K-Bro Linen And 2 Other TSX Dividend Stocks To Consider

As the first half of 2024 concludes, Canadian markets have shown resilience with solid gains, particularly benefiting from the broader positive momentum seen in global stock indices and economic optimism. This backdrop sets a favorable stage for investors to consider dividend-paying stocks, which can offer both stability and potential income in a flourishing economic environment. In light of current market conditions, focusing on dividend stocks could be a prudent strategy for those looking to harness steady returns amidst ongoing market advancements.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.81% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.17% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.41% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.42% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.31% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.56% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.22% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.18% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 8.99% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

K-Bro Linen

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. operates in Canada and the United Kingdom, offering laundry and linen services primarily to healthcare institutions, hotels, and other commercial organizations, with a market capitalization of approximately CA$348.03 million.

Operations: K-Bro Linen Inc. generates CA$330.33 million in revenue from its laundry and linen services catered to the healthcare and hospitality sectors.

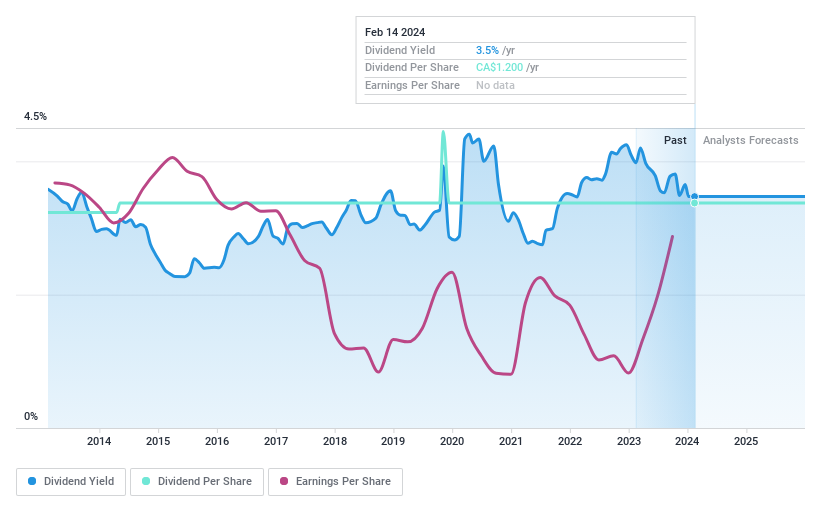

Dividend Yield: 3.5%

K-Bro Linen, while not a top-tier dividend payer with a yield of 3.6%, offers consistent dividends, supported by a stable payout ratio of 73.2% and cash flow coverage at 38.5%. Recent activities include reaffirmed monthly dividends and a share buyback program indicating confidence in financial stability. Despite earnings dipping slightly to CAD 1.81 million in Q1 2024 from CAD 2 million the previous year, the company's strategic buybacks and regular dividend payments reflect a balanced approach to shareholder returns and capital management.

Take a closer look at K-Bro Linen's potential here in our dividend report.

Our valuation report here indicates K-Bro Linen may be undervalued.

Royal Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada is a diversified financial services company with global operations and a market capitalization of approximately CA$207.77 billion.

Operations: Royal Bank of Canada generates its revenue from several key segments: Personal & Commercial Banking (CA$20.92 billion), Wealth Management (CA$17.47 billion), Capital Markets (CA$10.70 billion), and Insurance (CA$5.91 billion).

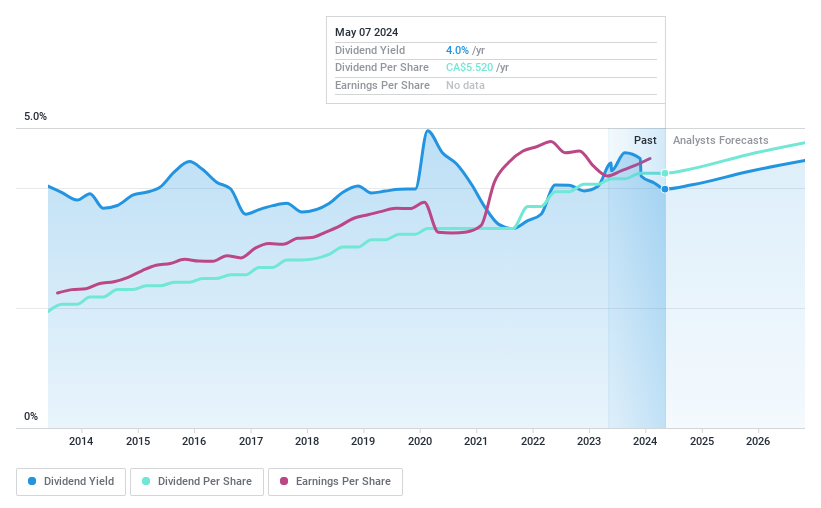

Dividend Yield: 3.8%

Royal Bank of Canada, with a modest dividend yield of 3.86%, falls below the top quartile in the Canadian market but maintains a stable payout history over the last decade. Its dividends are well-covered by earnings, reflected by a 50% payout ratio currently and an anticipated 48.2% in three years. Recent financials show robust growth with earnings up 9.3% this past year and projections for continued expansion at 3.55% annually, supporting future dividend reliability despite its lower yield position relative to peers.

Suncor Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of CA$67.91 billion.

Operations: Suncor Energy's revenue streams include CA$23.76 billion from Oil Sands, CA$31.51 billion from Refining and Marketing, and CA$2.17 billion from Exploration and Production.

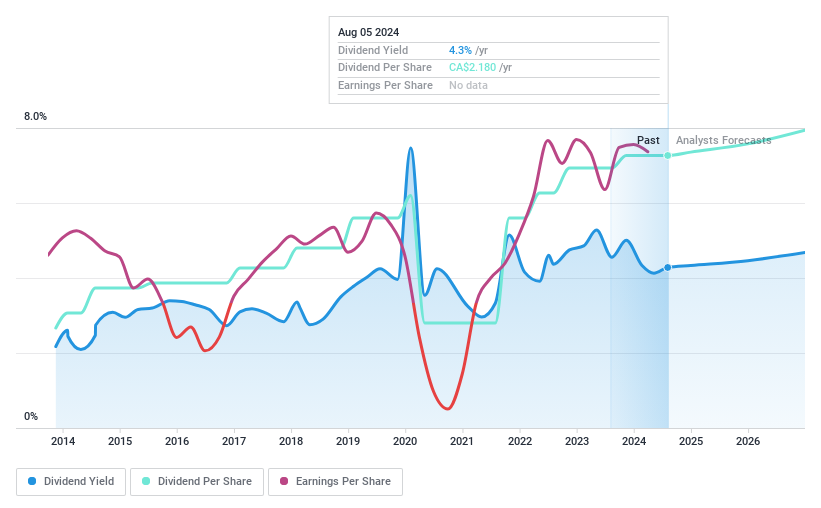

Dividend Yield: 4.1%

Suncor Energy has shown a mix of strengths and weaknesses as a dividend stock. Recent performance indicates increased oil sands production and refinery output, suggesting operational growth. However, its dividends have been historically volatile, with recent affirmations maintaining a CAD 0.545 quarterly payout amid varied shareholder sentiments on company policies. Trading below estimated fair value and with dividends well-covered by both earnings and cash flow (35% payout ratio), the outlook is cautiously optimistic despite forecasts of declining earnings over the next three years.

Key Takeaways

Unlock our comprehensive list of 33 Top TSX Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:KBL TSX:RY and TSX:SU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance