Shake-up at money manager Neil Woodford's business after fund freeze

Neil Woodford’s listed business moved to reassure investors and prop up its share price on Friday, as the star money manager continues to battle the fallout from a fund suspension at the start of the month.

Woodford Patient Capital (WPCT.L) said it plans to cut its debts and shake up its board after talks with shareholders.

The changes come after a turbulent few weeks for the trust and its money manager, Neil Woodford. Woodford Patient Capital Trust has seen its share price slide since the star fund manager froze investors out of accessing cash they had placed into the Woodford Equity Income Fund.

Woodford Patient Capital is separate from the Equity Income Fund but Neil Woodford is the portfolio manager for both funds.

The fund freeze, which was sparked by a liquidity crunch, has raised questions about Woodford’s investments in private companies, his structuring of those investments, and the overall reputation of one of the City’s most famous money managers.

READ MORE: Star fund manager Neil Woodford 'sailed close to the wind'

Earlier this week, Britain’s top financial watchdog accused Woodford of sailing “close to the wind” and Bank of England governor Mark Carney said funds like the Woodford Equity Income Fund were “built on a lie.”

To contain some of the fall-out, Woodford Patient Capital announced a series of changes on Friday and reassured investors that processes were in place to stop any similar problems at the investment trust.

Woodford Patient Capital plans to reduce its debt of £126m to zero within a year, the company said. It will use the proceeds from sales of other investments to re-invest in businesses that need more capital, rather than borrowing.

Meanwhile, Mercury Asset Management veteran Stephen Cohen is joining Woodford Patient Capital’s board. He will chair the audit, risk and valuation committee.

Non-executive director Carolan Dobson is stepping down from the board. Susan Searle, chair of the Woodford Patient Capital Trust board, said Dobson’s departure was “disappointing” but thank her for her efforts.

Woodford was earlier this week accused by FCA chief executive Andrew Bailey of “sailing close to the wind” in the run up to the fund suspension by listing part of his investments in Guernsey in a bid to meet liquidity requirements. The move was technically allowed but not in the spirit of the rules, Bailey said.

The money manager has also been criticised for the way he moved investments between his companies.

The Woodford Patient Capital board said it had put in place “additional controls” to ensure the board is notified of any new investments, further investments into existing portfolio companies, or sale of assets. The board said there “are robust processes in place to avoid any conflicts of interest.”

READ MORE: Funds like Woodford 'built on a lie' and 'fundamental questions' ignored

The board also reassured investors that there is “an independent valuation process relating to the valuation of the unquoted assets.” FCA CEO Bailey said earlier this week that the regulator stepped in to stop the Woodford Equity Income fund valuing its own private investments around the start of 2017.

“The dialogue we have had with shareholders has been thoughtful and constructive,” Searle said in a statement.

“The main areas of discussion for shareholders are consistent with the Board's immediate priorities, notably: gearing levels, the share price discount to net asset value, valuations, Board composition and the ongoing developments at the Portfolio Manager.

"As a result, the Board is building on some of the immediate measures taken following the gating of the Woodford Equity Income Fund on 3 June 2019 and as the situation remains fluid, will use the additional controls in place while continuing to monitor and assess the situation as it evolves, to ensure the long-term interests of shareholders are protected.”

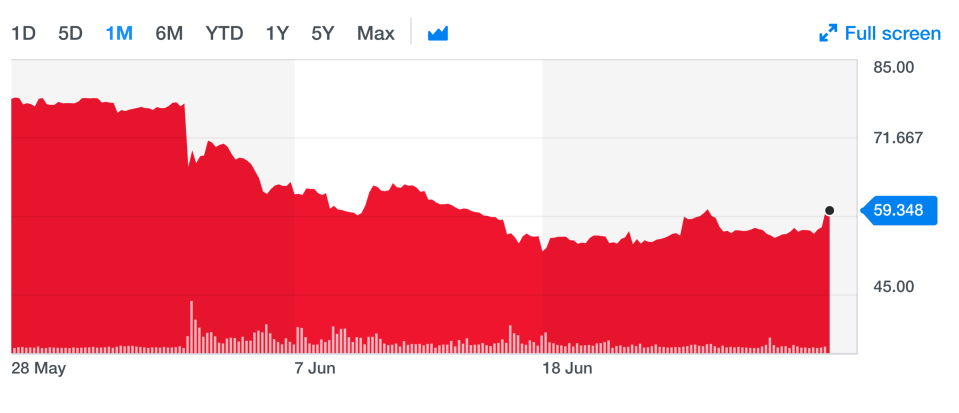

Shares in Woodford Patient Capital Trust have fallen over 20% since withdrawals from the Woodford Equity Income fund were suspended at the start of the month. The listed company now trades at a discount of around 14% against its net asset value – the value of its assets once liabilities are removed

The investment trust said it is mulling a share buyback to prop up its net asset value. Shares in Woodford Patient Capital Trust were up 3.2% to £59.36 on Friday morning.

————

Oscar Williams-Grut covers banking, fintech, and finance for Yahoo Finance UK. Follow him on Twitter at @OscarWGrut.

Read more:

Yahoo Finance

Yahoo Finance