Exploring Undervalued Small Caps With Insider Buying In Hong Kong June 2024

As of June 2024, the Hong Kong market reflects a cautious sentiment, mirroring broader global economic uncertainties and localized challenges. With the Hang Seng Index experiencing a notable decline, it becomes increasingly important to identify small-cap companies that demonstrate strong potential for value appreciation amidst prevailing market conditions. In this context, stocks with insider buying activity can signal robust future prospects as insiders often buy shares based on their confidence in the company's future performance.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Far East Consortium International | NA | 0.3x | 37.77% | ★★★★★☆ |

Xtep International Holdings | 11.2x | 0.8x | 40.18% | ★★★★☆☆ |

Nissin Foods | 15.2x | 1.4x | 35.29% | ★★★★☆☆ |

China Leon Inspection Holding | 9.6x | 0.7x | 29.27% | ★★★★☆☆ |

Tian Lun Gas Holdings | 7.4x | 0.5x | 19.60% | ★★★★☆☆ |

China Lesso Group Holdings | 4.3x | 0.3x | 2.94% | ★★★★☆☆ |

Transport International Holdings | 11.0x | 0.6x | 45.78% | ★★★★☆☆ |

Abbisko Cayman | NA | 96.3x | 35.54% | ★★★★☆☆ |

Giordano International | 8.9x | 0.8x | 33.99% | ★★★☆☆☆ |

China Overseas Grand Oceans Group | 3.2x | 0.1x | -16.66% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

iDreamSky Technology Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: iDreamSky Technology Holdings is a company specializing in game and information services, including SaaS and other related services, with a market capitalization of approximately CN¥1.92 billion.

Operations: Game and Information Services, including SaaS and related services, generated CN¥1.92 billion in revenue for iDreamSky Technology Holdings. The company's gross profit margin has seen fluctuations, with a notable decrease to 35.14% by the end of 2023 from earlier figures hovering around 44%.

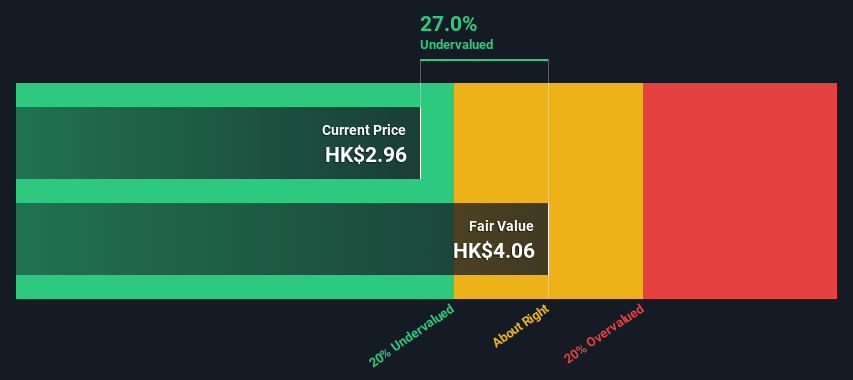

PE: -9.7x

iDreamSky Technology Holdings, despite a challenging year with a net loss reduction from CNY 2.49 billion to CNY 556.35 million, shows signs of recovery and potential underpricing. Recently, insider Xiangyu Chen demonstrated confidence by acquiring 1.08 million shares for nearly HK$2.97 million, signaling strong belief in the company's prospects. With earnings expected to grow significantly and no recent dilution affecting shareholders negatively, this entity exemplifies the hidden gems among Hong Kong's lesser-known firms poised for revival and growth.

Nissin Foods

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nissin Foods is a company specializing in the production and sale of instant noodles and related products, primarily serving markets in Mainland China, Hong Kong, and other parts of Asia.

Operations: Mainland China and Hong Kong, along with other Asian regions, contribute significantly to the company's revenue streams, totaling HK$4.15 billion. Over the years observed, gross profit margin has shown a trend of fluctuation but generally increased from 30.55% in 2017 to approximately 34.16% by mid-2024.

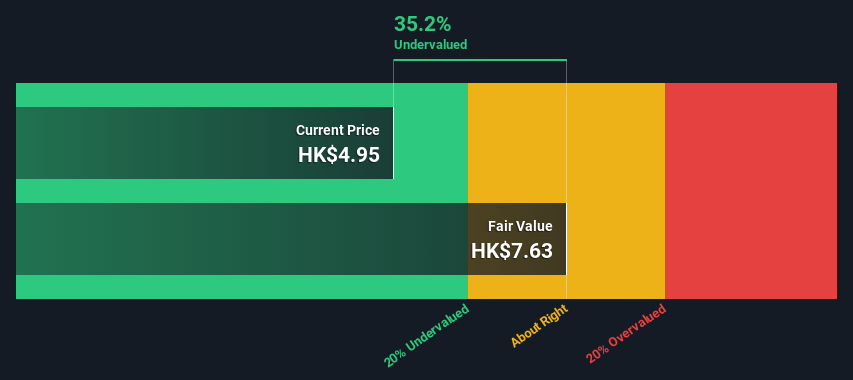

PE: 15.2x

Nissin Foods, a lesser-known entity in Hong Kong's market, recently saw significant insider confidence with Kiyotaka Ando acquiring 155,430 shares. This move underscores a robust belief in the company’s prospects amidst its financial performance showing a slight dip in sales to HK$963 million but an increase in net income to HK$118 million for Q1 2024. Additionally, the appointment of Mr. Kiyoshi Matsuura as Executive Director hints at strategic leadership refreshment aimed at enhancing production efficiencies. The recent approval of a dividend increase further reflects positively on its financial health and commitment to shareholder value.

Take a closer look at Nissin Foods' potential here in our valuation report.

Evaluate Nissin Foods' historical performance by accessing our past performance report.

Abbisko Cayman

Simply Wall St Value Rating: ★★★★☆☆

Overview: Abbisko Cayman is a company focused on the development of innovative medicines, with a market capitalization of approximately CN¥19.06 billion.

Operations: In recent financial periods, the entity consistently reported a gross profit margin of 100%, reflecting its ability to fully convert revenue into gross profit despite substantial operating expenses and R&D investments. For instance, as of mid-2024, it recorded CN¥19.06 million in revenue with corresponding operating and R&D expenses totaling approximately CN¥530.14 million and CN¥433.74 million respectively, indicating significant ongoing investment in development activities.

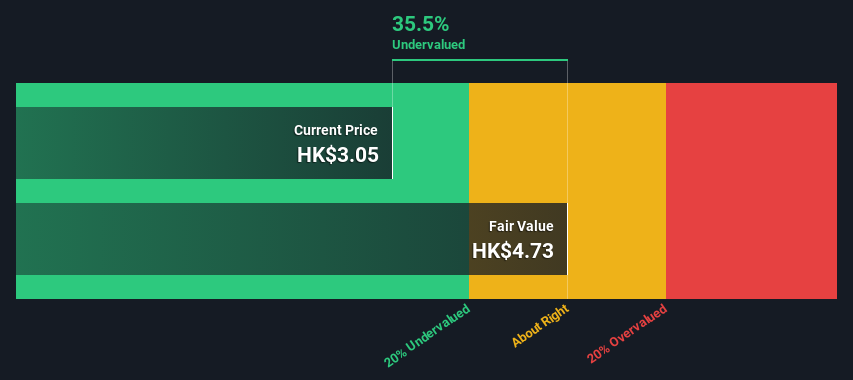

PE: -4.3x

Abbisko Cayman, a lesser-known entity in Hong Kong's market, recently appointed Dr. Yu Hongping as joint company secretary, underscoring its leadership's deep roots in pharmaceutical innovation since 2016. Despite lacking significant revenue (CN¥19M), the firm is poised for a 42.46% yearly revenue surge, although earnings might dip by 2.3% annually over three years. Notably, insider confidence shone through as executives bolstered their stakes in the company recently, signaling belief in its trajectory amidst challenges like high-risk funding reliance solely on external borrowing. This move aligns with Abbisko's recent FDA Orphan Drug Designation for their FGFR4 inhibitor targeting rare liver cancer—a testament to its strategic focus on niche but critical therapeutic areas.

Summing It All Up

Get an in-depth perspective on all 16 Undervalued Small Caps With Insider Buying by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1119 SEHK:1475 and SEHK:2256.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance