June 2024 Insight Into Three SEHK Stocks Estimated To Be Undervalued

Amidst a backdrop of global economic uncertainties and fluctuating markets, the Hong Kong stock market has shown resilience, presenting potential opportunities for investors looking for undervalued assets. Identifying stocks that are poised for growth despite broader market challenges can be particularly rewarding in such an environment.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

Name | Current Price | Fair Value (Est) | Discount (Est) |

Best Pacific International Holdings (SEHK:2111) | HK$2.13 | HK$3.80 | 44% |

Plover Bay Technologies (SEHK:1523) | HK$3.15 | HK$5.72 | 44.9% |

Kuaishou Technology (SEHK:1024) | HK$49.50 | HK$98.61 | 49.8% |

Gaush Meditech (SEHK:2407) | HK$13.88 | HK$26.11 | 46.8% |

East Buy Holding (SEHK:1797) | HK$14.74 | HK$29.17 | 49.5% |

Innovent Biologics (SEHK:1801) | HK$37.15 | HK$67.02 | 44.6% |

REPT BATTERO Energy (SEHK:666) | HK$14.26 | HK$27.18 | 47.5% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$10.26 | HK$19.04 | 46.1% |

Zhaojin Mining Industry (SEHK:1818) | HK$13.68 | HK$25.12 | 45.5% |

CGN Mining (SEHK:1164) | HK$2.74 | HK$4.87 | 43.7% |

Here we highlight a subset of our preferred stocks from the screener

COSCO SHIPPING Energy Transportation

Overview: COSCO SHIPPING Energy Transportation Co., Ltd. operates as an investment holding company, specializing in the transportation of oil, liquefied natural gas (LNG), and chemicals both domestically along the coast of China and internationally, with a market capitalization of approximately HK$75.01 billion.

Operations: The company primarily generates revenue from the transportation of oil, liquefied natural gas (LNG), and chemicals.

Estimated Discount To Fair Value: 34.5%

COSCO SHIPPING Energy Transportation Co., Ltd. is currently trading at HK$10.52, significantly below our estimated fair value of HK$16.07, marking it as undervalued based on cash flows. Despite a high level of debt and an unstable dividend track record, the company's recent earnings results show robust growth with net income increasing to CNY 1,235.67 million from CNY 1,095.89 million year-over-year for Q1 2024. Expected annual earnings growth is forecasted at a very large rate over the next three years compared to the Hong Kong market average, although revenue growth forecasts are more modest but still above market trends.

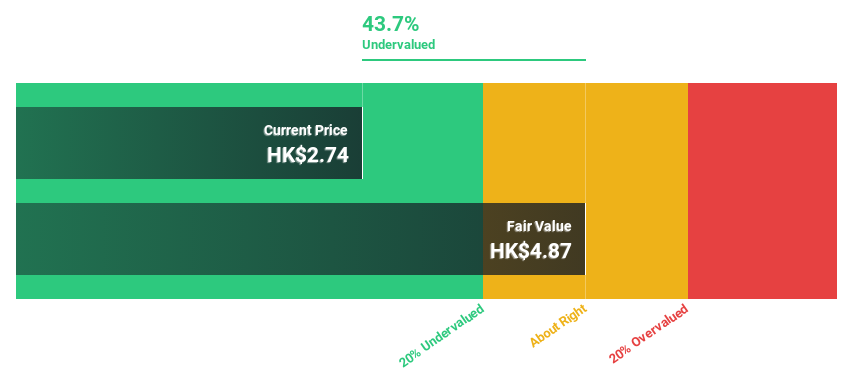

CGN Mining

Overview: CGN Mining Company Limited focuses on the development and trading of natural uranium resources for nuclear power plants, with a market capitalization of approximately HK$20.83 billion.

Operations: The company generates revenue primarily from natural uranium trading, amounting to HK$7.36 billion, and a smaller segment in property investment, which contributes HK$3.17 million.

Estimated Discount To Fair Value: 43.7%

CGN Mining, priced at HK$2.74, is trading below its calculated fair value of HK$4.87, highlighting its undervaluation based on cash flow analysis. Despite a decline in profit margins from 14.1% to 6.8%, the company's revenue is expected to grow at 15.7% annually, outpacing the Hong Kong market's 7.8%. Additionally, earnings are projected to increase by 17.6% per year, surpassing the market average of 11.7%. Recent events include unaudited natural uranium production figures and financial results showcasing a sales surge to HK$7.36 billion from HK$3.65 billion year-over-year.

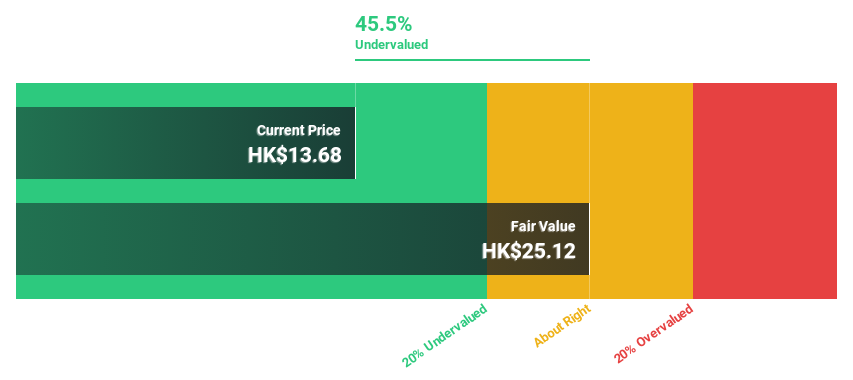

Zhaojin Mining Industry

Overview: Zhaojin Mining Industry Company Limited is an investment holding company that focuses on the exploration, mining, processing, smelting, and sale of gold and silver products in the People’s Republic of China, with a market capitalization of approximately HK$46.54 billion.

Operations: The company primarily generates revenue from the exploration, mining, processing, smelting, and sale of gold and silver products.

Estimated Discount To Fair Value: 45.5%

Zhaojin Mining Industry, with a current price of HK$13.68, is significantly undervalued by cash flow metrics, trading 45.5% below the estimated fair value of HK$25.12. Despite its robust earnings growth—projected at 44.48% annually—the company's debt is poorly covered by operating cash flows, raising concerns about financial health amidst aggressive expansion evidenced by recent equity and fixed-income offerings totaling over HK$1.73 billion and CNY 0.1 million respectively.

Next Steps

Discover the full array of 43 Undervalued SEHK Stocks Based On Cash Flows right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1138 SEHK:1164 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance