Here's Why CyberArk (CYBR) is a Promising Portfolio Pick Now

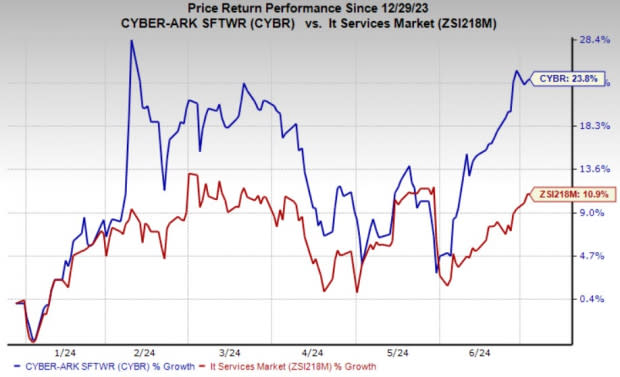

CyberArk’s CYBR shares jumped 23.8% in the year-to-date period, mainly due to its back-to-back quarters of impressive financial performance. The rise in share price showcases investors' trust in CYBR's strong fundamentals and its dominant position in the cyber security market.

CyberArk beat earnings estimates in each of the trailing four quarters, with an average surprise of 112%. Moreover, CYBR has a strong long-term earnings growth expectation of 33.4%, significantly higher than the Zacks Computers – IT Services industry’s forecast of 18.8%.

The Zacks Consensus Estimate for CyberArk’s fiscal 2024 earnings is pegged at $2.04 per share, suggesting growth of 82.1% from the year-ago period's reported figure. For fiscal 2025, the consensus mark for earnings is pegged at $3.35 per share, indicating a year-over-year increase of 64%.

Additionally, CYBR currently sports a Zacks Rank #1 (Strong Buy) and has a Growth Score of A at present. The Growth Style Score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or 2 (Buy) and a Growth Score of A or B offer solid investment opportunities.

With healthy fundamentals, CyberArk appears to be a solid investment option at the moment.

Image Source: Zacks Investment Research

Long-Term Growth Drivers

CyberArk’s products are in high demand as enterprises confront a slew of data breaches. Cost-effective resource sharing on the back of cloud computing has left some loopholes that cyber criminals use to launch advanced cyberattacks through the cloud. This has prompted enterprises to take more stringent measures like the enforcement of security policies, protocols and products. The increase in budget allocation from enterprises toward cybersecurity is adding to CyberArk’s prospects.

CYBR’s enterprise password vault, privileged access management (PAM) and privileged session manager are being used at various enterprise levels to mitigate challenges, adding to CYBR’s competitive advantage in this space. CyberArk's PAM solutions equip enterprises with a range of products to monitor and manage privileged account access and activities while mitigating numerous cyber risks.

Moreover, CyberArk’s enterprise password vault and PAM are also gaining traction among the companies that want to implement stringent data policies due to their hybrid working needs. The company is benefiting from a rising number of companies embracing hybrid working to save costs of office space.

Due to its expertise, CYBR is gaining customer accounts, which adds to its top line. The large customer base gives the company a chance to sell more products to existing users. Also, CyberArk has closed many big deals in recent quarters, which is positive as it boosts deferred revenues and visibility. Additionally, when products are updated, it brings in more money as companies strive to keep their threat management systems up-to-date.

CyberArk has made certain acquisitions with the likes of C3M and IDaptive Holdings to expedite growth. The buyout of C3M has strengthened its existing Cloud Privilege Security offerings with capabilities for identifying security and compliance risks in cloud Identity and Access Management policies, cloud activity monitoring and threat detection. The acquisition of California-based IDaptive Holdings helped it expand its PAM and SaaS-based identity security solutions capabilities.

CyberArk’s sustained focus on expanding its portfolio through innovation and acquisitions has helped it add new customers, thereby boosting overall financial performance. In the first quarter of 2024, CyberArk’s revenues jumped 37% year over year to $221.6 million. Its non-GAAP earnings were 75 cents per share against the year-ago quarter’s loss of 17 cents.

Other Stocks to Consider

Some other top-ranked stocks from the broader technology sector are NVIDIA NVDA, Dropbox DBX and Datadog DDOG, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for NVIDIA’s 2025 earnings per share has been revised upward by 3 cents to $2.68 in the past 30 days. Shares of NVDA have skyrocketed 159% in the year-to-date period.

The Zacks Consensus Estimate for Dropbox's 2024 earnings per share has been revised upward by 11 cents to $2.12 in the past 60 days. Shares of DBX have plunged 23.3% in the year-to-date period.

The Zacks Consensus Estimate for Datadog’s 2024 earnings per share has been revised upward by 12 cents to $1.54 in the past 60 days. Shares of DDOG have gained 8.3% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Datadog, Inc. (DDOG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance