June 2024 Insights Into UK Stocks Estimated To Be Undervalued

As global markets exhibit caution and the FTSE 100 faces downward pressure, investors are keenly observing economic indicators and geopolitical events that could influence market dynamics. In such a climate, identifying undervalued stocks in the UK market requires a nuanced understanding of both macroeconomic factors and individual company fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

Name | Current Price | Fair Value (Est) | Discount (Est) |

Kier Group (LSE:KIE) | £1.40 | £2.73 | 48.7% |

Morgan Advanced Materials (LSE:MGAM) | £3.13 | £6.09 | 48.6% |

Mercia Asset Management (AIM:MERC) | £0.295 | £0.58 | 49.3% |

Loungers (AIM:LGRS) | £2.68 | £5.26 | 49.1% |

Deliveroo (LSE:ROO) | £1.286 | £2.48 | 48.1% |

Nexxen International (AIM:NEXN) | £2.47 | £4.91 | 49.7% |

Franchise Brands (AIM:FRAN) | £1.51 | £2.96 | 49% |

Elementis (LSE:ELM) | £1.44 | £2.80 | 48.5% |

Aston Martin Lagonda Global Holdings (LSE:AML) | £1.512 | £2.95 | 48.7% |

eEnergy Group (AIM:EAAS) | £0.055 | £0.11 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener

Fevertree Drinks

Overview: Fevertree Drinks PLC operates globally, specializing in the development and sale of premium mixer drinks across the UK, the US, Europe, and other international markets, with a market capitalization of approximately £1.24 billion.

Operations: The company generates its revenue primarily from the sale of non-alcoholic beverages, totaling £364.40 million.

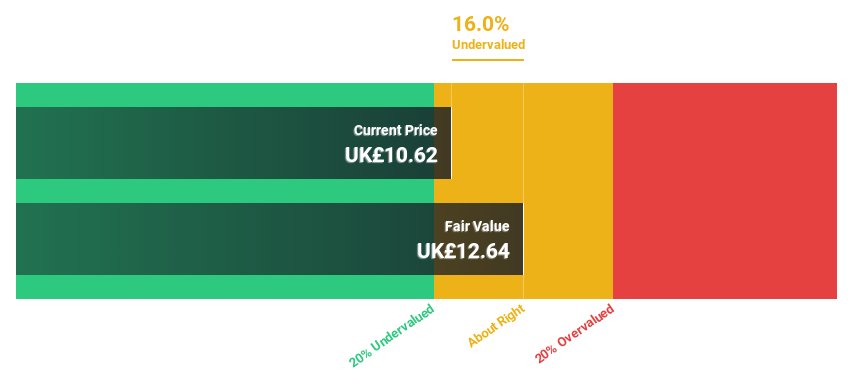

Estimated Discount To Fair Value: 16%

Fevertree Drinks, valued at £10.62, trades below its estimated fair value of £12.64, indicating potential undervaluation. Despite a decline in net profit margin from 7.2% to 4.2%, earnings are expected to grow by 35.1% annually, outpacing the UK market projection of 12.5%. However, its forecasted revenue growth at 7.7% yearly is modest compared to high-growth benchmarks and impacted by significant one-off items affecting financial results as seen in its recent annual performance with a drop in net income from GBP 24.9 million to GBP 15.4 million despite an increase in sales.

Babcock International Group

Overview: Babcock International Group PLC operates in aerospace, defense, and security sectors across various regions including the UK, Europe, Africa, North America, and Australasia with a market cap of approximately £2.71 billion.

Operations: Babcock International Group's revenue is primarily generated from its Marine, Nuclear, Land, and Aviation segments, totaling £1.53 billion, £1.33 billion, £1.08 billion, and £0.53 billion respectively.

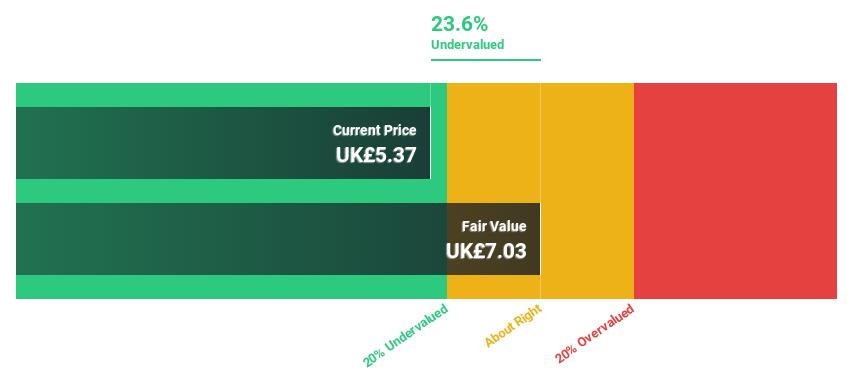

Estimated Discount To Fair Value: 23.6%

Babcock International Group, priced at £5.37, is trading below its calculated fair value of £7.03, suggesting a significant undervaluation based on discounted cash flows. Despite a decrease in net profit margin from 3.6% to 0.7%, Babcock's earnings are expected to surge by 29.71% annually over the next three years, surpassing the UK market's average growth rate of 12.5%. However, high debt levels and substantial one-off items may be distorting financial results, tempering its immediate appeal despite strong forecasted returns on equity and earnings growth potential.

Smith & Nephew

Overview: Smith & Nephew plc operates globally, developing, manufacturing, marketing, and selling medical devices and services, with a market capitalization of approximately £8.76 billion.

Operations: The company's revenue is divided into three main segments: Orthopaedics generating $2.21 billion, Sports Medicine & ENT at $1.73 billion, and Advanced Wound Management contributing $1.61 billion.

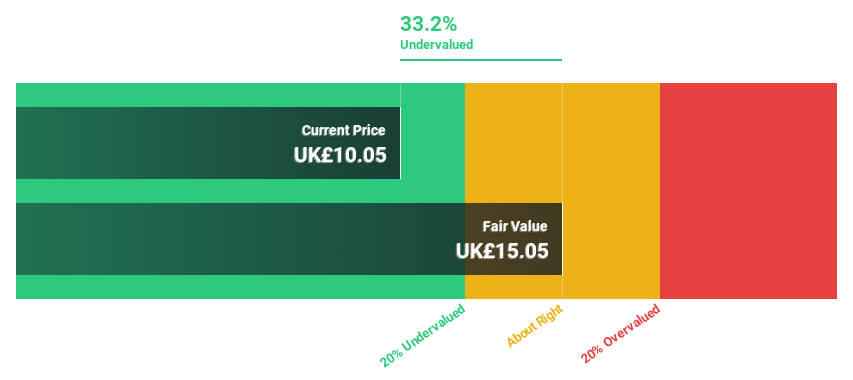

Estimated Discount To Fair Value: 33.2%

Smith & Nephew, valued at £10.05, is perceived as undervalued, trading 33.2% below its estimated fair value of £15.05 based on discounted cash flows. Despite a dividend yield of 2.95%, it's not well-backed by earnings or cash flows and the company carries high debt levels. However, with earnings forecasted to grow by 21.7% annually over the next three years—outpacing the UK market average—analysts predict a potential price increase of 29.4%. Recent dividends and innovative product launches like RENASYS EDGE highlight its active market engagement.

The growth report we've compiled suggests that Smith & Nephew's future prospects could be on the up.

Delve into the full analysis health report here for a deeper understanding of Smith & Nephew.

Seize The Opportunity

Click here to access our complete index of 66 Undervalued UK Stocks Based On Cash Flows.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:FEVRLSE:BAB LSE:SN. and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance