Here’s how Fundsmith Equity and Scottish Mortgage shares performed in the first half of 2024

Within the fund part of my investment portfolio, I have a decent-sized holding in Fundsmith Equity. I also own a few shares in Scottish Mortgage Investment Trust (LSE: SMT).

So, how did these two products perform for me in the first half of 2024 as global stock markets rallied? Let’s take a look.

Scottish Mortgage shares are rising

I don’t have the official performance data for Scottish Mortgage yet as its investment manager Baillie Gifford is always a little slow to release the monthly factsheet for the investment trust.

But I can work out its H1 return myself. At the end of June, the trust’s share price was 884.2p versus 808p at the start of the year. That equates to a gain of 9.4%. Note that I’m also entitled to a dividend of 2.64p per share, which I’ll receive on 11 July. That bumps the return up to about 9.8% if I include that.

That’s a pretty good return in six months. I’m happy with it.

That said, plenty of other growth-focused funds delivered higher returns. For example, the Blue Whale Growth fund (which I also have a position in) returned 20.4% for the half year. That’s more than twice the return from Scottish Mortgage.

One issue with this investment trust is that it owns a lot of disruptive growth companies that don’t have any profits. These kinds of companies can underperform when interest rates are high.

I’m still bullish on the trust. But for it to really outperform, we need to see interest rates come down meaningfully (I’m expecting some rate cuts in the second half of 2024).

A solid performance from Fundsmith

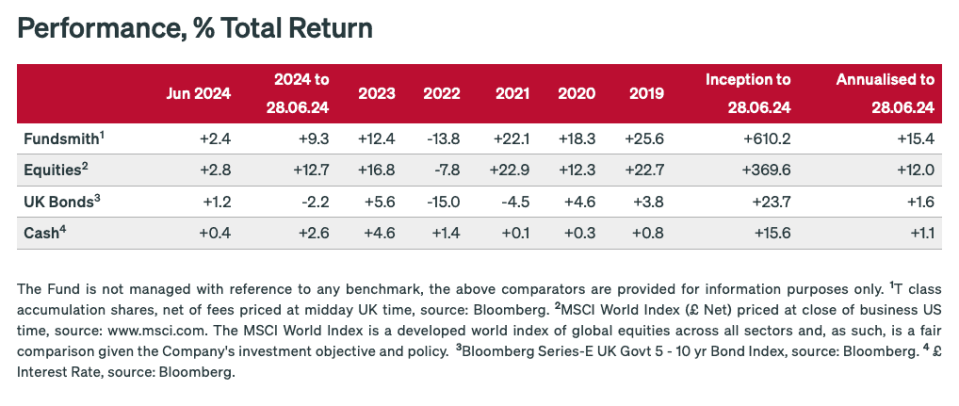

As for Fundsmith Equity, its latest factsheet shows that it delivered a return of 9.3% in H1.

Again, I’m happy with that performance.

But it should be noted that this was below the return of the MSCI World Index, which posted a gain of 12.7% for the period. In other words, Fundsmith lagged a common benchmark for global equity funds.

Source: Fundsmith

It’s not hard to work out why this fund underperformed the MSCI World Index in H1. Ultimately, it has far less exposure to high-flying Big Tech stocks than the index (it doesn’t have any exposure to Nvidia).

In the first half of the year, these stocks delivered the bulk of the market’s gains (just like they did in 2023). So, any fund manager lacking exposure to them most likely lagged the market.

Despite its recent underperformance, I’ll be holding on to Fundsmith. With its focus on high-quality stocks, I see it as a hedge. If the tech sector was to experience a meltdown, I’d expect the fund to outperform.

There’s no guarantee it will though. This is a concentrated fund that holds less than 30 stocks. If portfolio manager Terry Smith gets his share picks wrong, it could keep underperforming.

So, I will continue to buy other top stocks and funds to diversify my investment portfolio.

The post Here’s how Fundsmith Equity and Scottish Mortgage shares performed in the first half of 2024 appeared first on The Motley Fool UK.

More reading

Ed Sheldon has positions in Nvidia, Scottish Mortgage Investment Trust Plc, Blue Whale Growth fund, and Fundsmith Equity. The Motley Fool UK has recommended Nvidia. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance