Japan Bank to Overhaul Investments as Wrong-Way Rate Bets Trigger Bond Losses

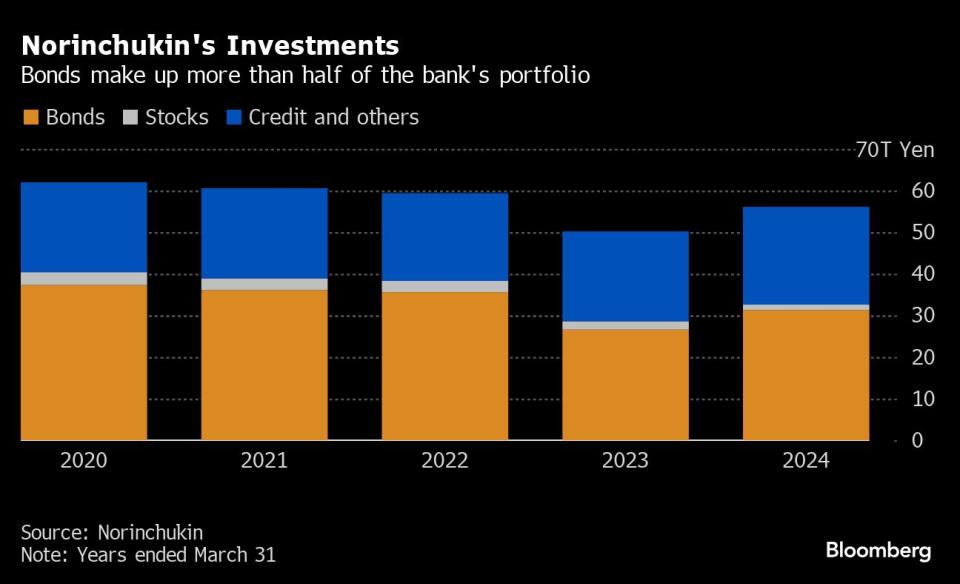

(Bloomberg) -- Norinchukin Bank will consider investing in a range of assets as it braces for massive losses on the sale of roughly 10 trillion yen ($63 billion) in US and European sovereign bonds.

Most Read from Bloomberg

What to Know About the Deadly Flesh-Eating Bacteria Spreading in Japan

‘I Live in Hell’: Anti-Growth Fervor Grips US South After Pandemic Boom

Nvidia’s 591,078% Rally to Most Valuable Stock Came in Waves

Nvidia Becomes World’s Most Valuable Company as AI Rally Steams Ahead

Japan’s biggest agricultural bank will dispose of the foreign bonds gradually during the fiscal year ending March, a company spokesman said in an email. It expects a net loss of 1.5 trillion yen for the year, triple the previous estimate of 500 billion yen.

Collateralized loan obligations are an investment option, the spokesman said on Wednesday. It will also look at investing in domestic and overseas bonds, stocks and project financing. Its unrealized losses have been reflected in its capital ratio and won’t affect the bank’s soundness, the spokesman added.

With an investment portfolio equivalent to $357 billion, Norinchukin is one of the largest Japanese investors in international financial markets. Trading desks from London to New York were buzzing with speculation on Tuesday about where the bank might shift its holdings, with several market participants pointing to CLOs as a likely possibility along with other non-government fixed-income securities.

While Japanese regulators haven’t expressed concerns about the financial stability of Norinchukin or other big financial firms, the disclosures have raised questions about potential losses lurking elsewhere in the nation’s banking system.

“Reallocating assets is difficult given the constraints of regulatory capital and profitability, as well as the difficult market environment,” said Eiji Kubo a director at S&P Global Ratings in Tokyo. “If you do it poorly, you could end up getting slapped back and forth.”

Chief Executive Officer Kazuto Oku flagged the bond sales earlier in an interview with the Nikkei newspaper, saying the company will reduce interest-rate risk and “diversify into assets that take on corporate and individual credit risk.”

Norinchukin’s losses on bonds ballooned after it misjudged how long interest rates would stay elevated. A sharp rise in foreign-currency funding costs wiped out returns from bonds bought when their yields were lower.

The bank’s foreign-exchange funding strategy saddled it with a negative carry, meaning its interest expenses are higher than its interest income, according to Pri de Silva, a senior analyst at Bloomberg Intelligence.

“We believe that the negative carry could account for a large portion of the expected loss in fiscal 2024,” he said.

Norinchukin has long been known as one of the largest buyers of bonds in the $1.3 trillion CLO market. The company previously said that the losses didn’t involve its holdings of CLOs, which totaled 7.4 trillion yen as of March.

To replenish capital, Norinchukin said last month it will raise 1.2 trillion yen from the agricultural cooperatives that own it.

It’s not the first time that the bank has tapped its members for cash after investment losses. In 2009, it was forced to raise 1.9 trillion yen after racking up Asia’s biggest realized and unrealized losses on investments in asset-backed securities during the global financial crisis.

Japan’s Financial Services Agency, which regulates the bank, isn’t concerned about its health, according to an FSA official. The paper losses are already reflected in its capital ratio, the official said.

“Realizing the losses isn’t ideal, but they may think there are better opportunities available,” said Philip McNicholas, Asia sovereign strategist at Robeco Group in Singapore. It “highlights some deficiencies in supervision that are likely to be rectified, but it’s not a systemic risk.”

--With assistance from Nao Sano and Patrick Winters.

(Updates with analyst comment in sixth paragraph)

Most Read from Bloomberg Businessweek

Coke—and Dozens of Others—Pledged to Quit Russia. They’re Still There

Google DeepMind Shifts From Research Lab to AI Product Factory

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance