July 2024 Insight On Undervalued Small Caps With Insider Actions In The United States

Amidst a buoyant U.S. market landscape, marked by the S&P 500 reaching an unprecedented high and dovish remarks from Federal Reserve Chairman Jerome Powell, small-cap stocks present unique opportunities for discerning investors. In this context, understanding the intrinsic qualities that define undervalued small-cap stocks becomes crucial to identifying potential investment gems.

Top 10 Undervalued Small Caps With Insider Buying In The United States

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Columbus McKinnon | 20.8x | 1.0x | 46.42% | ★★★★★☆ |

PCB Bancorp | 8.8x | 2.4x | 45.05% | ★★★★★☆ |

Thryv Holdings | NA | 0.7x | 30.15% | ★★★★★☆ |

Titan Machinery | 3.7x | 0.1x | 29.66% | ★★★★★☆ |

Franklin Financial Services | 9.0x | 1.8x | 37.04% | ★★★★☆☆ |

Ramaco Resources | 13.7x | 1.1x | 12.46% | ★★★★☆☆ |

Chatham Lodging Trust | NA | 1.3x | 18.79% | ★★★★☆☆ |

Papa John's International | 19.8x | 0.7x | 36.84% | ★★★☆☆☆ |

Delek US Holdings | NA | 0.1x | -151.20% | ★★★☆☆☆ |

Alta Equipment Group | NA | 0.1x | -149.54% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Ramaco Resources

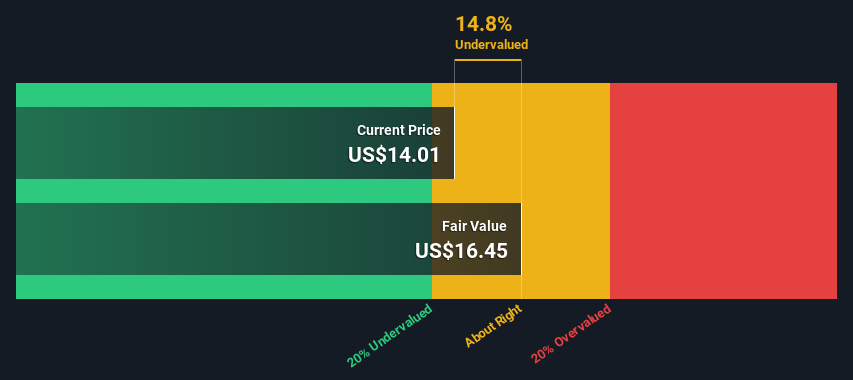

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ramaco Resources is a company that operates in the metals and mining sector, specifically focusing on coal, with a market capitalization of approximately $699.84 million.

Operations: The company primarily generates revenue from coal mining, with a reported revenue of $699.84 million. It has experienced a gross profit margin of 25.27% as of the latest reporting period, reflecting its cost management in relation to sales generated from this segment.

PE: 13.7x

Despite a challenging year with profit margins contracting from 17.3% to 8%, Ramaco Resources has shown resilience, recently added to several Russell indices, signaling potential growth avenues. Insider confidence is evident as they recently purchased shares, underscoring belief in the company's prospects amidst leadership and operational shifts aimed at enhancing financial and mining operations. With earnings expected to grow modestly at 2.95% annually and recent strategic index additions, Ramaco presents a nuanced opportunity within the undervalued segments of the market.

Navigate through the intricacies of Ramaco Resources with our comprehensive valuation report here.

Explore historical data to track Ramaco Resources' performance over time in our Past section.

Clear Channel Outdoor Holdings

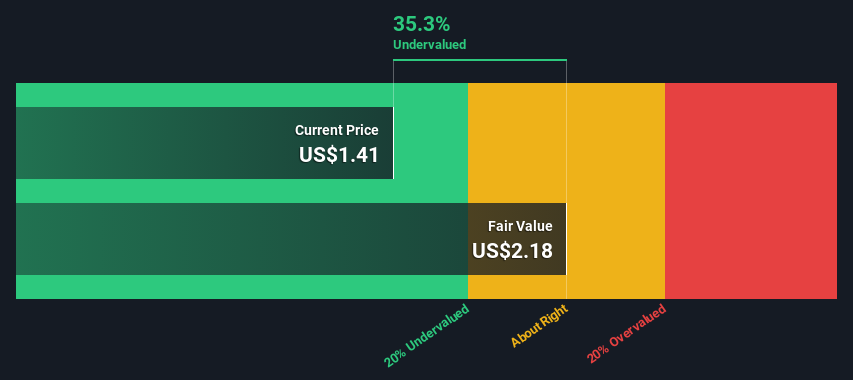

Simply Wall St Value Rating: ★★★★★☆

Overview: Clear Channel Outdoor Holdings is a global outdoor advertising company with operations spanning airport, European, and American markets, and a market capitalization of approximately $0.65 billion.

Operations: The company operates across various segments, with America (excluding airports) contributing $1.11 billion to the revenue, followed by Europe-north at $630.45 million, Airports at $334.74 million, and other sources at $91.71 million. The gross profit margin has shown fluctuations over several periods, most recently recorded at 48.15% for the quarter ending July 3, 2024.

PE: -4.9x

Recently added to multiple Russell indexes, Clear Channel Outdoor Holdings stands out with its strategic shelf registration aimed at raising $64.74 million through common stock offerings, signaling expansion or debt management initiatives. Despite a challenging Q1 with a $89.67 million net loss and sales of $481.75 million, the firm anticipates a rebound with projected Q2 revenues between $547 million and $572 million. Insider confidence is evident as they recently purchased shares, underscoring belief in the company’s potential turnaround and growth trajectory amidst operational adjustments.

Leggett & Platt

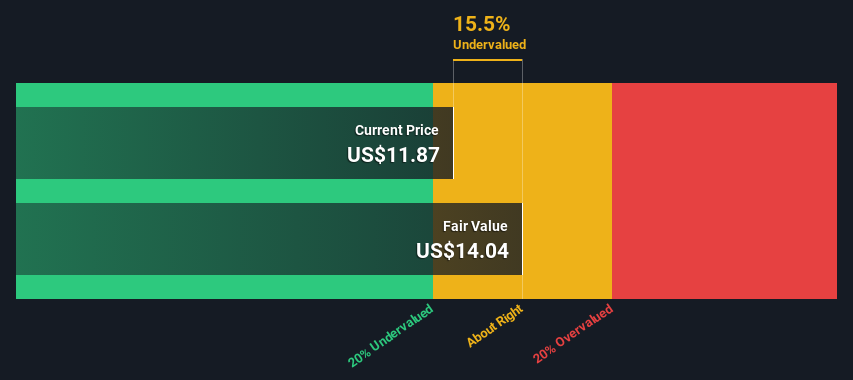

Simply Wall St Value Rating: ★★★★★☆

Overview: Leggett & Platt is a diversified manufacturer specializing in engineered components and products for bedding, furniture, and various industrial markets, with a market capitalization of approximately $4.65 billion.

Operations: With revenue streams primarily from Bedding Products, Specialized Products, and Furniture, Flooring & Textile Products totaling approximately $4.61 billion, the company reported a gross profit of $821.6 million in the most recent fiscal quarter. The gross profit margin stood at 17.83%, reflecting the cost efficiency measures in place relative to production and operational costs.

PE: -9.4x

Recently, Leggett & Platt has demonstrated notable insider confidence, with executives purchasing shares, signaling belief in the company's prospects despite its recent drop from the S&P 400 to the S&P 600. This move could reflect a strategic realignment or an undervalued state. With earnings expected to grow by over 40% annually and a proactive approach towards acquisitions as stated in their first-quarter webcast, Leggett & Platt is positioning itself for robust future growth. Moreover, the return of Karl Glassman as CEO suggests a commitment to leveraging deep industry experience and continuity in leadership during pivotal transitions.

Dive into the specifics of Leggett & Platt here with our thorough valuation report.

Understand Leggett & Platt's track record by examining our Past report.

Where To Now?

Click here to access our complete index of 61 Undervalued Small Caps With Insider Buying.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:METC NYSE:CCO and NYSE:LEG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance