at €185.2, trades significantly below its fair value of €284.92, reflecting a deep undervaluation based on discounted cash flows. The company's earnings are expected to surge by 33.8% annually over the next three years, outpacing the German market's growth rate. However, SAP’s forecasted return on equity is relatively modest at 16.1%. Recent strategic alliances and technological integrations, like the expanded partnership with Datricks and LTIMindtree, highlight SAP’s commitment to enhancing operational efficiencies and sector-specific solutions.

The growth report we've compiled suggests that SAP's future prospects could be on the up.

Get an in-depth perspective on SAP's balance sheet by reading our health report here.

Stabilus

Overview: Stabilus SE operates globally, manufacturing and selling gas springs, dampers, vibration isolation products, and electric tailgate equipment across various regions including Europe, the Americas, Asia-Pacific, the Middle East, and Africa; it has a market capitalization of approximately €1.08 billion.

Operations: Stabilus generates revenue from several geographic segments, with €548.37 million from Europe, the Middle East, and Africa, €465.72 million from the Americas, and €293.73 million from the Asia-Pacific region.

Estimated Discount To Fair Value: 44.5%

Stabilus SE, with a current trading price of €43.5, is significantly undervalued by more than 20% based on discounted cash flow models, suggesting good value at a price well below the estimated fair value of €79.13. Despite recent adjustments lowering revenue forecasts for FY2024 to between €1.3 billion and €1.35 billion due to weaker demand in key segments, Stabilus shows potential with expected earnings growth of 20.53% per year outstripping the German market's forecast of 18.6%. However, concerns include a high debt level and unstable dividends.

Key Takeaways

Delve into our full catalog of 29 Undervalued German Stocks Based On Cash Flows here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MTX XTRA:SAP and XTRA:STM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance