Nvidia Enters Correction Territory as Slump Erases $430 Billion

(Bloomberg) -- Nvidia Corp. shares entered correction territory on Monday, as an ongoing selloff erased a historic amount of value for the AI-focused chipmaker.

Most Read from Bloomberg

SpaceX Tender Offer Said to Value Company at Record $210 Billion

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

China’s Finance Elite Face $400,000 Pay Cap, Bonus Clawbacks

Supreme Court Ends OxyContin Settlement, Cracking Sackler Shield

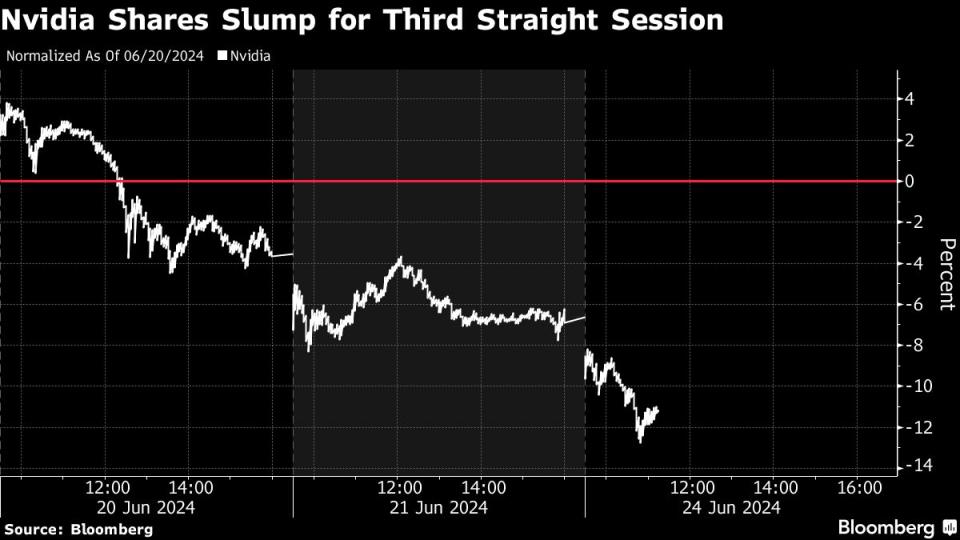

The stock fell 6.7%, its third straight negative session and biggest one-day percentage drop since April. The three-day drop erased about $430 billion from Nvidia’s market capitalization, the biggest three-day value loss for any company in history, according to data compiled by Bloomberg.

Shares fell 13% over the period, past the 10% threshold that represents a correction. The drop weighed on chipmakers with the Philadelphia Stock Exchange Semiconductor Index falling 3% on Monday. Broadcom Inc. fell 4% while Qualcomm Inc. dropped 5.5% and ARM Holdings Plc slumped 5.8%. US-listed shares of Taiwan Semiconductor Manufacturing Co. shed 3.5%.

The drop put Nvidia’s valuation back below the $3 trillion threshold, and under both Microsoft Corp. and Apple Inc. in size. Nvidia briefly claimed the title as the world’s largest stock last week.

“In the near-term, it is plausible that investors begin suffering from AI-fatigue or become more broadly concerned about index concentration,” said Neville Javeri, portfolio manager and head of the Empiric LT Equity team at Allspring Global Investments.

Even with the slump, Nvidia remains up nearly 140% this year, making it the second-best performer among S&P 500 Index components, behind Super Micro Computer Inc., another favorite AI play.

The stock suffered a drawdown of about 20% earlier this year, although it quickly returned to all-time highs.

While investors have flocked to Nvidia given the sky-high demand for its chips used in AI processing, the scale of Nvidia’s rally — it soared about 240% over the course of 2023 — has underlined concerns about its valuation. The stock trades at 21 times estimated sales over the next 12 months, making it the most expensive in the S&P 500 by this measure. Still, it remains well liked on Wall Street. Nearly 90% of the analysts tracked by Bloomberg recommend buying, and the average analyst price target points to upside of about 12% from current levels.

“The momentum in Nvidia and AI stocks in general has been staggering,” said Charlie Ashley, portfolio manager at Catalyst Funds. “In terms of investing, I would not be a contrarian right now.”

--With assistance from Tom Contiliano.

(Updates to market close)

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance