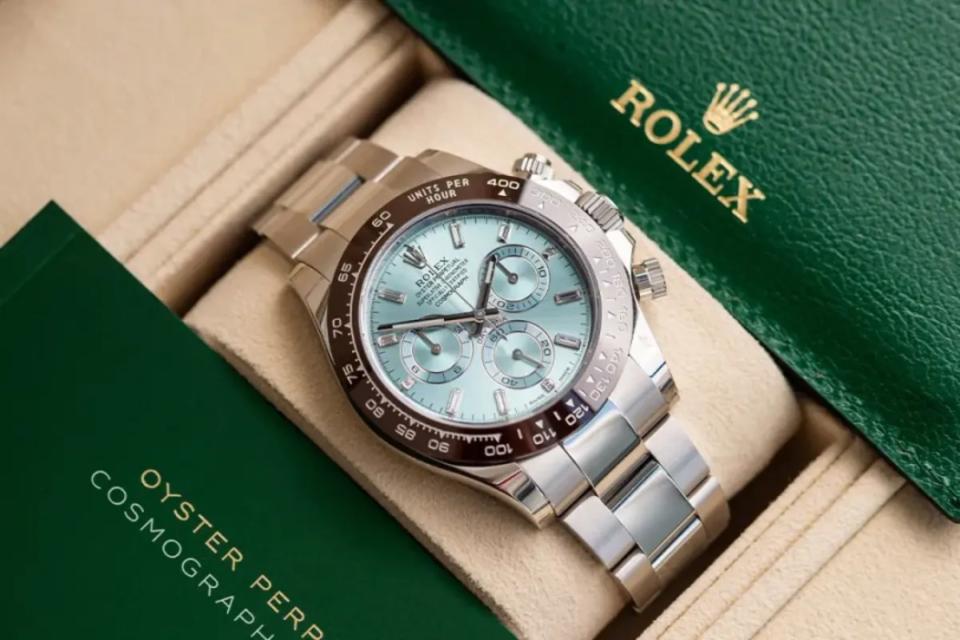

‘People got burnt’ the Rolex, Patek Philippe and Audemars Piguet luxury watch boom comes to an end

The last few years have been a rollercoaster for those in the luxury watch market. After a startling boom during the pandemic, the prices of the market leaders, such as Rolex, Patek Philippe and Audemars Piguet watches collapsed in 2022 and are down about 30 per cent from their pandemic peaks.

“[The downturn] was kind of predictable,” Matt Culling, Managing Director at Global Watches in London, said, adding that Global Watches had stopped buying stock because prices were going up so fast.

The average price of a Rolex has fallen eight per cent in the last twelve months to £20,768, while the average price of a Patek Philippe watch has fallen 14 per cent to £114,973, according to New Bond Street Pawnbrokers.

Watches of Switzerland said in January it expected revenue for the full year to be in the range of £1.53bn-£1.55bn, down from a guidance of £1.65-£1.70bn.

“[The bubble wasn’t] something that we’ve seen before in the watch market,” Culling said.

The price of a Rolex rose by around 20 per cent in the fourth quarter of 2021. “[At that point] it was predictable that prices would at some stage correct,” Culling said. Preowned Rolex prices have since corrected down about 30 per cent from their peak.

Falling demand from Asian buyers has also hurt watchmakers. Demand in mainland China and Hong Kong slumped by 25.4 per cent and 19 per cent in February, respectively, according to the Federation of the Swiss Watch Industry.

“We had the boom… then the music stopped and everything came crashing down towards the end of the last year,” Joel Faith, Director Atlas Watches said. “[But] since then we’ve been a lot busier – I think the market has stabilised in the last couple of weeks.”

“Green shoots” are appearing, Culling said. “With hope of interest rates coming down, the economy has started to look a bit better. People generally have a little bit more money now that energy prices have come down and a bit of confidence in the market as well… We expect to see a steady tick up in prices after consolidation sometime this year.”

“When you look back over a longer time scales, prices have just steadily increased… I’d like to think [the boom] was a one-off event, but you just never know,” Culling said.

Gen Z and women could save Rolex prices

A Bain & Co market study found that Gen Z and women are strongly interested in watches and are increasingly entering the market.

Women have historically represented the core of consumption in the luxury fashion market (for apparel and accessories). Spending by women in this segment has averaged 60 per cent to 65 per cent of total market value.

However, when it comes to watches, this demographic has historically been under-penetrated, accounting for only 30 per cent to 35 per cent of the market.

“Recent years have witnessed a significant shift, marked by a growing interest from women in the world of watches,” Claudia D’Arpizio, Senior Partner at Bain & Company, said.

Federica Levato, Senior Partner at Bain & Company, said: “Responding to this changing landscape, numerous watchmakers are proactively addressing the increasing demand from women. They are not only bolstering their “female” offering but also strategically emphasizing this category in their marketing and communication campaigns, as well as optimizing their distribution channels.”

“If historically “women’s” watch models were designed as “jewel watches”, enriched with precious stones and intended to be used as a complement to jewelry, today many brands are evolving their offering by injecting many models that are designed for a “genderless” consumer, as well as reinforcing their “woman’s” non-jewelry watches, sometimes capitalizing on the same inspiration and stylistic codes of the men’s.”

However, this doesn’t yet seem to have translated into London’s watch shops.

“To be honest, I see a complete mixed bag of people – everyone from Gen Z to sixties, seventies,” Faith added.

He does, however, see demand across the board finally rising: “Personally – and this is not maybe not the most popular opinion – I really believe we’re going to see a boom in the coming months. Prices have bottomed out [and] everyone got spooked away, but now there’s some traction and stability… I think people are going to come back and when they do, there’s only one way [to go].”

However, faith doesn’t believe this boom will be close to the pandemic bubble. “I think a lot of people got burnt, and they’ve learnt from that time.”

Yahoo Finance

Yahoo Finance