Once Avoided Like ‘Plague,’ EM Duration Is Back in Fashion

(Bloomberg) -- Investors in emerging-market debt are once again turning to long-duration bonds, a popular bet at the end of last year that burnt many of them in the first months of 2024.

Most Read from Bloomberg

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Tech Keeps a Lid on US Stocks as Nvidia Tumbles: Markets Wrap

Two consecutive months of below-estimate US inflation has revived expectations for rate cuts by the Federal Reserve, triggering a rebound in long-dated sovereign debt after hopes for lower rates had evaporated.

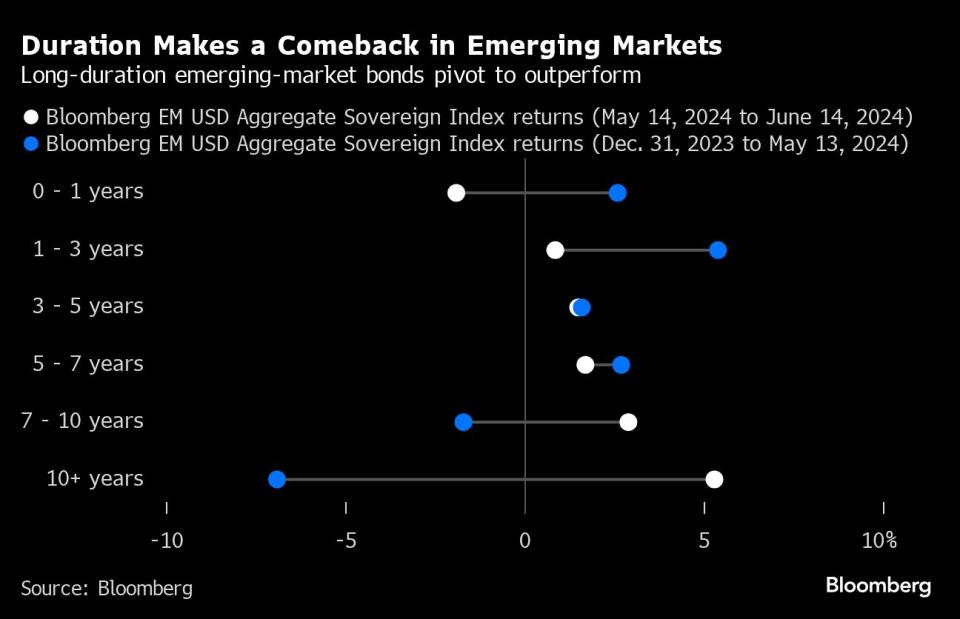

Since the beginning of May, dollar-denominated emerging-market sovereign bonds with a maturity of 10 years or more have outperformed every other category — gaining 5.3%, according to data compiled by Bloomberg. This is a drastic turnaround from earlier in 2024 when the cohort was severely lagging, down 6.9% from the start of the year through April.

“Investors have been avoiding longer duration like the plague,” said Guido Chamorro, senior portfolio manager at Pictet Asset Management in London. “We believe that EM sovereign bonds, including longer duration bonds, are in a good place to perform well as the US rate cut cycle begins.”

After opening the year betting on nearly seven interest-rate cuts from the Fed, traders slashed those wagers amid a run of sticky inflation reports and evidence of robust growth. Then, following the release of unexpectedly soft May consumer-price data, investors revived forecasts for two rate reductions this year, starting as early as September.

That green-lit the duration trade for investors of developing-world bonds, according to Arif Joshi, emerging-markets debt manager at Lazard Asset Management.

“To the extent the latest data is representative of the next year, with US growth around 2% and inflation positively missing to the downside, that’s a fantastic backdrop for the duration trade,” Joshi said. “The textbook says that duration is a winning trade.”

Value Plays

The reversal in performance for longer-dated bonds underscores how volatile Fed policy path expectations have been this year. In that context of uncertainty, selectivity remains crucial.

For Joshi, that means sticking with investment-grade and strong double-B debt within the emerging-market long-duration sector.

Pictet’s Chamorro has also started to add longer-date debt to “safe EM names” with healthy spreads and in select pockets, as those are likely to benefit first. Among his favorites are Guatemala and Serbia, which are just below the investment grade category, where the 10-year part of the curve has spreads around 200-basis points above US Treasuries.

Chamorro also likes investment-grade countries that still look cheap relative to peers, like Peru and Saudi Arabia. Several of these countries have met investor demand with sizable new bond sales, as both Saudi Arabia and Serbia have been seen hefty issuance this year.

For Eric Fine, a portfolio manager at Van Eck Associates, valuations reflect the Fed’s bearish rates outlook, which is fueling his decision to move into duration in recent weeks after having been in a low duration position for that past 12 months.

“Four cuts were priced out from the beginning of the year,” he said. “It’s not unreasonable to think the pendulum could swing back. That’s a pretty good scenario for EM and it’s a pretty good scenario for duration.”

The yield on dollar-denominated sovereign and corporate bonds from emerging markets ended last week at 7.09%, falling 12 basis points in June, according to a Bloomberg index tracking the debt.

Fine sees select opportunities in higher-yielding sovereigns such as Angola, Ivory Coast and other African nations supplying commodities to Europe. Locally, he favors Asian markets like Korea and Malaysia with lower inflation and sound policies.

Political Risks

Not all investors are ready to embrace the emerging-market duration trade just yet, as there’s been many false dawns to the Fed’s rate-cutting campaign, and dependence on local central banks to consider.

“Our view at present is to be cautious,” said Graham Stock, senior EM sovereign strategist at RBC BlueBay Asset Management. “We still see some residual strength in the US economy that could delay that moment of reckoning for the Fed.”

Some fund managers also remain wary of extending too far out on the curve amid lingering economic and political uncertainties, and after being rocked by this year’s volatility. Upcoming elections in the US and key emerging markets have injected an additional layer of risk, particularly surrounding the trajectory of fiscal policies, according to Claudia Calich, head of emerging-market debt at M&G Investments in London.

But Pictet’s Chamorro remains resolutely optimistic, saying the gains are here to stay and forecasting that the duration trade could entice a new wave of bond sales.

“Maybe we will even eventually see the return of the 100-year emerging-market bond,” Chamorro said. “It sounds like science fiction now. But just wait.”

What to Watch

Money managers will monitor the minutes of Brazilian central bank’s latest meeting after policymakers paused the easing cycle in an unanimous vote

Mexico’s central bank will be in the spotlight with its overnight rate decision; traders are eager for clues on whether Banxico will turn more cautious in the short term amid currency volatility

The Czech central bank board will discuss whether to make another 50 basis-point cut in the benchmark rate or reduce the pace to 25 basis points

India is expected to release fiscal data for May

Unemployment rate data is due in places including Argentina, Brazil, Chile, Hungary, Mexico, Taiwan

Consumer prices data also due in Poland, Singapore

Kenya, Argentina, Czech Republic are expected to release their GDP figures

--With assistance from Carter Johnson, Edward Bolingbroke, Selcuk Gokoluk and Ezra Fieser.

(Updates with bond yields above risk spread chart)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance