Insulet's (PODD) Omnipod 5 Favored in Study for Type 2 Diabetes

Insulet Corp. PODD recently announced positive results from its Omnipod 5 Automated Insulin Delivery System (Omnipod 5) type 2 diabetes pivotal trial. The landmark study assessed the impact of AID (Automated Insulin Delivery) on a diverse group of people with type 2 diabetes who require insulin.

The findings were shared at the American Diabetes Association 84th Scientific Sessions in Orlando, FL. Presently, Omnipod 5 is FDA-cleared in the United States and C.E. marked for use in those with type 1 diabetes aged two years and older.

More on the Omnipod 5 Study

The SECURE-T2D pivotal trial primarily aimed to evaluate change in HbA1c with Omnipod 5 in adults aged 18 to 75 years living with type 2 diabetes with a current insulin regimen for at least three months. Other criteria included a baseline HbA1c between 7% and 12% for those using basal insulin only and 12% or less for those using basal and bolus or pre-mixed insulin. Secondary objectives included demonstrating improvements in time in range and time in hyperglycemia, as well as demonstrating non-inferiority for hypoglycemia. Diabetes distress, a patient-reported outcome, was also assessed.

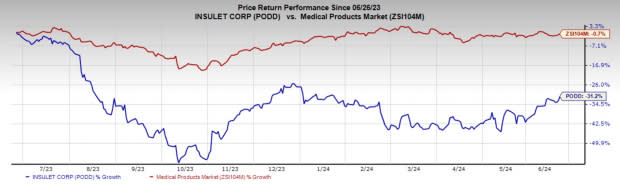

Image Source: Zacks Investment Research

One of the most racially diverse studies in diabetes technology, the study represented 305 participants from 21 sites across the United States, including 24% Black and 22% Hispanic participants. Among them, more than half (55%) were on a stable dose of GLP-1 receptor agonists, 73% used multiple daily injections of insulin, 21% used basal-only insulin at baseline, and only 5.6% used an insulin pump at baseline.

After 14 days of standard therapy, the study participants used the Omnipod 5 AID system for 13 weeks without any restrictions on eating and exercise. They were given the option to bolus for blood glucose corrections only for actual carbohydrate intake or a set carbohydrate regimen.

Importance of SECURE-T2D Pivotal Trial Outcome

The study results revealed glycemic improvements using Omnipod 5 compared with insulin injections or pump therapy treatments in adults with type 2 diabetes. The outcome demonstrated significant reductions in HbA1c, time in hyperglycemia, total daily insulin dose and a large improvement in TIR without increasing time in hypoglycemia. Additionally, a clinically meaningful improvement was also reported in diabetes distress.

These results indicate that simple, easy-to-use AID technology, such as Omnipod 5, can be adopted by a broad population of people with type 2 diabetes, potentially improving their lives. In particular, the findings could have a notable impact among Black and Hispanic people, who face a higher prevalence of type 2 diabetes and increased mortality rates.

Despite more than 30 million people living with type 2 diabetes in the United States, there are currently no FDA-cleared AID systems for this population. Insulet recently submitted these study results to the FDA to expand Omnipod 5’s indications for use for people with type 2 diabetes and expects to commercially launch in the United States in early 2025, subject to clearance.

Industry Prospects

Per a Research report, the global market for type 2 diabetes was valued at $32 billion in 2022 and is expected to witness a CAGR of 8.2% by 2032.

The introduction of new therapeutic compounds with improved efficacy and safety opens up the possibility of developing new treatments. Also, the growing obesity epidemic in many regions of the world is supporting the profitability of the industry.

Recent Developments

Last week, Insulet announced the full commercial launch of Omnipod 5 with Dexcom G6 and Abbott FreeStyle Libre 2 Plus continuous glucose monitor sensors in the United Kingdom and the Netherlands and in France with G6 compatibility. In the United States, Omnipod 5 with G7 integration is now commercially available, along with a limited market release of the Omnipod 5 App for iPhone.

Price Performance

In the past year, Insulet shares have declined 31.2% compared with the industry’s fall of 0.7%.

Zacks Rank and Key Picks

Insulet currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, ResMed RMD and Medpace MEDP. While Hims & Hers Health and ResMed each sport a Zacks Rank #1 (Strong Buy), Medpace carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 169.4% in the past year. Estimates for the company’s earnings have increased from 18 cents to 19 cents in 2024 and from 33 cents to 35 cents in 2025 in the past seven days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for ResMed’s fiscal 2024 earnings per share have remained constant at $7.70 in the past 30 days. Shares of the company have declined 4% in the past year compared with the industry’s fall of 0.7%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Estimates for Medpace’s 2024 earnings per share have remained constant at $11.29 in the past 30 days. Shares of the company have surged 79.4% in the past year compared with the industry’s 5.4% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ResMed Inc. (RMD) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance