High Insider Ownership Growth Companies On The ASX For June 2024

Amidst a backdrop of fluctuating performances in global markets, the Australian ASX200 has shown resilience, closing up recently despite mixed signals from the US. This context sets a fitting stage to explore growth companies on the ASX that not only demonstrate robust potential but also feature high insider ownership—a marker often associated with strong governance and aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 30.1% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 76.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 62.8% |

Argosy Minerals (ASX:AGY) | 14.5% | 129.6% |

Chrysos (ASX:C79) | 21.4% | 63.5% |

Here we highlight a subset of our preferred stocks from the screener.

Chrysos

Simply Wall St Growth Rating: ★★★★★☆

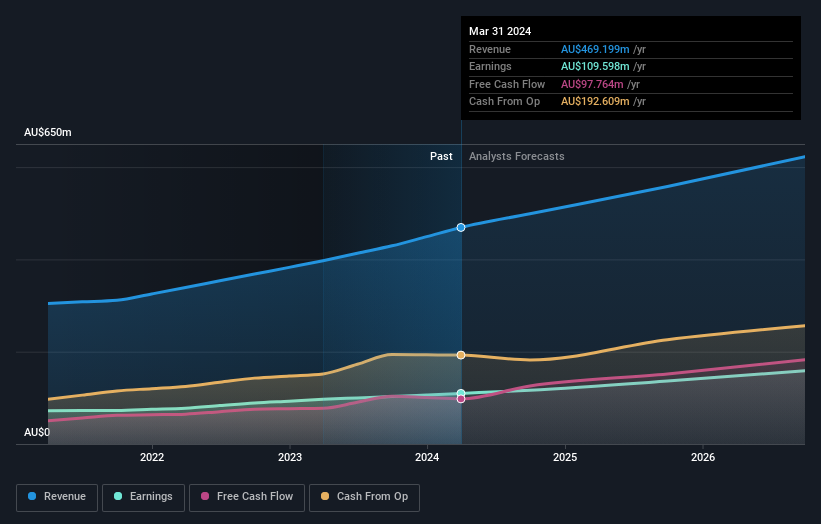

Overview: Chrysos Corporation Limited is a company focused on the development and supply of mining technology, with a market capitalization of approximately A$655.35 million.

Operations: The company generates revenue primarily from mining services, which amounted to A$34.24 million.

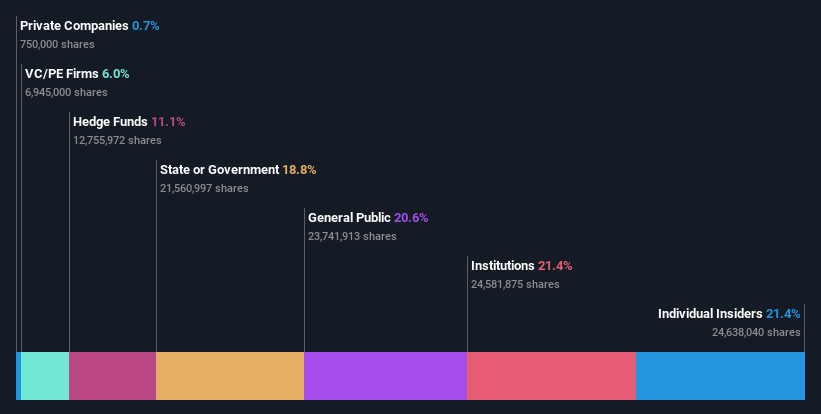

Insider Ownership: 21.4%

Earnings Growth Forecast: 63.5% p.a.

Chrysos Corporation Limited, a growth-oriented company with high insider ownership in Australia, is poised for significant development. The company's revenue is expected to grow by 35.3% annually, outpacing the Australian market average of 5.5%. Despite a low forecasted return on equity of 7.8% in three years, earnings are projected to increase by 63.48% per year. Notably, insiders have been net buyers over the past three months, underscoring their confidence in the company’s trajectory. Additionally, Chrysos is anticipated to become profitable within the next three years.

Capricorn Metals

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricorn Metals Ltd is an Australian company focused on the evaluation, exploration, development, and production of gold properties, with a market capitalization of approximately A$1.86 billion.

Operations: The primary revenue for the firm is generated from its Karlawinda segment, totaling A$356.94 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 26.5% p.a.

Capricorn Metals, an Australian growth company with high insider ownership, shows a mixed financial outlook. While earnings are expected to rise by 26.49% annually, recent substantial insider selling raises concerns. The company's profit margins have decreased from 25.4% to 5.2%, yet its revenue growth at 14.3% annually surpasses the national market average of 5.5%. Return on equity is anticipated to be robust at 30.9% in three years, indicating potential for significant value creation despite current challenges.

Dive into the specifics of Capricorn Metals here with our thorough growth forecast report.

Our valuation report unveils the possibility Capricorn Metals' shares may be trading at a premium.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions in Australia and internationally, with a market capitalization of A$6.01 billion.

Operations: The company generates revenue through three primary segments: software (A$317.24 million), corporate (A$83.83 million), and consulting (A$68.13 million).

Insider Ownership: 12.3%

Earnings Growth Forecast: 14.3% p.a.

Technology One, an Australian software company with high insider ownership, demonstrates promising growth prospects. Its earnings are projected to increase by 14.3% annually, outpacing the broader Australian market's 13.7%. Despite a high price-to-earnings ratio of 54.9x compared to the industry average of 63.4x, its return on equity is expected to be strong at 32.6% in three years. Recent financial results show a revenue jump to A$240.83 million and net income growth to A$48 million for the first half of 2024.

Click to explore a detailed breakdown of our findings in Technology One's earnings growth report.

The valuation report we've compiled suggests that Technology One's current price could be inflated.

Taking Advantage

Access the full spectrum of 90 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:C79 ASX:CMM and ASX:TNE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance