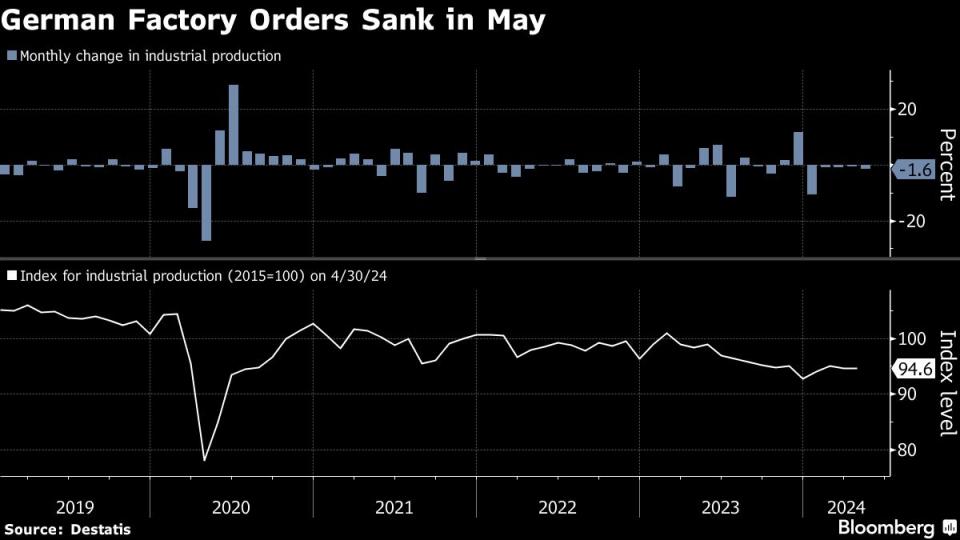

German Factory Orders Unexpectedly Slump as Recovery Falters

(Bloomberg) -- German factory orders unexpectedly plummeted in May — the latest setback to the recovery in Europe’s largest economy.

Most Read from Bloomberg

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Newsom Shocks California Politics by Scrapping Crime Measure

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Demand dropped 1.6% from April — defying analyst estimates for a 0.5% increase, data Thursday showed. The result extends the slump to five months, highlighting the persistent struggles of German manufacturers. Orders were down 8.6% on the year.

The decline would have been even worse without above-average bulk orders, according to the release. There was a marked drop in demand outside the euro zone.

“Together with the recent deterioration in business expectations in the manufacturing sector, the continuing decline in orders points to rather subdued momentum in industry in the coming months,” the Economy Ministry said. “Orders are only likely to stabilize once global trade continues to recover and demand for industrial products gradually picks up.”

The report adds to some less-than-positive figures of late on Germany’s rebound. In June, private-sector activity rose less than expected — as did investor confidence, as measured by the ZEW institute.

Still, the Bundesbank said last month that while growth “continues to face headwinds, there are increasing bright spots.” It estimates gross domestic product advanced “slightly” in the second quarter.

The latter half of the year is expected to be stronger as rising wages feed higher spending by households. Slower inflation will help: consumer-price gains moderated to 2.5% in June. And a moderation across the euro zone is boosting the chances of more interest-rate cuts by the European Central Bank this year.

--With assistance from Joel Rinneby and Kristian Siedenburg.

(Updates with details, comment starting in third paragraph.)

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance