With as little as £300 a month invested, this stock could net £16,000 a year in passive income

The idea of earning passive income is very appealing. The free time to chase those lifelong dreams without being chained to a desk five days a week. Who’d say no to that?

But it doesn’t come easy.

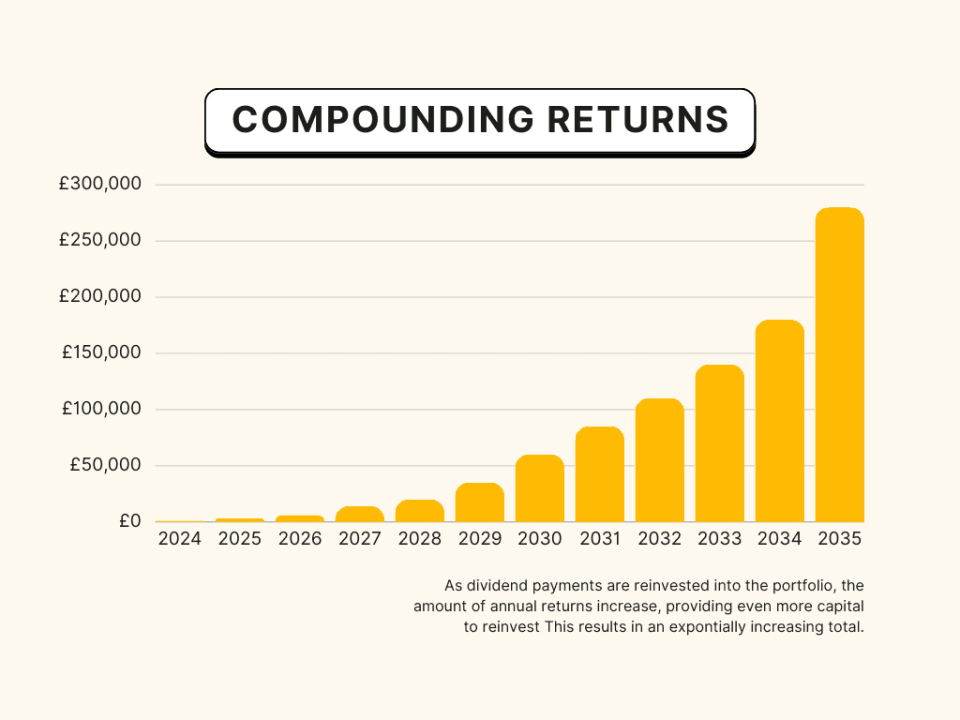

Earning money usually requires time and effort, but for passive income, it’s possible to replace the effort with savings. In other words, investing in dividend stocks and compounding the returns.

The magic combination

Dividend stocks regularly pay out a percentage per share. Reinvesting these payments can create a snowball effect of wealth accumulation.

There are plenty of dividend-paying stocks on the London Stock Exchange but not all are equal. In addition to a high yield, it’s important to choose stocks with a strong value proposition and track record of payments.

Investment trusts or income shares are a good option as they typically pay a reliable dividend. However, they usually have limited growth potential. The real diamond in the rough to look for is an undervalued share with a long history of consistent dividend payments.

A lesser-known specialist bank

One good example, I feel, is Paragon Banking Group (LSE:PAG), the specialist lender and savings bank.

But investments come with some risk and this one is no exception. Much of its daily operations involve debt, which is normal for banks, but also something to check. With £3.13bn in debt and only £1.4bn in shareholder equity, its debt-to-equity (D/E) ratio is worryingly high at 221%.

Yet it’s reduced its debt position significantly in the past 10 years, but an ideal D/E ratio would be below 100%. Growth has also slowed recently, with profit margins down from 73% to 39% this year. And earnings are forecast to grow by only 4.3% this year — a fair bit lower than the industry average of 14.7%.

So why do I like it as a dividend stock?

This £1.6bn FTSE 250 constituent sports a slightly-above-average dividend yield of 5%. While there are certainly many stocks that pay higher dividends, I like Paragon’s track record and growth potential.

Other than a brief pandemic break, it paid a regular bi-annual dividend, which has increased from 7.8p to 37.4p in just 10 years. If the dividend continues to increase at this rate (which won’t necessarily happen), it will be paying over £1 per share in the next 10 years.

What’s more, the shares are estimated to be undervalued by 53% using a discounted cash flow analysis. That leaves a lot of room for growth.

Calculating returns

The Paragon share price hasn’t done much in the past 20 years. But in the past four years since Covid, it’s done very well. Since May 2020, it’s up 130%, with annualised returns of 23%.

Of course, past performance doesn’t indicate future results, but I think the UK stock market average of 7% a year is a good benchmark.

An initial investment of £1,000 combined with a £300 monthly contribution could build a pot of £4,720 in one year.

By reinvesting the 5% dividends and continuing the monthly contributions, this could grow to £295,980 in 20 years. Taking into consideration the increasing dividend, it could be paying out £16,000 in annual dividends.

That’s in no way guaranteed, of course, but it’s a decent bit of spare cash each month!

The post With as little as £300 a month invested, this stock could net £16,000 a year in passive income appeared first on The Motley Fool UK.

More reading

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance