MRC Global (MRC) Exhibits Healthy Prospects Amid Headwinds

MRC Global Inc. MRC has been benefiting from its diversified presence across several end markets, including upstream production, midstream pipelines, gas utilities and Downstream, Industrial and Energy Transition ("DIET"). The company has been witnessing strength in the DIET sector, driven by an increase in energy transition activities in the United States. It expects revenues from the DIET sector to increase modestly in 2024 on the back of strong level of refinery and chemical plant maintenance activities.

The company’s focus on customer service, aided by reliable operations and supply-chain management, bodes well. Cost management actions are also supporting its margin performance. For instance, MRC Global’s adjusted gross margin increased 40 bps year over year to 21.6% in the first quarter of 2024.

MRC intends to augment its shareholders’ wealth over time. In the first three months of 2024, the company’s dividend payments totaled $6 million. It also repurchased shares worth $5 million in the same period. Also, in 2023, it paid dividends of $24 million to shareholders and bought back shares worth $4 million.

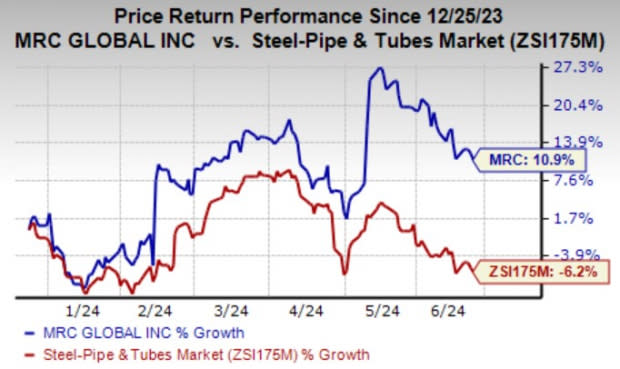

Image Source: Zacks Investment Research

In the past six months, the Zacks Rank #3 (Hold) company has gained 10.9% against the industry’s decline of 6.2%.

However, a decline in customer spending for modernization and replacement activity and delayed customer projects have been affecting the Gas Utilities and Production & Transmission Infrastructure (PTI) sectors. Revenues from the Gas Utilities and PTI sectors decreased 13% and 11% year over year, respectively, in the first quarter. Management expects overall revenues in the range of flat to decline in low-single digit in 2024.

MRC has also been dealing with the adverse impacts of high operating costs and expenses. In the first quarter, its cost of sales remained high at $643 million. Selling, general and administrative expenses increased 2.5% to $125 million in the quarter due to higher employee-related costs and associated benefit costs.

Promising Stocks

We have highlighted three better-ranked stocks, namely AZZ Inc. AZZ, Valmont Industries VMI and Mueller Water Products MWA. While AZZ and VMI sport a Zacks #1 Rank (Strong Buy) each, MWA carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AZZ delivered a trailing four-quarter average earnings surprise of 36%. In the past 60 days, the Zacks Consensus Estimate for AZZ’s 2024 earnings has increased 5.3%.

Valmont Industries has a trailing four-quarter average earnings surprise of 13%. The consensus estimate for VMI’s 2024 earnings has risen 7% in the past 60 days.

Mueller Water Products delivered a trailing four-quarter average earnings surprise of 51.8%. In the past 60 days, the consensus estimate for MWA’s 2024 earnings has improved 14.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

MUELLER WATER PRODUCTS (MWA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance