Insider-Favored Growth Stocks To Watch In July 2024

As global markets navigate through a relatively quiet period with small-cap and tech stocks showing notable performance, investors are keenly awaiting the upcoming quarterly earnings reports. In such a climate, growth companies with high insider ownership can be particularly compelling, as this ownership structure often signals confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 26.7% |

Medley (TSE:4480) | 34% | 28.7% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

Let's dive into some prime choices out of from the screener.

Aspen Pharmacare Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aspen Pharmacare Holdings Limited engages in the manufacturing and global distribution of specialty and branded pharmaceutical products, with a market capitalization of approximately ZAR 102.32 billion.

Operations: The company generates revenue primarily through its manufacturing segment, which produced ZAR 12.81 billion.

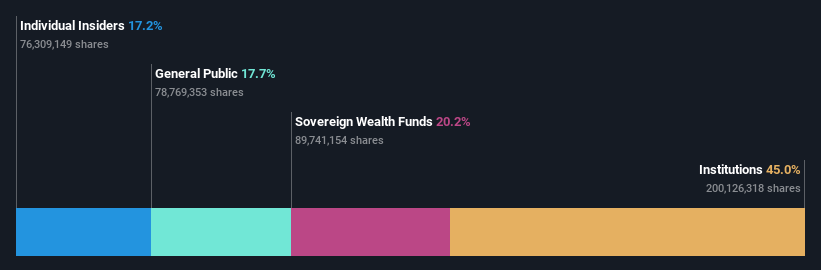

Insider Ownership: 17.2%

Revenue Growth Forecast: 10.2% p.a.

Aspen Pharmacare Holdings, despite a forecasted low return on equity of 9.4% in three years, is positioned for robust growth with earnings expected to increase by 27.7% annually, significantly outpacing the South African market's 18.9%. Additionally, its revenue is projected to grow at 10.2% per year, surpassing the market average of 3.2%. The stock also trades at a considerable discount, valued at 49.1% below its estimated fair value, highlighting potential for appreciation.

Sunstone Development

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sunstone Development Co., Ltd. specializes in the research, development, production, and sales of prebaked carbon anodes for the aluminum industry, operating both in China and internationally with a market capitalization of approximately CN¥7.14 billion.

Operations: The company generates its revenue primarily from the production and sales of prebaked carbon anodes, serving the aluminum sector globally.

Insider Ownership: 37.6%

Revenue Growth Forecast: 17.9% p.a.

Sunstone Development is poised for notable growth with earnings expected to surge by 81.99% annually. Although its revenue growth of 17.9% per year is below the 20% high-growth benchmark, it still outpaces the Chinese market's average of 13.7%. The company's transition to profitability within three years aligns with above-market expectations, despite a low forecasted return on equity of 9.6%. Financially, Sunstone carries a high level of debt but trades at good value relative to its peers.

UTour Group

Simply Wall St Growth Rating: ★★★★★★

Overview: UTour Group Co., Ltd. operates in the outbound tourism sector, providing wholesale and retail services both in China and globally, with a market capitalization of approximately CN¥5.99 billion.

Operations: UTour Group generates its revenue primarily through the wholesale and retail of outbound tourism services across domestic and international markets.

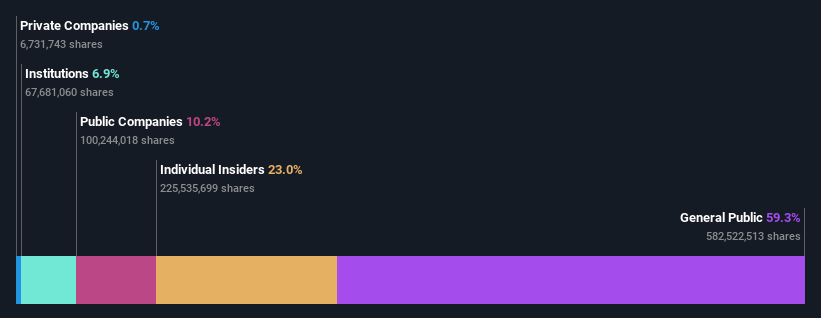

Insider Ownership: 23%

Revenue Growth Forecast: 36.4% p.a.

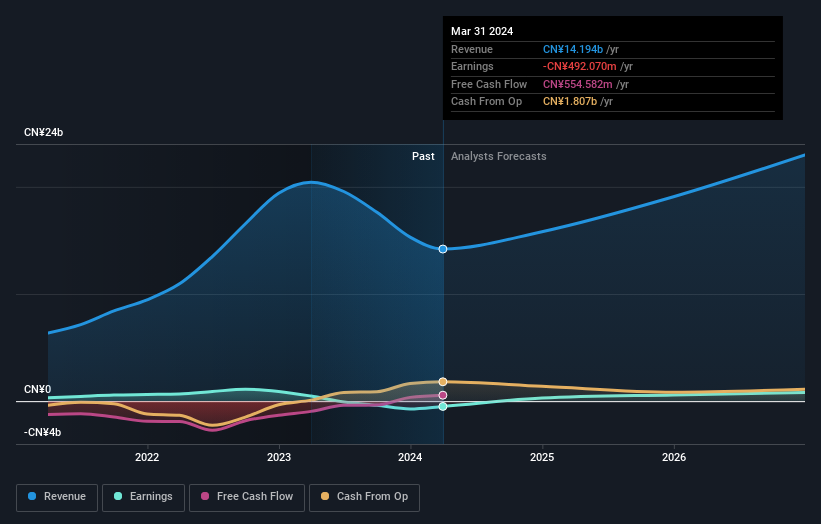

UTour Group has transitioned into profitability this year, with its revenue and earnings growth significantly outpacing the Chinese market average. Despite a high level of debt, the company is trading well below our estimate of its fair value. Recent financial results show substantial improvement, with first-quarter sales rising to CNY 1.02 billion from CNY 137.84 million a year earlier and net income reaching CNY 28.05 million, reversing a previous loss.

Dive into the specifics of UTour Group here with our thorough growth forecast report.

Our valuation report unveils the possibility UTour Group's shares may be trading at a premium.

Next Steps

Embark on your investment journey to our 1452 Fast Growing Companies With High Insider Ownership selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include JSE:APN SHSE:603612 and SZSE:002707.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance