Insider-Owned Growth Leaders On SEHK For July 2024

As global markets navigate through varying economic signals, Hong Kong's stock market has shown resilience amidst regional uncertainties. This backdrop sets a compelling stage for examining growth companies with high insider ownership on the SEHK, which can offer unique advantages in such fluctuating environments.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.2% | 104.1% |

Fenbi (SEHK:2469) | 32.6% | 43% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

DPC Dash (SEHK:1405) | 38.2% | 90.2% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Ocumension Therapeutics (SEHK:1477) | 23.1% | 93.7% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.5% |

Beijing Airdoc Technology (SEHK:2251) | 28.7% | 83.9% |

Here's a peek at a few of the choices from the screener.

J&T Global Express

Simply Wall St Growth Rating: ★★★★☆☆

Overview: J&T Global Express Limited, primarily engaged as an investment holding company, provides express delivery services and has a market capitalization of approximately HK$63.45 billion.

Operations: The company generates its revenue primarily from air freight services, totaling approximately HK$8.85 billion.

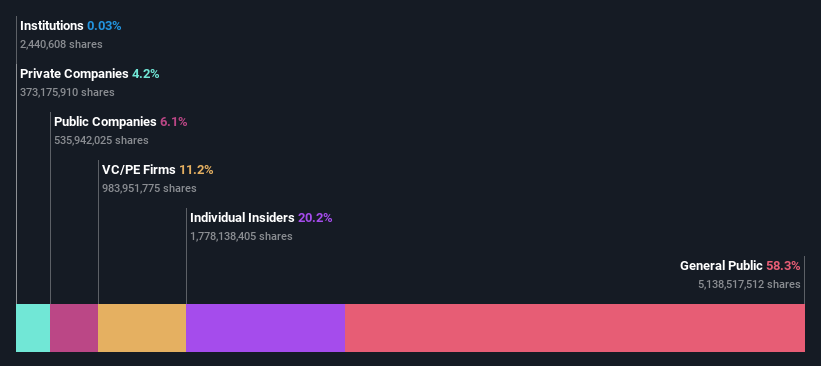

Insider Ownership: 20.2%

J&T Global Express is poised for significant growth with revenue expected to increase by 15.8% annually, outpacing the Hong Kong market's 7.7%. While currently unprofitable, profitability is anticipated within three years, surpassing average market growth rates. Despite a low forecasted return on equity of 17.9% in three years, the company's recent inclusion in the FTSE All-World Index underscores its expanding market presence. Notably, there has been no insider buying or selling reported in the past three months.

ESR Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and more with a market cap of HK$45.67 billion.

Operations: The company's revenue is derived mainly from fund management at HK$774.64 million and new economy development, contributing HK$105.48 million.

Insider Ownership: 13.1%

ESR Group, despite trading at 40.8% below its estimated fair value, shows potential with a revenue growth forecast of 9.6% annually, surpassing Hong Kong's average of 7.7%. However, its interest payments are poorly covered by earnings and profit margins have declined from last year's 54.8% to 23.9%. Insider ownership remains significant amid privatization talks with a consortium including Warburg Pincus, suggesting alignment with shareholder interests but introducing uncertainty regarding future listing status.

Click here to discover the nuances of ESR Group with our detailed analytical future growth report.

Our valuation report here indicates ESR Group may be overvalued.

MGM China Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MGM China Holdings Limited is an investment holding company that operates gaming and lodging resorts in the Greater China region, with a market capitalization of approximately HK$48.41 billion.

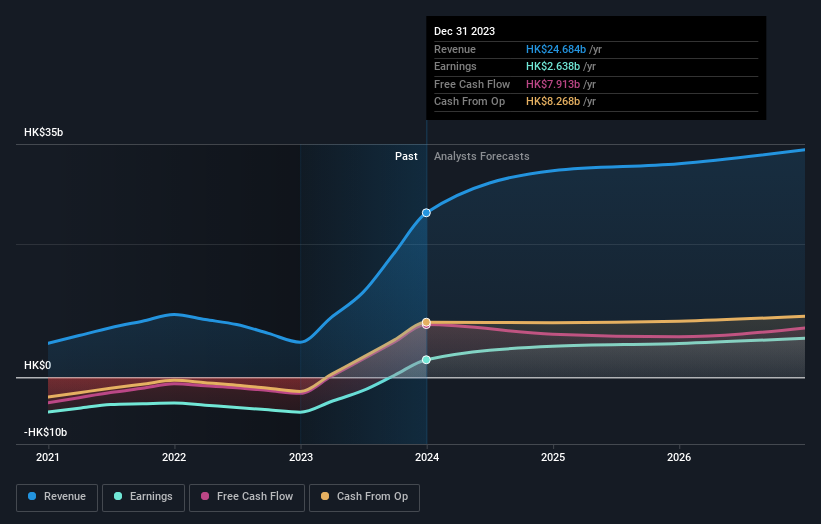

Operations: The company generates revenue primarily from its casinos and resorts segment, totaling approximately HK$24.68 billion.

Insider Ownership: 10%

MGM China Holdings, trading 43.4% below its fair value, is set for a 17.7% annual earnings growth, outpacing the Hong Kong market's 11.2%. Despite this potential, its interest payments struggle against earnings and revenue growth lags behind the desired 20% mark at 8%. Recently, it issued US$500 million in senior notes to manage debts effectively. Concurrently, a shareholder-approved buyback plan could enhance shareholder value but raises questions on long-term capital allocation strategies.

Where To Now?

Discover the full array of 54 Fast Growing SEHK Companies With High Insider Ownership right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1519 SEHK:1821 and SEHK:2282.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance