Gates (GTES) vs. Sterling (STRL): Which is a More Profitable Pick?

With a major focus on developing the country’s roads, bridges and more, the construction companies are benefiting from the U.S. administration’s massive infrastructure plan to build modern, sustainable infrastructure and a clean future. Moreover, the increased demand from telecom customers for wireline networks, wireless/wireline converged networks and wireless networks using 5G technologies has been benefiting construction-related companies.

Increasing construction activities in the public sector, stable job market and solid GDP numbers have aided the U.S. construction market. Although the sector is ailing from prevailing macroeconomic headwinds and a tight labor market, the Fed’s intention to stabilize inflation with just one rate cut this year will likely work in favor.

Within the Zacks Engineering - R and D Services industry, companies like Gates Industrial Corporation plc GTES, Sterling Infrastructure, Inc. STRL, AECOM ACM and M-tron Industries, Inc. MPTI are currently witnessing strong backlog, thanks to regular contract wins and operational improvements.

Each of the aforementioned companies currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Based on various parameters, let’s check whether GTES or STRL is a more profitable stock.

Determinants of the Stocks

Found in 1911, Gates is a global manufacturer of innovative, highly engineered power transmission and fluid power solutions. It offers a broad portfolio of products to diverse replacement channel customers and original equipment manufacturers (first-fit). These products are used in applications across numerous end markets, including automotive replacement and first-fit, diversified industrial, industrial off-highway, industrial on-highway, and personal mobility.

GTES currently has a market cap of $4.26 billion. It is highly correlated with industrial activity and utilization and not with any single end market, given the diversification of its business and high exposure to replacement channels.

Sterling operates within three segments specializing in E-Infrastructure, Transportation and Building Solutions in the United States, primarily across the Southern, Northeastern, Mid-Atlantic and Rocky Mountain regions and the Pacific Islands. The company mainly focuses on low-bid heavy highway projects, growing high-margin products and services, and expansion via acquisitions.

STRL currently has a market cap of $3.79 billion. Its E-Infrastructure Solutions segment serves large, blue-chip end users in the e-commerce distribution center, data center, manufacturing, warehousing, and power generation sectors and more. The Transportation Solutions unit covers heavy highway, aviation and rail projects and depends on federal and state infrastructure spending. The Building Solutions segment is comprised of residential and commercial businesses.

Zacks Consensus Estimate & Stock Performance

The Zacks Consensus Estimate for Gates’ 2024 earnings indicates a 2.9% year-over-year rise. Sterling bottom line for 2024 is likely to increase 18.6%.

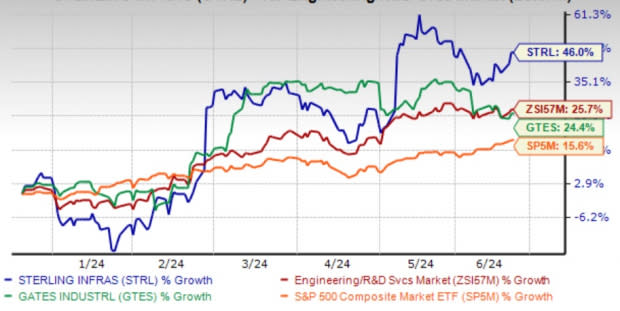

Image Source: Zacks Investment Research

Shares of Gates and Sterling have gained 24.4% and 46%, respectively, in the past six months compared with the industry’s 25.7% growth and S&P 500 Index’s 15.6% increase. The overall picture is encouraging, precisely, STRL has performed pretty well compared with GTES and the industry.

Meanwhile, both GTES and STRL surpassed earnings estimates in the last four quarters. Both companies delivered average earnings surprises of 14.9% and 22.3%, respectively.

A Look at Stocks' Profitability & Valuation

Return on Equity in the trailing 12 months for Gates is 10.5% compared with Sterling and the industry’s 25.1% and 16.8%, respectively. This implies that STRL provides more impressive returns to investors than GTES and the collective industry.

The industry is clearly overvalued than the S&P 500, with respect to the forward 12-month price-to-earnings (P/E) ratio. The industry has an average forward 12-month P/E ratio of 23.91, which is above the S&P 500’s average of 21.59.

Coming to the two stocks under consideration, Gates and Sterling have a 12-month forward P/E ratio of 10.57 and 22.36, respectively. Here, GTES is the clear winner as it is less pricey than STRL. Hence, it might be a good idea to focus on Gates within this industry right now.

Our Take

STRL certainly has the edge over GTES, as it has a slightly higher market cap, better price performance, prospects and history. Also, it provides impressive returns to investors. Yet, Gates has more upside potential for the near future.

The companies remain optimistic about overall construction market trends, given promising fundamentals, increasing government funding and improving industry parameters.

A Brief Overview of the Other Two Stocks

AECOM has topped earnings estimates in one of the trailing four quarters, met once and missed twice, with an average surprise of 3%.

The Zacks Consensus Estimate for ACM’s fiscal 2024 EPS indicates a rise of 21% year over year.

M-tron has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 26.7%.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 8.8% and 58.6%, respectively, from prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance