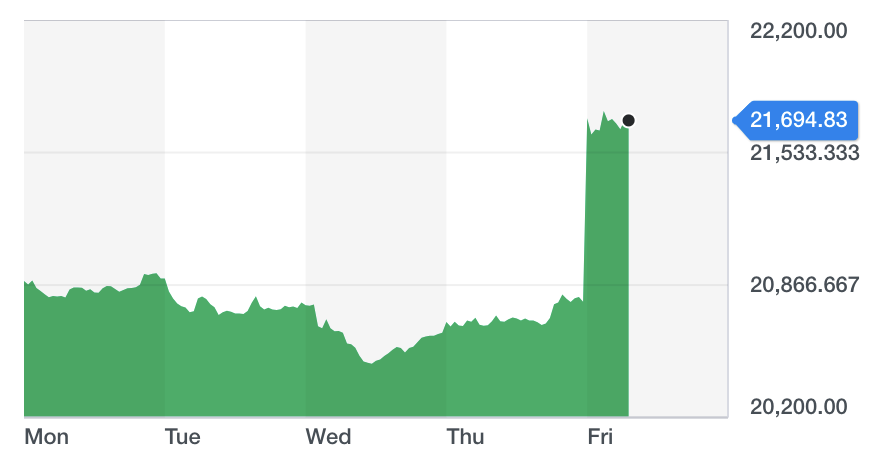

FTSE 250 hits all-time record high in post-election wave of relief

The index that tracks Britain’s top 250 publicly traded companies reached an all-time record high on Friday in the wake of prime minister Boris Johnson’s commanding election victory.

The FTSE 250 (^FTMC) climbed by more than 4%, with many of its domestically focused companies seeing strong gains.

The index jumped to as high as 21,741, reaching a record and topping its previous July 2018 high of 20,877.

“UK equities were basking in the warm glow of the Tory victory as investors threw out their worst-case scenarios for the British economy,” said Neil Wilson, the chief markets analyst at Markets.com, on Friday.

READ MORE: Mail, rail, water stocks turbo boost UK markets post election

“There are some seriously relieved investors — and bankers and corporate financiers. In particular, we are seeing some absolutely stonking moves among the UK-focused equities.”

“It all points to a huge vote of confidence in the prospects for the British economy as a result of the Tory win. You just cannot understate the sense of relief here in the City.”

One of the primary factors boosting stocks is the fact that Johnson’s win paves the way for a relatively smooth exit from the European Union at the end of January.

Because he achieved such an emphatic majority, he is now less dependent on the far-right factions of his Conservative party, and also no longer reliant on the votes of Northern Ireland’s Democratic Unionist Party.

This means that the prospect of the UK crashing out of the European Union without a deal has now faded. In particular, this is seen as a good thing for the housing market, which has been significantly dented by Brexit uncertainty.

Investors are also relieved that the Labour party’s plans to nationalise vast swathes of the economy — from railways and utilities to banks and broadband — will now not come to fruition.

READ MORE: How the pound’s exchange rate after the UK election will affect you

Shares in UK banks, rail firms, the utilities sector, and the construction industry rose significantly on Friday.

Housebuilding firm Taylor Wimpey (TW.L) was one of the biggest gainers on the index. Shares in the company climbed by more than 10% on Friday, as did shares in estate agent Foxtons (FOXT.L) and Persimmon (PSN.L).

Shares in Virgin Money UK (VMUK.L) climbed by more than 18%, while Royal Bank of Scotland (RBS.L) shares were up by more than 10%. Lloyds Banking Group shares were up by more than 6% (LLOY.L).

Yahoo Finance

Yahoo Finance