Norinchukin’s Second Investing Debacle Followed Clear Warning

(Bloomberg) -- The warning for Norinchukin from Japan’s financial regulator was clear — its deep reliance on foreign bond holdings was a risky strategy and needed to change.

Most Read from Bloomberg

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Jain Raises $5.3 Billion in Biggest Hedge Fund Debut Since 2018

Russia Is Storing Up a Crime Wave When Its War on Ukraine Ends

Yen Is Under Pressure Even as Japan Steps Up Its Verbal Warnings

By the time the bank’s managers reacted, it was too little, too late.

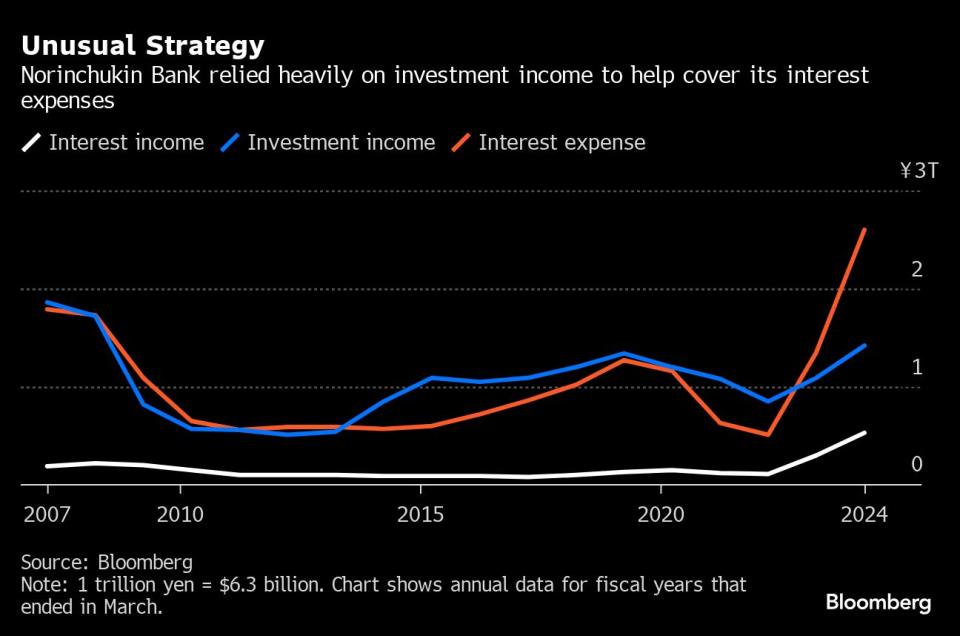

Known for its investments in CLOs, Norinchukin became cautious after suffering heavy losses during the financial crisis of 2009. It turned to the apparent safety of US Treasuries but didn’t adjust its portfolio quickly enough as surging inflation prompted the Federal Reserve and other central banks to raise borrowing costs.

After sustained high interest rates in the US imposed deepening losses, the bank said in May it would sell down its lower-yielding securities. Yet it still didn’t fully grasp how bad its predicament was. Within the space of a month, its estimated loss exploded to 1.5 trillion yen ($9.4 billion), triple the original forecast. On Friday, Chief Executive Officer Kazuto Oku didn’t rule out that the losses could widen further.

“Quick action is needed when the market strays from your expected path,” said Hideyasu Ban, an analyst at Bloomberg Intelligence. “It would’ve been better in retrospect if they’d made a decision earlier.”

Norinchukin had begun to diversify its securities portfolio after years of urging by the Financial Services Agency, according to Toshinori Yashiki, the FSA’s deputy director-general.

Still, “given the sheer size of the portfolio, it wasn’t so easy to change,” he said. The bank has close engagement with the FSA and manages its finances in accordance with the agency’s supervision and guidance, a spokesperson said in an email.

Norinchukin’s structure contributed to the debacle. The unlisted bank is owned by the country’s roughly 3,300 agricultural cooperatives, which provide it with both capital and deposits.

They also depend on returns from the bank because of limited lending opportunities in the countryside. Consequentially, Norinchukin’s loans account for far less of its assets than Japan’s main commercial banks.

The bank has assets of roughly 100 trillion yen, of which half are securities and less than 20% are loans. Japan’s largest bank, Mitsubishi UFJ Financial Group Inc., has about 20% of its assets in securities and 30% in loans.

The farming cooperatives long received an additional interest rate known as shoreikin from Norinchukin. When Japan’s growth surged in the 1970s, deposits from individual members grew, leaving the bank with a surplus of money. It broadened its purview from narrowly financing farmers to lending to other industries as well as investing in local capital markets and government bonds.

With Japanese government bonds providing low returns and anemic lending, Norinchukin ventured overseas in the 1990s. The bank’s investment unit built out a global network of operations in New York, London, Singapore, Hong Kong, Beijing, Sydney and Amsterdam.

After repeated losses on securitized products, Norinchukin piled into US Treasuries and other foreign sovereign debt.

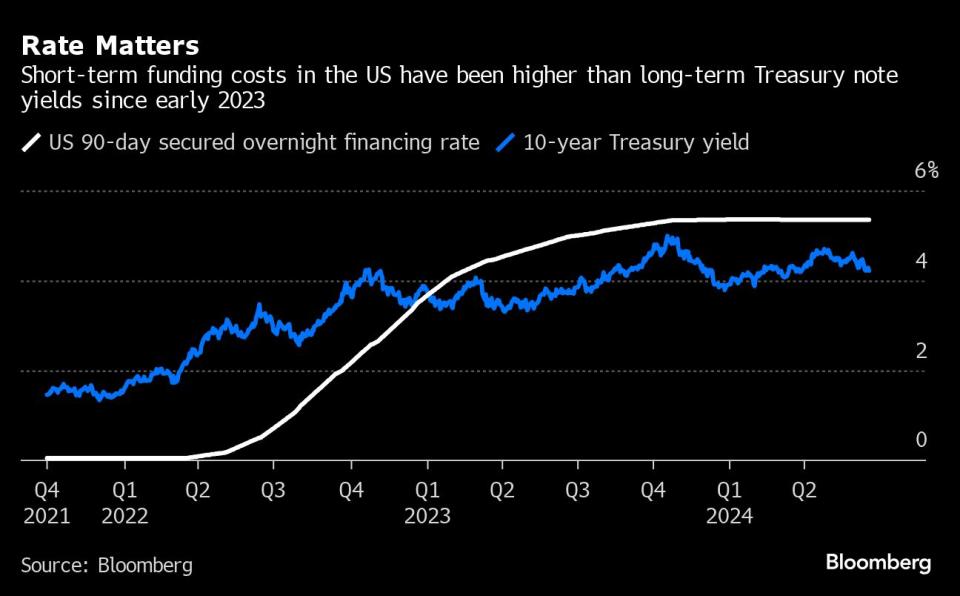

But it funded the investments by borrowing dollars, whose costs soon exceeded the amount that it was earning in interest, making the strategy unsustainable.

“Substituting sovereign bonds for CLO seems an equally risky strategy,” said Angela Gallo, a senior lecturer in finance at Bayes Business School in London.

Norinchukin wasn’t alone in being hit by a surge in dollar funding costs. Other banks and insurers also had losses on their foreign bonds and they dumped them in the past two years after the Fed’s aggressive rate hikes began in 2022.

Norinchukin’s Funding, Capital Rules Complicate Restructuring

The bank did take some measures to cut its reliance on its securities portfolio, including building up its project finance division. CEO Oku has pledged to expand that business as well as get more revenue from its asset management subsidiary.

While they own the bank, the cooperatives’ oversight is generally accommodative. At Norinchukin’s equivalent of an AGM on Friday, Oku was reappointed. The mood at the meeting was calm and all resolutions were passed unanimously, according to participants. No one has lost their job or resigned because of the losses.

“The way that I should take responsibility for this is to fulfill my duty to get us firmly through this situation,” Oku said.

--With assistance from Ambereen Choudhury, Serena Ng and Nao Sano.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance