Inflation drops to two per cent ahead of Bank of England interest rate decision

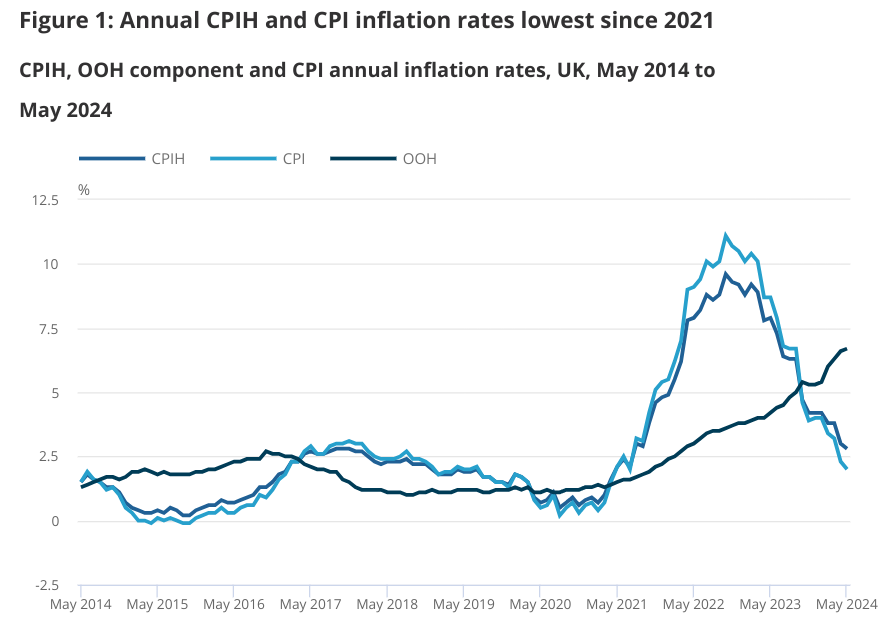

Inflation returned to the two per cent target in May for the first time since July 2021 as markets prepare for the Bank of England’s latest interest rate decision tomorrow.

Prices just rose 2.0 per cent in the year to May, according to the Office for National Statistics (ONS), down from 2.3 per cent in April. This was in line with economists’ expectations.

Core inflation, which strips out volatile components such as food and energy, fell to 3.5 per cent, down from 3.9 per cent previously and in line with expectations.

Easing food inflation was the biggest contributor to the lower level of inflation, with food and drink prices actually falling in May.

Prices for bread, vegetables and sugary treats all fell in the month, bringing the annual rate of food inflation to 1.7 per cent, its lowest level since October 2021.

This was partially offset by higher transport prices, which increased on an annual basis for the first time since October 2023 on the back of higher motor fuel prices.

Even though inflation has returned to the two per cent target, the Bank of England is very unlikely to cut interest rates tomorrow. Policymakers at the Bank are cautious of lowering rates when there are still signs of inflationary pressures in the domestic economy.

The figures showed that services inflation, which is a more accurate gauge of domestic inflationary dynamics, only fell to 5.7 per cent from 5.9 per cent in April.

Economists had expected to see a greater fall, particularly after last month’s surprisingly hot reading.

“The Bank will need to see a continued fall in services inflation before it can be confident that headline inflation will stay sustainably at its two per cent target in the medium term,” Yael Selfin, chief economist at KPMG UK said.

Figures out last week also showed that annual wage growth in the private sector was running at around 5.8 per cent, nearly twice the level consistent with the two per cent inflation target.

“Rate-setters will still need to weigh the fall in headline inflation against signs that domestic price pressures, such as elevated pay growth, are proving slower to come down,” Martin Sartorius, principal economist at the Confederation of British Industry (CBI) said.

The Bank is also expecting to see a slight uptick in inflation later in the year as the downward drag from falling energy prices starts to wane.

Without a watertight case for lowering rates, the Monetary Policy Committee (MPC) is likely to be cautious of changing policy during an election campaign.

MPC members have been prevented from making speeches during the campaign, making it more difficult for markets to gauge how rate-setters are interpreting incoming data.

However, the data will likely influence the guidance issued by the Bank tomorrow. Traders put the odds of an August interest rate cut at about 50/50.

The European Central Bank cut interest rates for the first time in five years earlier this month, although the US Federal Reserve is only likely to start cutting rates in September.

Yahoo Finance

Yahoo Finance