Here's Why You Should Consider Buying Alvotech (ALVO) Stock

Alvotech ALVO makes biosimilar versions of branded medicines that have gone off-patent. The year 2024 has been transformational for Alvotech as it marked a gradual transition of ALVO from an R&D company into a full-scale global commercial biologic company.

The company recently gained approval for some key biosimilar products like AVT04, its biosimilar to J&J’s JNJ blockbuster immunology drug, Stelara, and AVT02, its biosimilar to AbbVie’s ABBV blockbuster immunology drug Humira. Alvotech has a commercialization partnership with Teva Pharmaceuticals TEVA in the United States. The brand names of AVT04 and AVT02 are Selarsdi and Simlandi, respectively, in the United States.

J&J’s Stelara will lose patent exclusivity in the United States next year. AbbVie’s Humira lost patent protection in the United States last January. Simlandi was approved in February 2024 and launched in May in the United States. Alvotech claims that AVT02 is a high-concentration interchangeable biosimilar to the reference product and has received exclusivity for its approved strengths in the U.S. market. Its partner Teva is making rapid progress on discussions positioning Simlandi biosimilar on formularies in the United States. AVT04/Selarsdi was approved in the United States in April 2024. AVT04 is already launched in Canada and Japan. AVT04 is expected to be launched in Europe in the third quarter of 2024 and in the United States by the name of Selarsdi in February next year, per the settlement agreement with J&J.

Alvotech also recently signed new commercialization agreements for Simlandi in the United States and for AVT03, its proposed biosimilar to Amgen’s blockbuster drugs Prolia and Xgeva, in the United States and Europe.

While being focused on near-term commercial opportunities, Alvotech is also rapidly advancing its pipeline. Alvotech announced positive top-line data from confirmatory patient studies on AVT06, its biosimilar candidate to Regeneron’s Eyela and AVT05, its proposed biosimilar to J&J’s Simponi. These biosimilars have also been developed in partnership with Teva. Alvotech thus has plans in place to file marketing applications for at least three biosimilar candidates in the second half of this year — AVT03, AVT06 and AVT05.

On the first quarter conference call held in May, Alvotech raised its revenue guidance for 2024 to $400-$500 million from $300-$400 million based on rapid progress in commercialization and development.

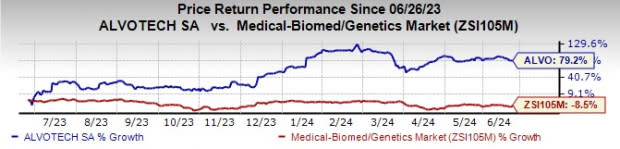

Alvotech’s stock has risen 79.2% in the past year against a decrease of 8.5% for the industry.

Image Source: Zacks Investment Research

In the past 60 days, 2024 loss estimates for Alvotech have improved from 79 cents per share to 66 cents per share. For 2025, loss estimates have improved from 11 cents to 2 cents per share in the past 60 days.

Alvotech carries a Zacks Rank #2 (Buy) currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Alvotech (ALVO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance