Personal Care Stocks Q1 Teardown: Medifast (NYSE:MED) Vs The Rest

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Medifast (NYSE:MED) and the best and worst performers in the personal care industry.

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

The 13 personal care stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.1%. while next quarter's revenue guidance was 7.5% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and personal care stocks have had a rough stretch, with share prices down 7.3% on average since the previous earnings results.

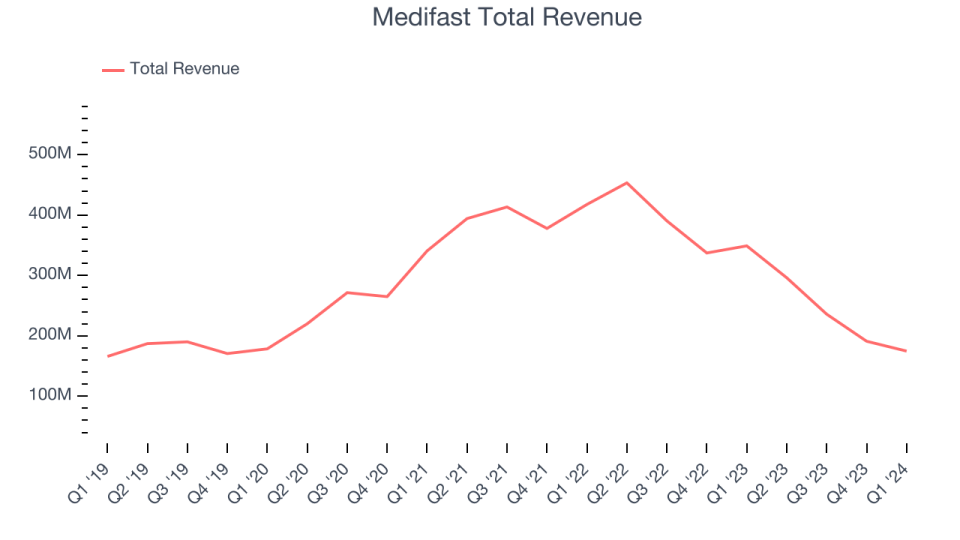

Weakest Q1: Medifast (NYSE:MED)

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Medifast reported revenues of $174.7 million, down 49.9% year on year, in line with analysts' expectations. It was a weak quarter for the company, with revenue guidance for next quarter missing analysts' expectations.

“Fast paced medical innovation is providing greater access to medical weight loss solutions than ever before. We are transforming our OPTAVIA offer to include comprehensive support for consumers who wish to use GLP-1 medical weight loss solutions on their individual journeys to sustainable healthy lifestyles. It’s a market that is estimated by a recent BCG market study to have the potential to grow to $50B or more by 2030, and it’s one that we are uniquely positioned to capitalize on,” said Dan Chard, Chairman & Chief Executive Officer.

Medifast delivered the slowest revenue growth of the whole group. The stock is down 42.3% since the results and currently trades at $20.48.

Read our full report on Medifast here, it's free.

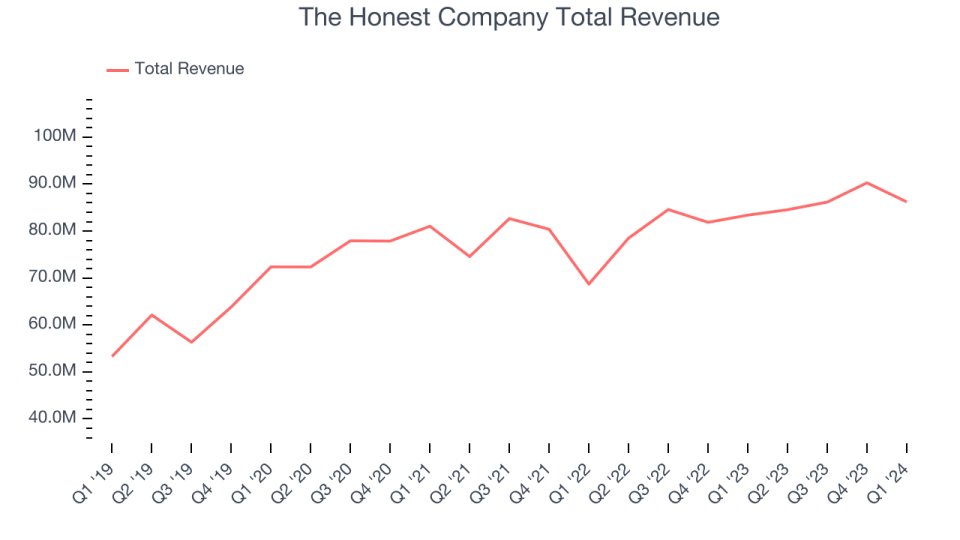

Best Q1: The Honest Company (NASDAQ:HNST)

Co-founded by actress Jessica Alba, The Honest Company (NASDAQ:HNST) sells diapers and wipes, skin care products, and household cleaning products.

The Honest Company reported revenues of $86.22 million, up 3.4% year on year, outperforming analysts' expectations by 3.5%. It was a stunning quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 7.8% since the results and currently trades at $2.71.

Is now the time to buy The Honest Company? Access our full analysis of the earnings results here, it's free.

Inter Parfums (NASDAQ:IPAR)

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

Inter Parfums reported revenues of $324 million, up 3.9% year on year, falling short of analysts' expectations by 1.4%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is down 7% since the results and currently trades at $115.

Read our full analysis of Inter Parfums's results here.

Estée Lauder (NYSE:EL)

Named after its founder, who was an entrepreneurial woman from New York with a passion for skincare, Estée Lauder (NYSE:EL) is a one-stop beauty shop with products in skincare, fragrance, makeup, sun protection, and men’s grooming.

Estée Lauder reported revenues of $3.94 billion, up 5% year on year, in line with analysts' expectations. It was a solid quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is down 27.8% since the results and currently trades at $106.

Read our full, actionable report on Estée Lauder here, it's free.

Olaplex (NASDAQ:OLPX)

Rising to fame on TikTok because of its “bond building" hair products, Olaplex (NASDAQ:OLPX) offers products and treatments that repair the damage caused by traditional heat and chemical-based styling goods.

Olaplex reported revenues of $98.91 million, down 13.1% year on year, surpassing analysts' expectations by 3.9%. It was an ok quarter for the company, with a decent beat of analysts' gross margin estimates but a miss of analysts' earnings estimates.

The stock is up 14.3% since the results and currently trades at $1.6.

Read our full, actionable report on Olaplex here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance