MSC Industrial (MSM) Q3 Earnings Meet Estimates, Revenues Miss

MSC Industrial Direct Company, Inc. MSM reported third-quarter fiscal 2024 (ended on Jun 1, 2024) adjusted earnings per share (EPS) of $1.33, which came in line with the Zacks Consensus Estimate. The bottom line decreased 23.6% year over year attributed to the prolonged weakness in the manufacturing sector, where MSM has a significant exposure.

Including one-time items, the company reported EPS of $1.27 compared with the year-ago quarter’s $1.69.

MSC Industrial generated revenues of around $979 million, down 7% from the year-ago quarter. The top line missed the Zacks Consensus Estimate of $993 million. Sales were impacted by a 300-basis point headwind from the non-recurrence of Public Sector orders that were reported in the prior year. This, coupled with the weakness in the manufacturing sector, led to a 7.1% decline in average daily sales.

MSM Price, Consensus & EPS Surprise

Image Source: Zacks Investment Research

MSM, on Jun 13, had announced that it anticipated third-quarter net sales to be lower year over year citing the ongoing weakness in heavy manufacturing and a slower-than-expected ramp at its core customer. The company also indicated that gross margins will be lower than expectations due to unfavorable product and customer mix headwinds, and unanticipated negative impacts of its web pricing realignment initiative.

Operational Update

The cost of goods sold decreased 7.5% year over year to $579 million. Gross profit was down 7% to $400 million. The gross margin was 40.9% compared with the year-ago quarter’s 40.7%.

Operating expenses dipped 1% year over year to $289 million in the fiscal third quarter. Adjusted operating income amounted to $111.5 million, down 19.6% from $138.6 million in the prior-year quarter. The adjusted operating margin was 11.4%, a 170-basis point contraction from the prior-year quarter’s 13.1%.

Cash & Debt Position

MSC Industrial had cash and cash equivalents of $25.9 million at the end of the fiscal third quarter compared with $50 million at the end of fiscal 2023. It generated cash flow from operating activities of $303 million in the first nine months of fiscal 2024 compared with $567 million in the comparable period in fiscal 2023.

The company’s long-term debt was around $300 million at the end of the reported quarter, up from $224 million at fiscal 2023-end.

Guidance

Along with its preliminary third-quarter results on June 13, MSM Industrial has lowered its fiscal 2024 outlook. The company expects average daily sales to decline in the band of 4.7-4.3% year over year, a significant shift from the previous expectation of flat to 5% year-over-year growth.

The adjusted operating margin is expected to be in the range of 10.5-10.7%, down from the prior mentioned 12-12.8%. Depreciation and amortization expense guidance has been lowered to around $80 million from the previously stated $85 million.

The company expects interest and other expenses to be $45 million, updated from the prior-expected $40-$50 million range.

These expectations have remained unchanged following the fiscal third-quarter results.

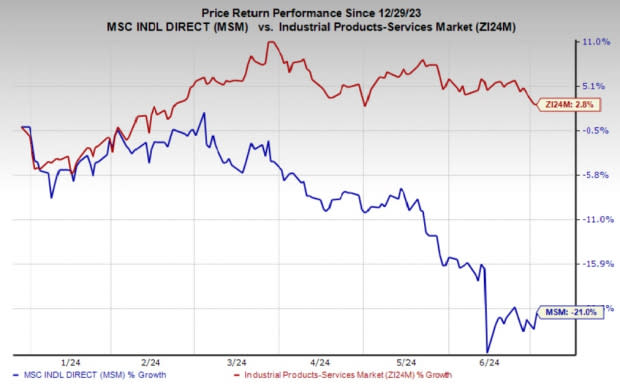

Price Performance

MSC Industrial’s shares have lost 21% year to date against the industry’s 2.8% growth.

Image Source: Zacks Investment Research

Industrial Services Stocks Awaiting Results

W.W. Grainger GWW is expected to release its fiscal second-quarter results later this month.

The Zacks Consensus Estimate for the company’s EPS is pegged at $9.59 for the quarter, indicating a 3.3% increase from the year-ago reported figure. GWW’s earnings have surpassed the consensus estimate in each of the trailing four quarters, delivering an average earnings surprise of 3.6%. The consensus estimate for total revenues is pinned at $4.36 billion, indicating year-over-year growth of 4.2%.

TPI Composites TPIC is expected to release its second-quarter results early next month. The Zacks Consensus Estimate for the company’s earnings is currently pegged at a loss of 68 cents per share. The estimate, however, indicates an improvement from the loss of $1.90 per share reported in the year-ago quarter. The consensus estimate for total revenues is pinned at $317 million, indicating a year-over-year decrease of 16.9%. In the preceding four quarters, TPIC’s earnings missed the Zacks Consensus Estimate in three quarters, while missing on one occasion, delivering an average negative earnings surprise of 61%.

Zacks Rank & a Stock to Consider

MSC Industrial currently carries a Zacks Rank #5 (Strong Sell).

A better-ranked stock from the Industrial Products sector is Applied Industrial Technologies AIT, which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved 2% north in the past 60 days. The company’s shares have gained 11% so far this year.

MSC Industrial Direct Company, Inc. (MSM) reported third-quarter fiscal 2024 (ended on Jun 1, 2024) adjusted earnings per share (EPS) of $1.33, which came in line with the Zacks Consensus Estimate. The bottom line decreased 23.6% year over year attributed to the prolonged weakness in the manufacturing sector, where MSM has a significant exposure.

Including one-time items, the company reported EPS of $1.27 compared with the year-ago quarter’s $1.69.

MSC Industrial generated revenues of around $979 million, down 7% from the year-ago quarter. The top line missed the Zacks Consensus Estimate of $993 million. Sales were impacted by a 300-basis point headwind from the non-recurrence of Public Sector orders that were reported in the prior year. This, coupled with the weakness in the manufacturing sector, led to a 7.1% decline in average daily sales.

MSM, on Jun 13, had announced that it anticipated third-quarter net sales to be lower year over year citing the ongoing weakness in heavy manufacturing and a slower-than-expected ramp at its core customer. The company also indicated that gross margins will be lower than expectations due to unfavorable product and customer mix headwinds, and unanticipated negative impacts of its web pricing realignment initiative.

Operational Update

The cost of goods sold decreased 7.5% year over year to $579 million. Gross profit was down 7% to $400 million. The gross margin was 40.9% compared with the year-ago quarter’s 40.7%.

Operating expenses dipped 1% year over year to $289 million in the fiscal third quarter. Adjusted operating income amounted to $111.5 million, down 19.6% from $138.6 million in the prior-year quarter. The adjusted operating margin was 11.4%, a 170-basis point contraction from the prior-year quarter’s 13.1%.

Cash & Debt Position

MSC Industrial had cash and cash equivalents of $25.9 million at the end of the fiscal third quarter compared with $50 million at the end of fiscal 2023. It generated cash flow from operating activities of $303 million in the first nine months of fiscal 2024 compared with $567 million in the comparable period in fiscal 2023.

The company’s long-term debt was around $300 million at the end of the reported quarter, up from $224 million at fiscal 2023-end.

Guidance

Along with its preliminary third-quarter results on June 13, MSM Industrial has lowered its fiscal 2024 outlook. The company expects average daily sales to decline in the band of 4.7-4.3% year over year, a significant shift from the previous expectation of flat to 5% year-over-year growth.

The adjusted operating margin is expected to be in the range of 10.5-10.7%, down from the prior mentioned 12-12.8%. Depreciation and amortization expense guidance has been lowered to around $80 million from the previously stated $85 million.

The company expects interest and other expenses to be $45 million, updated from the prior-expected $40-$50 million range.

These expectations have remained unchanged following the fiscal third-quarter results.

Price Performance

MSC Industrial’s shares have lost 21% year to date against the industry’s 2.8% growth.

Industrial Services Stocks Awaiting Results

W.W. Grainger (GWW) is expected to release its fiscal second-quarter results later this month.

The Zacks Consensus Estimate for the company’s EPS is pegged at $9.59 for the quarter, indicating a 3.3% increase from the year-ago reported figure. GWW’s earnings have surpassed the consensus estimate in each of the trailing four quarters, delivering an average earnings surprise of 3.6%. The consensus estimate for total revenues is pinned at $4.36 billion, indicating year-over-year growth of 4.2%.

TPI Composites (TPIC) is expected to release its second-quarter results early next month. The Zacks Consensus Estimate for the company’s earnings is currently pegged at a loss of 68 cents per share. The estimate, however, indicates an improvement from the loss of $1.90 per share reported in the year-ago quarter. The consensus estimate for total revenues is pinned at $317 million, indicating a year-over-year decrease of 16.9%. In the preceding four quarters, TPIC’s earnings missed the Zacks Consensus Estimate in three quarters, while missing on one occasion, delivering an average negative earnings surprise of 61%.

Zacks Rank & a Stock to Consider

MSC Industrial currently carries a Zacks Rank #5 (Strong Sell).

A better-ranked stock from the Industrial Products sector is Applied Industrial Technologies (AIT), which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Applied Industrial has an average trailing four-quarter earnings surprise of 8.2%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.62 per share, which indicates year-over-year growth of 9.9%. Estimates have moved 2% north in the past 60 days. The company’s shares have gained 11% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

MSC Industrial Direct Company, Inc. (MSM) : Free Stock Analysis Report

TPI Composites, Inc. (TPIC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance