Here's Why We Think Solid State (LON:SOLI) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Solid State (LON:SOLI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Solid State

How Quickly Is Solid State Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Solid State's EPS has grown 21% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

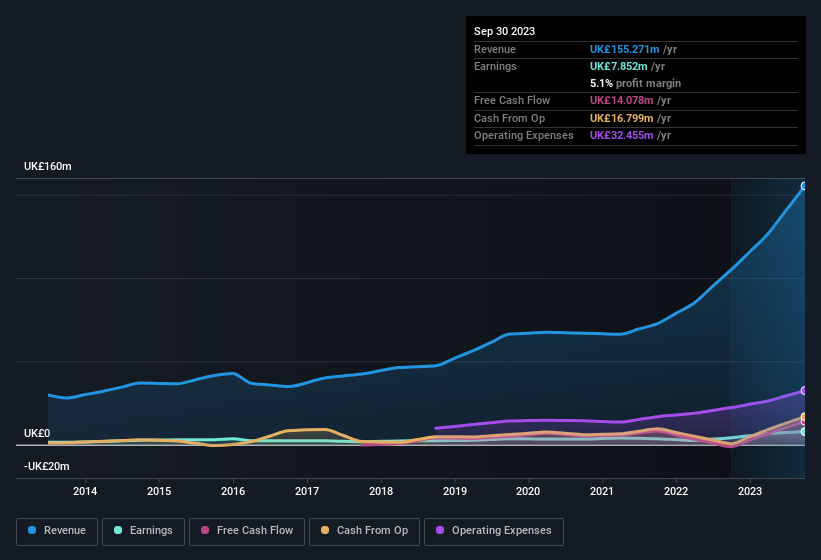

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Solid State achieved similar EBIT margins to last year, revenue grew by a solid 48% to UK£155m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Solid State's forecast profits?

Are Solid State Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders in Solid State both added to and reduced their holdings over the preceding 12 months. All in all though, their acquisitions outweighed the amount of shares they sold off. At face value we can consider this a fairly encouraging sign for the company. We also note that it was the CFO, Group Finance Director & Executive Director, Peter James, who made the biggest single acquisition, paying UK£40k for shares at about UK£13.31 each.

Along with the insider buying, another encouraging sign for Solid State is that insiders, as a group, have a considerable shareholding. Indeed, they hold UK£27m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. As a percentage, this totals to 16% of the shares on issue for the business, an appreciable amount considering the market cap.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Gary Marsh is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Solid State, with market caps between UK£79m and UK£315m, is around UK£583k.

The Solid State CEO received UK£511k in compensation for the year ending March 2023. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Solid State Worth Keeping An Eye On?

For growth investors, Solid State's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. Before you take the next step you should know about the 1 warning sign for Solid State that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Solid State, you'll probably love this curated collection of companies in GB that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance